Investment is risky, and investors must grasp the idea of risk-return trade-off. Risk-return trade-off refers to a link between possible returns from investment and associated risks.

Typically, investors anticipate getting more than they have risked. It happens because investments with a higher risk may lose money compared to those with less risky undertakings. Thus, investors recognise that the trade-off between risk and return is vital for their sound investment choices.

This article explains the risk-return trade-off concept in detail.

Also read: Key risks in investing in the stock market

What is the risk-return trade-off?

The theory of risk-return trade-off means that the expected return on investment increases with the risk increase.

But what does risk-return trade-off imply? It implies that when people think about the future and money investments, they tend to align low uncertainty levels with low returns on their investments. In contrast, high uncertainty or risks have high returns.

It is the trading principle linking high risk and high return. Also, time is fundamental in developing appropriate levels of reward and risk for a portfolio.

For instance, if an investor has long-term equities available to them, then they will be able to overcome the perils of bear markets while also participating during bull markets; conversely, when an investor has only a short time frame within which to invest these same equities present a greater exposure to risk than most other types of investment.

Importance of risk-return trade-off

The risk-return trade-off is the bedrock upon which portfolios are built. Furthermore, time passage must be considered critically. The more extended the period over which an individual expects to hold an investment, the greater their preference for higher returns. It provides financial flexibility to assume more significant risks.

It assists in financial planning by striking a good balance between risk and return on investments. Moreover, it is the best way of understanding different asset classes. Likewise, it shows the risks associated with each asset class. It makes it easier to achieve financial objectives successfully.

Risk-return trade-off helps in portfolio optimisation. Portfolio optimisation reduces risk and maximises profits through terms that stipulate the level of return or profit for a given level of risk. When investors know what kind of risk they have, they can divide it among different classes of assets.

Also read: Risk management in stock market

Factors influencing risk and return trade-off

- Investment horizon: The period that you intend to hold an investment can alter the trade-off between risk and return. Usually, if investments have longer maturities, you can involve yourself in more ventures that may be considered risky to achieve higher returns, given the chance of recuperating losses over time.

- Asset class: A variety of asset classes have different levels of risk and reward. Stocks, for example, tend to be more risky than bonds but offer greater possibilities for income generation

- Economic conditions: Economic factors may influence the risk or return trade-off of any investment. Investors in doubt about the state of the economy might prefer low-risk investments that will produce steady income, whereas, during an economic boom, more risks are taken if that will result in better returns.

- Company-specific factors: Furthermore, firm-specific factors determine the linkage between risk and return by influencing the types or levels of risks one should take. Therefore, you must do due diligence on these aspects to invest in such securities as shares or debentures.

How to calculate the risk-return trade-off?

Considering the potential returns and risks associated with other investments, investors must calculate the risk-return trade-off. An investment’s prospective return is the investor’s earnings in case of a good performance by that investment. On the other hand, an investment’s risk refers to how much money an investor stands to lose with it.

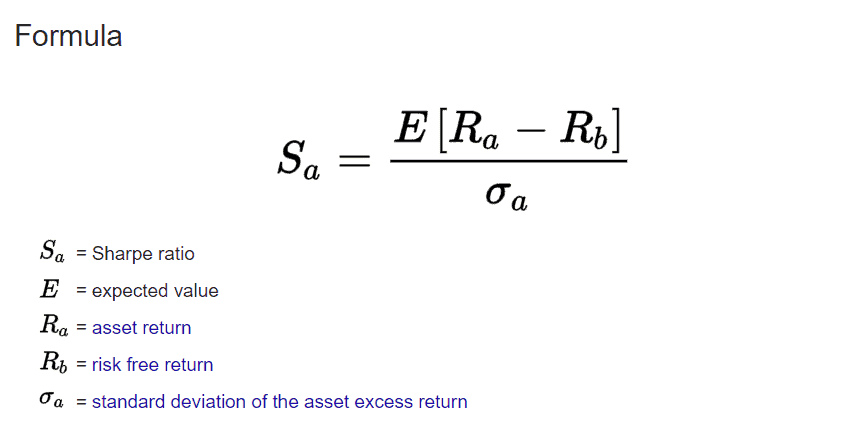

One way of determining the trade-off between risk and return is using the Sharpe ratio. It’s a measure of return on investment that considers the risks involved in an investment.

