Brokerage companies make it easier for people to conduct financial transactions and help buyers find their way around the markets. The overall number of demat accounts reached 15.1 crores in India as of March 2024.

In such a scenario, this article looks into the Indian brokerage sector, from the steps involved in starting a business to current market trends and the wide range of services offered.

About brokerage firms in India

A financial organisation that facilitates the purchase and sale of financial assets is known as a brokerage business. These financial instruments include different assets, such as equities, bonds, commodities, and derivatives.

Brokers who work for brokerages have extensive knowledge of the financial markets and have valid licences to practice. They assist customers with share sale and purchase decisions, conduct market research, and help clients make financial choices. They could also provide other services, including financial planning, financial advisory, and portfolio handling.

As of February 2024, the Central Depository Services Ltd. (CDSL) maintained its upward trend in terms of overall demat accounts and month-on-month growth in the market share of brokerage firms in India. In February, the number of active customers at NSE climbed by 4.8% month-over-month, reaching 40.05 million.

Presently, 63.5% of all active customers on the NSE are associated with the most prominent five discount brokers, up from 59.6% in February 2023.

Also read: Stock broking industry

Types of stock brokers

The Securities and Exchange Board of India (SEBI) ensures that all stock brokers in the country are authorised members of exchanges. To trade stocks, you may choose a full-service broker or discount broker. Their service offerings are the primary differentiator between them.

- Full-service brokers

When it comes to investments in commodities, equities, mutual funds, and more, a full-service broker has you covered with research, trading, and advice. Additionally, it offers the ability to purchase and sell stocks.

Brokers like this provide specialised client relationship executives. They include investment management services, investment strategy, handling portfolios, assistance, and guidance.

- Discount brokers

Discount brokers primarily conduct operations online. Today, they have become more prevalent because of technological advancements. They provide brokerage solutions for anyone looking to trade stocks at a discount.

In addition to standard brokerage services, these firms do not provide tax preparation, financial planning, or market analysis.

Also read: What is sebi

Eligibility criteria for becoming a stockbroker or opening a brokerage firm

- A bachelor’s degree and a minimum age of 21 are required for all applicants.

- Following graduation, two years of professional experience are required at a stockbroking company as an authorised clerk, assistant, or an authorised stock broker’s trainee.

- It is advisable to acquire training in specific fields, such as economics or finance, to qualify as a licenced stockbroker.

How to start a brokerage firm in India?

- Determine the expenses

It is essential to determine all associated expenses when starting a brokerage company in India. Potentially relevant costs include capital requirements, infrastructure, personnel, legal, insurance, and more. If you want your company’s finances and future to be successful, you must budget properly.

- Decide which market to target

Consider areas like consumers’ expectations, the state of the market, and the competitors. Finding the sweet spot between competence and profitability is essential. To find an attractive and durable target margin, your business must first examine its expenses, pricing strategies, and market trends.

- Calculate your earnings

Look at the potential sources of income, including commissions from brokerage services, charges for advisory services, interest on margin, and other related services. Consider the market, your competitors, and the kind of customers you want to attract to make a precise estimation of your company’s revenue and profit.

- Incorporate all applicable legal principles

Verify with legal counsel to ensure you’re following all rules and regulations, adhere to SEBI regulations, get any licences and registrations you need, create detailed client agreements, and put systems in place for handling risk and compliance effectively.

Requirements to start a stock brokerage firm in India

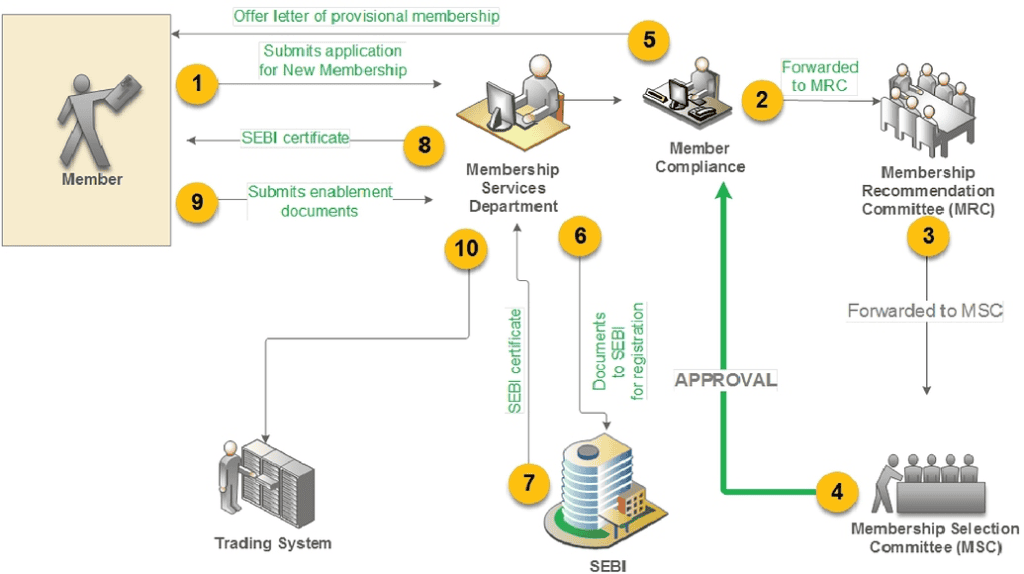

- The NSE Membership Services Department requires that you file a New Membership Application when starting a stock brokerage firm in India.

- When the Membership Services Department gives its stamp of approval, the membership request is forwarded to the Membership Recommendation Committee and the Membership Selection Committee.

- After reviewing the application, the Membership Selection Committee forwards it to the Member Compliance Department for final authorisation.

- Upon approval, you will get the Offer Letter of Provisional Membership.

- To register with SEBI, you must provide them with specific documentation. The trading system will be made available to you when the SEBI Certificate has been authorised.

Also read: Financial Securities

Conclusion

The stockbroking industry is highly competitive and challenging, requiring individuals with extensive industry knowledge and a diverse set of skills. Before one can become a stockbroker, one needs to be sure they’re eligible and have fulfilled all the necessary criteria.