When it comes to trading charts, even for experienced traders, it can be challenging to identify specific patterns. Trading chart patterns often take on forms that may be used to predict price movements, including stock breakouts and reversals.

Understanding chart patterns will give you a competitive edge in the marketplace, and using them will improve the relevance of your next technical analysis.

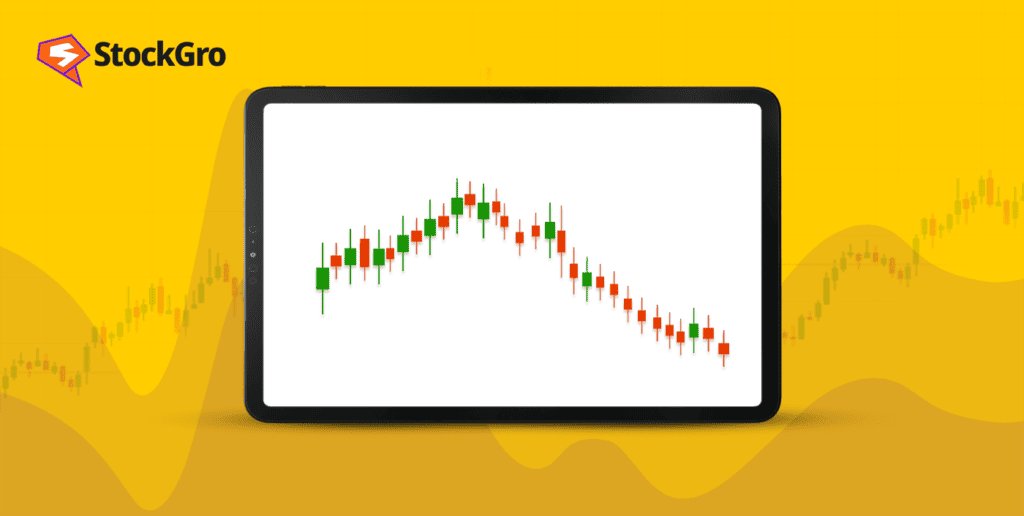

An upside-down “U”-shaped graph of price fluctuations indicates a rounding top chart pattern. A rounding top also shows a reversal and suggests a bullish security trend. On the other hand, the formation of a rounding bottom comes at the end of an extended rising pattern. It usually indicates a reversal in the long-term price fluctuation.

In this article, we will look at the meaning of the rounding bottom chart pattern, how to identify one, and how to trade a rounding bottom. Let’s begin!

Also read: Understanding double bottom pattern

What is a rounding bottom pattern?

The rounding bottom pattern is made up of a neckline resistance level and a rounding bottom U shape. The rounding bottom pattern, sometimes called the saucer bottom pattern, can forecast a long-term rising trend.

This technical analysis pattern is found in the financial sector, particularly in penny stocks, where traders can quickly identify expected reversal points in a downtrend due to the high volatility of the shares.

The rounding bottom pattern indicates the end of the present downturn and a possible beginning of an upswing. For this reason, this pattern often encourages traders to go long.

The pattern, however, continues to decline further before the price stabilises and forms a rounding bottom. The price eventually rises above the stabilised area’s neckline. This marks the end of the pattern.

How does a rounding bottom pattern function?

While a rounding bottom lacks the “handle” portion’s temporary downward tendency, it still has a similar shape to the bullish cup and handle pattern. A rounding bottom’s first downward slope indicates an oversupply, which pushes down the price of the stock.

As more people enter the market at a lower price and demand for the stock grows, the market shifts to an upward trend. Once the rounding bottom is completed, the stock resumes its new upward trend after breaking out. The positive market reversal signalled by the rounding bottom chart pattern indicates that market sentiment is gradually shifting from negative to positive.

Also read: Learn the know-how of the cup and handle trading patterns.

How can I identify a rounding bottom pattern?

A rounding bottom chart pattern can be broken down into several primary components. The buildup to the stock’s initial decline towards its bottom can be observed by the previous high in the trend.

When the stock price levels off and gets closer to the bottom of the pattern formation, the trading volume remains at its lowest. It would be at its highest at the beginning of the decline. Investors buying back into the stock results in the volume rising as the stock bounces back and continues to finish the pattern.

Breakdown of the rounding bottom pattern

Downtrend: A consistent decline in the value of a security or asset is the first indication of a pattern.

Rounding curve: As the market levels out and begins to create a smooth rounding curve, the downturn continues. The saucer-like look is usually created by a gradual curvature.

Support line: This is the lowest price that was attained during the pattern creation and is found at the bottom of the rounding bottom. Usually, this support line lies flat or has a slight upward slope.

Resistance line: The highest point of the saucer’s curvature is where the resistance line is drawn. It stands for a level that the price found it challenging to break above when the pattern was forming. Additionally, the resistance line is usually level or has a slight downward slope.

Volume: As the rounding bottom pattern develops, volume tends to decline, signifying a reduction in selling pressure. This volume decline indicates that sellers, or bears, may be losing control of the market.

Breakout: If the price breaches the resistance line, the pattern is said to be finished. This breakout of the rounding bottom pattern suggests that the previous downtrend may be recovering and might start a new uptrend.

Also read: The double top breakdown: Profit from chart patterns

Trade rounding bottom: Here’s how

It takes patience when you are about to go with the ‘u pattern trading, as it takes a while to develop. When the declining price trend stabilises for some time before starting to rise again, you may consider that the pattern has developed.

If the volume traded is higher during a price decline, flat during price stability, or rising during a price increase, this indication gets strengthened.

Drawing the neckline is the next thing to do once the pattern has been verified. A line connecting swings in a pattern is called a neckline. Traders may consider booking a long position whenever the stock price breaks through the neckline. When trading long, some traders additionally set up stop-loss limits.

When the price reaches the target price, most traders try to exit their positions.

Although the rounding bottom pattern may be implemented in any time frame, higher time frames, such as the daily chart, are the most effective for spotting and using this pattern. In addition to helping you evaluate potential trades for the lower time frames, the higher time frames can provide you with more market clarity.

Conclusion

In conclusion, the rounding bottom pattern is created when the price of a security hits a new low, goes horizontally, and then rebounds.

As a result, it develops a rounded bottom appearance. This rounding bottom pattern, when correctly identified, could prevent traders from selling in a market that may not be advantageous.