Shapre’s ratio can be calculated by subtracting the risk-free rate (e.g., government bonds’ return) anticipated to be earned on the investment from expected returns and dividing this by the standard deviation in returns for the one given return. The greater the Sharpe ratio, the risk-adjusted return on investment is more desirable.

Beta coefficient

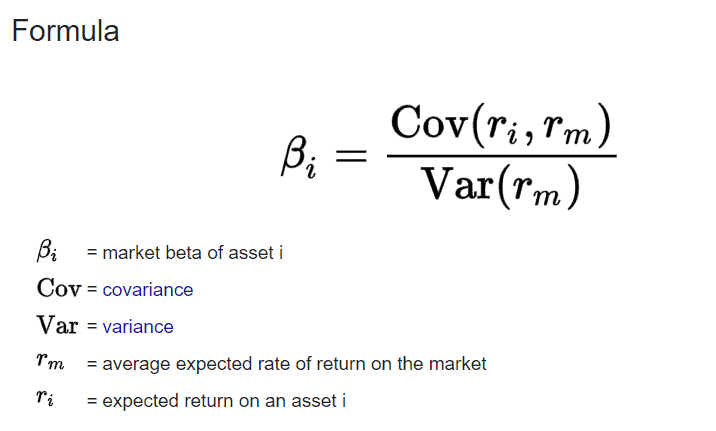

Alternatively, another approach to evaluating risk-return trade-off is employing the beta coefficient. Beta is a measure used in finance to assess individual security, mutual funds, or portfolios’ systematic risk level relative to the market or another benchmark.

In some instances, if an investment has a beta coefficient of 1, its price would move in relation to market movements, while anything more than 1 represents higher volatility greater than that of the market.

An investment with less than one beta would usually be considered less risky or volatile than the market. Moreover, investors can use this measure to determine how much risk is involved in particular investments and compare their risks and returns.

Further reading: Risk tolerance: Defining your personal investment strategy and portfolio

Bottomline

Learning how to balance risks and rewards enables investors to make investment decisions based on their tolerances for risk and financial objectives. In striking a fine line between risk and reward, investors can build robust portfolios that weather market upheavals while aiming at long-term growth with stability. This knowledge is vital for success in today’s fast-changing world of finance.

FAQs

- What is the risk and return trade-off in working capital management?

The balance between liquidity (low risk) and profitability (high return) is a risk-return trade-off in working capital management. Ideal management aims to ensure adequate liquidity for meeting short-term debts and maximising returns on unproductive cash through either investment or improvement in operational efficiency. This balancing act guarantees steady operations and openings for future growth while at the same time reducing the firm’s financial exposure vis-à-vis invested capital returns.

- What is an example of a risk trade-off?

A perfect illustration of a trade-off concerning risk is demonstrated through investing decisions that chase higher potential gains at the expense of more uncertainty or volatility. For instance, the option to invest in stocks rather than bonds includes trading-off between high returns and increased variability for low returns and stability, respectively. Hence, before making such choices, investors must weigh their return ambitions against their level of risk tolerance.

- What is the risk-return trade-off curve?

The curve of risk-return trade-off displays how much the level of danger (usually measured by volatility or uncertainty) is associated with the probable gain. It can be observed that the probability of significant returns is mainly linked to high-risk levels, but this means that they will also be characterised by increased uncertainty and possible losses. Investors rely on this line to assess risk vis-à-vis expected profits when making investment decisions.

- What is the risk-return trade-off in capital structure?

In the capital structure, there is a balance between the financial risk and the expected return on investments, referred to as the risk-return trade-off. The decision of what proportion of debt and equity financing to adopt lies with companies. Debt is associated with lower costs but heightens financial risks through repayment commitments, while equity financing has higher costs but less financial risks. The optimum capital structure maximises returns while managing risk to meet financial obligations and investor expectations.

- What is the meaning of trade return?

Trade return is usually the term that designates the income or loss from trading investments or assets within a portfolio. Therefore, it is the financial result of purchasing and vending securities or different types of financial instruments in a particular period. It indicates the effectiveness of trading decisions and strategies concerning market movements, investment objectives, and the monetary gains (or losses) they generate.