While investing, the allure of finding hidden opportunities with the potential for significant returns is undeniable. One of the hidden gems in the stock market is small-cap companies. While larger companies dominate the headlines, small-cap stocks have untapped potential to transform your investment portfolios.

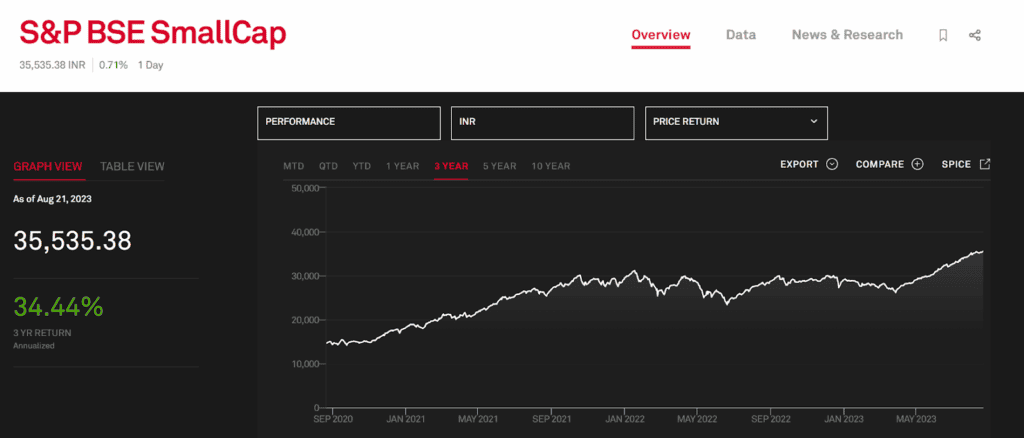

The S&P BSE SmallCap index, which tracks the performance of small-cap companies in India, has given an outstanding annualised return of 34.44% over three years as of August 21, 2023. Such impressive performance indicates the considerable growth of the small-cap segment.

Source: S&P Global

Association of Mutual Funds in India (AMFI) data also displays that several small-cap funds – direct and regular plans – have given 39% and 37% annualised returns, respectively, within three years.

However, it is necessary to remember that any asset’s past performance does not necessarily indicate future returns, and stocks carry inherent risks.

In this exploration, you can dive into the world of small-cap stocks and explore why small-cap stocks are known as hidden gems and lure savvy investors seeking outstanding growth prospects. Know the risks associated with and strategies to mitigate such risks.

You may also like: Decoding stock sizes: Large cap vs. Small cap vs. Mid cap

Defining small-cap stocks

The SEBI (Securities and Exchange Board of India) categorises all Indian companies listed on exchanges based on their market capitalisation. Market capitalisation or market cap signifies the total market value of a company’s outstanding shares. Multiply the current share price by the total number of a company’s outstanding shares to determine its market cap.

Small-cap stocks refer to the stocks issued by companies with a market cap of below Rs. 5,000 crore. These companies are in their early growth stage.

Key characteristics for clarity on ‘what is a small cap stock’ are as follows:

- As per the SEBI, small-cap companies are ranked 251st or beyond as per their market cap.

- Small-cap companies can offer significant growth potential as these companies are in their early stages, with huge room to expand and innovate.

- These stocks are considered risky due to their high dependency on market conditions, making them volatile.

Most small-cap companies have lower revenues than their large counterparts. However, they can be extremely profitable investments considering their high growth potential against high risk.

The allure of small-cap stocks

Small-cap companies can offer the following benefits to investors:

Higher growth potential

What makes small-cap companies so alluring is the higher growth potential than larger ones. While large, established companies have reached their peak performance, small companies are at a growth phase with more room for innovation and expansion.

With innovative products/services or business models, they can increase their market share and record substantial revenue growth. Investors who can identify promising small-cap stocks early can benefit from outsized returns over time.

