From Harshad Mehta in India to Bernie Madoff in the USA, stock market scams have not spared investors in any country. Today, such scamsters have gone a step ahead to use our everyday applications like Instagram and Telegram to deceive investors. But how do investors save themselves from these traps? Here is where regulatory bodies are essential.

The Securities and Exchange Commission is a regulatory authority monitoring the US stock market. In today’s article, we will understand the role and purpose of the Securities and Exchange Commission, along with its history and functions.

Also read: What is sebi

What does the Securities and Exchange Commission do?

The Securities and Exchange Commission is an agency created by the US government to supervise the activities of stock exchanges in the United States of America.

The Securities and Exchange Commission has divided its objectives into three primary goals, which are further divided into smaller goals:

- To protect investors against manipulation and fraud.

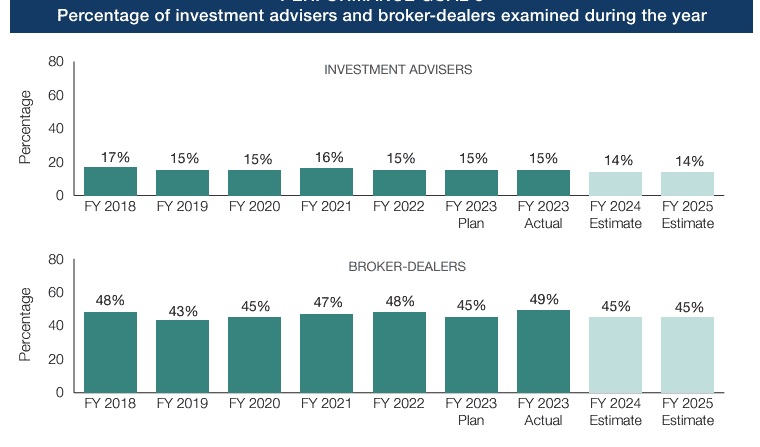

- Conduct examinations to identify risks and misconduct affecting investors.

- Enhance the capabilities to manage and analyse data for early detection of fraud.

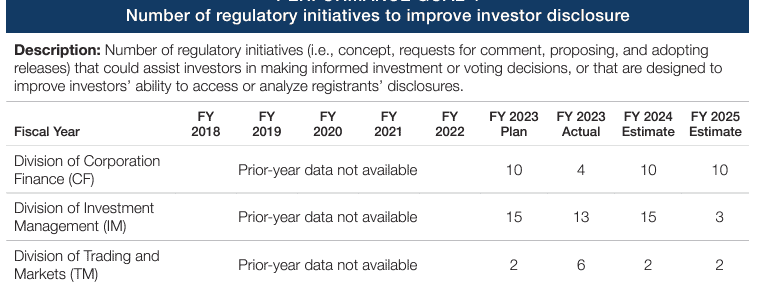

- Review and update the disclosure rules to help investors have access to detailed information for making the right investment decisions.

- Develop and enforce a regulatory framework that keeps up with the growing market and technology.

- Regularly review and update existing rules to incorporate the latest technology.

- Build strategies to identify and resolve infrastructure risks in the market, both to brokers and investors.

- Stay up to date with the happenings of evolving markets to implement similar ideas and techniques.

- Employ a skilled workforce that is diverse and inclusive to work towards the agency’s objectives.

- Empower and train the workforce.

- Focus on diversity and inclusion while hiring to be an equal employer.

- Collaborate with other SEC offices and facilitate internal movement of employees to gain overall exposure.

- Enhance the agency’s internal systems to keep it safe from cybersecurity threats.

Also read: RBI MPC Meeting 2024

Securities and Exchange Commission – History

The Blue-Sky Law was prevalent in the United States before the introduction of the SEC. According to the Blue-Sky Law, every state in the country had its own regulations to govern the activities of their respective stock exchanges. However, the law was found ineffective.

Besides, the stock market crash in the year 1929 forced the government to create an exclusive and efficient body to handle such issues. So, the Securities and Exchange Commission was established in 1934 under the Securities Act of 1933 and the Securities Exchange Act of 1934. While the Securities Act deals with the primary market, the Securities Exchange Act deals with the secondary market.

The agency has gone through an evolution since its inception to become one of the most powerful governing bodies in the country’s financial system, maintaining the activities of the stock market.

What are the functions of the Securities and Exchange Commission?

The Securities and Exchange Commission operates through six divisions to perform various functions:

- Corporation finance

This division deals with the disclosure of material information, both during an IPO (Initial Public Offering) and further trading in the secondary market, to help investors make informed decisions. Besides, it also assists companies regarding SEC’s rules.

- Economic and risk analysis

This division helps the Commission get insights into economic and statistical analysis about market trends, events and innovations. It also helps in developing the necessary analytical tools to assess the market and associated risks.

- Enforcement

This division conducts investigations and prosecutions against violations of federal laws.

- Examination

This division conducts various examinations for different stakeholders, like brokers and dealers, clearing agents, etc., to ensure they have the required knowledge to monitor risks and prevent fraud.

- Investment management

This division works towards ensuring that mutual fund and hedge fund companies, and other investment companies, work according to applicable investment rules in the country.

- Trading and markets

This division monitors all the activities of the market, especially those of major participants like stock exchanges, brokerage firms, etc.

Also read: Financial Securities

Bottomline

Given the increasing cases of fraud today, significantly in the financial sector, the role of regulatory authorities is crucial.

The Securities and Exchange Commission is one such authority governing the US securities market. The SEC ensures fair trading and prevents fraudulent activities to protect investors from losing their money.

The SEC is to the US stock market what the SEBI (Securities and Exchange Board of India) is to the Indian stock market. The SEC acts as the cornerstone, maintaining discipline, transparency and stability among stock exchanges in the United States of America.