Welcome to the world of finance, where the concept of a sinking fund acts as a financial lifeline for both individuals and organisations. Whether you’re planning for a major purchase or ensuring your business’s long-term stability, understanding the ins and outs of sinking funds is a valuable asset in your financial journey.

Let’s embark on this enlightening exploration of sinking funds.

What is a sinking fund?

A sinking fund serves as a financial strategy to set aside a portion of funds regularly to meet future financial obligations or repayments, particularly for debt or large capital expenses.

The primary purpose of a sinking fund is to ensure financial stability and reduce the burden of future financial commitments. By accumulating funds over time, individuals or organisations can guarantee the availability of necessary funds when needed, avoiding sudden financial strains or the need for additional borrowing.

It acts as a prudent financial planning tool, providing a sense of security and minimising the risk of default or financial distress when future financial obligations arise.

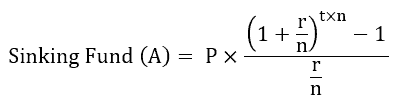

Below mentioned is the sinking fund method formula:

Source: EDUCBA

Where,

- A – Money accumulated

- P – Periodic contribution

- r – Interest rate

- t – Number of years

- n – Number of payments per year

You may also like: Key risks in investing in the stock market

Types of sinking fund

- Debt sinking fund: This type is focused on repaying outstanding loans or bonds, ensuring timely principal and interest payments.

- Maintenance sinking fund: Commonly used by businesses and homeowners’ associations, it covers maintenance and repair expenses for assets like buildings and infrastructure.

- Equipment sinking fund: To replace or upgrade equipment, such as machinery or vehicles, ensuring ongoing operational efficiency.

- Capital expenditure sinking fund: Designed for major capital projects like construction or expansion, supporting the growth and development of an entity.

- Reserve sinking fund: Primarily for saving and investing to build reserves for future financial stability and unforeseen contingencies.

Mistakes to avoid

Underestimating contribution needs:

A common mistake is underestimating the required contributions to the sinking fund. Inadequate funding can lead to insufficient funds for future obligations, jeopardising financial stability.

Poor investment choices:

Making ill-advised investment decisions for sinking fund assets can result in lower-than-expected returns. Careful investment planning is essential to maximise growth.

Neglecting inflation:

Failing to account for inflation erodes the real value of the sinking fund over time. Adequate adjustments should be made to counter the impact of rising prices and maintain the fund’s effectiveness.

Also Read: The Complete Guide to NFO – New Fund Offer

Advantages of sinking fund

- Debt management: Sinking funds help manage and reduce the risk associated with debt by ensuring funds are available for future debt repayments.

Regular contributions to a sinking fund can lead to lower interest rates on debt, saving money over the long term. - Financial stability: Sinking funds provide financial stability by ensuring funds are available for planned expenses, reducing the need for emergency borrowing. It allows for effective budgeting and financial planning, ensuring resources are allocated for future obligations.

- Investment opportunities: Funds in a sinking fund method can be invested to generate additional income, potentially increasing the pool of available funds.

Over time, the sinking fund investment can grow, allowing for the accumulation of wealth. - Flexibility: The sinking fund factor is tailored to specific financial goals or obligations, providing flexibility in financial planning.

They can adapt to changing financial circumstances, helping individuals or organisations meet evolving needs. - Risk mitigation: By ensuring funds are available for debt repayment, sinking funds reduce the risk of default and its associated consequences.

Sinking funds act as a buffer during economic downturns or unexpected financial crises, providing a financial safety net.

Also Read: Risk management in stock market

Sinking fund example

Example 1:

Suppose you plan to save for your child’s education, which you estimate will cost ₹1,00,000 in five years. You start by investing ₹16,000 annually in a fixed deposit with an interest rate of 7%.

With this disciplined approach, you’ll accumulate the necessary funds over time, ensuring you’re financially prepared for your child’s education expenses.

Solution:

Annual Deposit = ₹16,000

Interest Rate = 7% or 0.07

Number of Years = 5

Amount Accumulated = ₹16,000 × ((1 + 0.07)^5 – 1) / 0.07 = ₹94,877.49

Therefore, by making annual deposits of ₹16,000 at a 7% interest rate, you’ll accumulate approximately ₹94,877.49 in five years, which should cover your child’s education expenses.

Example 2:

Let’s consider XYZ Ltd., an Indian company, issued 200 bonds, each priced at ₹1,000. These bonds carried a 4% coupon rate, payable annually over the next fifteen years. At the end of this period, the company must buy back the bonds at their face value.

To accomplish this, the company designates these as sinking fund bonds and intends to make semi-annual deposits for a decade. We need to determine the amount of each semi-annual contribution at an annual interest rate of 5%.

Solution: Amount to Accumulate = ₹1,000 × 200 = ₹200,000 Interest = 5% ÷ 2 = 2.5% or 0.025 Compound Frequency = 2 times (semi-annually) Period = 10 years Semi-annual Contribution = ₹3,650.57 Therefore, XYZ Ltd.'s semi-annual contribution to the sinking fund is ₹3,650.57.

Also Read: Key risks in investing in the stock market

Difference between sinking fund and emergency fund

| Factors | Sinking Fund | Emergency Fund |

| Purpose | Planned for future expenses | Created for unforeseen financial crises |

| Time horizon | Short-term fund – linked to upcoming expense | Long-term fund – covers 3-6 months of expenses |

| Flexibility | Rigid purpose, not for emergencies | Provides flexibility, and can be used for unexpected expenses |

| Access and priority | Lower priority during crises | Top priority in emergencies, crucial safety net |

| Funding frequency | Regular, systematic contributions | Ongoing contributions even after reaching the goal |

Bottomline

By diligently setting aside funds and adhering to a structured plan, individuals and businesses can achieve their long-term financial goals, mitigate risks, and be well-prepared for unexpected financial challenges.

The advantages of a sinking fund, such as debt reduction, investment opportunities, and peace of mind, outweigh any potential pitfalls if managed wisely.

So, whether it’s for future projects, debt repayment, or unforeseen emergencies, a sinking fund can be a reliable financial companion on the path to fiscal security and success.