Since 2020 and continuing into 2023 (from January to June), small-cap companies have offered significant gains. You can look at impressive returns small-cap index has yielded in the table below:

| Returns from April 1, 2020 to June 30, 2023 | Returns YTD | |

| S&P BSE Sensex Index | 29.0% | 7.2% |

| S&P BSE Midcap Index | 37.6% | 14.3% |

| S&P BSE Smallcap Index | 46.8% | 13.1% |

Agility and adaptability to emerging trends

Smaller companies are often more agile and adaptable to changing market conditions which allows them to thrive in evolving markets. Unlike established or large-caps, small-caps shift their strategies as the market changes its direction.

They can respond to shifts in consumer preferences and technological advancements swiftly. Hence, these companies can capitalise on emerging industries more quickly as compared to established ones.

Less analyst coverage

Typically, many small-cap stocks remain unattractive to widespread analysts and big players, unlike their larger competitors. Such a lack of coverage may lead to the undervaluation of these stocks.

When the true value of a small cap share price does not reflect in its market prices, it may lead to market inefficiencies. Investors with the ability to identify hidden opportunities can take advantage of these inefficiencies.

Diversification

Small-cap stocks can help investors to diversify their investment portfolios. Small-cap stocks are influenced by different factors than large-caps and other investment types.

These factors include emerging trends, market sentiments, innovative strategies, potential market inefficiencies, etc. Therefore, these stocks can help investors to reduce overall portfolio risk, provided it is a well-researched addition.

Also Read: Key risks in investing in the stock market

Risks associated with small-cap stocks

- Limited liquidity: Limited liquidity indicates lower trading volume, making it challenging to trade them swiftly.

- Higher investment risk: There is an increased probability of losing investments due to business setbacks, market downturns or company-specific issues, as they can affect small-cap companies severely.

- Greater volatility: Volatility refers to the tendency that small-cap stocks may experience. It is greater and more frequent in the case of small-caps than large cap stocks, making them more risky.

Strategies for small-cap success

Consider the following strategies while investing in small caps:

- Identify undervalued companies

To uncover opportunities, investors need to identify undervalued small-cap stocks. It requires you to look beyond short-term market price movements.

Research well to get clarity on the company’s fundamentals and growth prospects in the long run and avoid making investments based on short-term fluctuations.

- Thorough research

Research and due diligence are crucial when investing in small-caps due to inherent risk and to achieve the goal of maximised potential returns. Investors performing thorough research and analysis can identify undervalued small-cap stocks with strong growth potential.

The research should include scrutinising the company’s financial statements, earnings, cash flow and management. Investors can check the management team’s track record to evaluate the company’s ability to innovate and navigate respective industry challenges.

- Risk management

Small-cap stocks tend to be more volatile than large-cap or established companies. Therefore, investors must focus on risk management. Investors can identify if the stock can experience higher price volatility due to changes in market sentiment or lower trading volumes.

It helps them to be prepared for potential price swings and choose industries based on their risk tolerance. Also, spreading investments across various small-cap stocks can be helpful to mitigate the risk. If a stock performs poorly, another stock in the portfolio may compensate and enhance the potential for positive returns.

Also Read: Immediate or Cancel (IOC) orders: A trader’s guide from concept to execution

Ways to invest in small-cap stocks

Three popular ways to invest in small-cap stocks are as follows:

- Investing in individual shares

Consider buying shares of small-cap companies through a brokerage account. Choose individual stocks based on your investment strategy, add them to your watchlist, research thoroughly, and manage your portfolio effectively.

- Mutual funds

Researching small-cap stocks can be time-consuming. Also, limited information is accessible by investors about such companies. Therefore, you may consider mutual funds investing in small-cap stocks which fund managers manage.

- Exchange-traded funds (ETFs)

Another option is ETFs. These are the funds replicating the performance of a small-cap stock index. These diversified funds pool money from many investors and invest it by tracking the broad small-cap indexes based on specific industries, themes, etc.

The closing

Small-cap stocks with the potential high profits can help investors to hold a high-return portfolio. However, investors must keep in mind that higher gains are associated with risks of losses.

Therefore, perform diligent research, consider quality small-cap stocks, determine your risk appetite, and diversify the investment portfolio to mitigate risk and meet financial goals in the long term.