If you’re keen on understanding the concept of price fluctuations, there’s no better place than the stock market.

Securities in the stock market are generally sensitive to demand, supply and various other economic factors. The impact of price fluctuations not only affect companies but also investors and traders who buy these stocks.

Stock options are a type of security in the stock market to protect investors to a certain extent and hedge the risk of losses due to price changes.

What is a stock option?

Stock options trading is also known as equity options trading.

Options in the stock market, are securities which give the holder the right to buy or sell an asset – on a future date, at a pre-agreed price. It is essential to note that the holder has the option to execute the contract but has no obligation to do so.

Options are a form of derivative, which means that the price of the option contracts is derived from the value of an underlying asset.

How do options work?

Let us consider an example of stock options to understand the concept better.

The current price of Company A’s stock is ₹ 100. You speculate the price to increase above ₹150 in a few months. You want to benefit from this situation, but you are unsure about investing as the price may or may not increase.

To manage the risk of uncertainty, you enter into an options contract with another trader to “buy the stock at ₹100 after three months.”

Now, assume that the price goes up to ₹140 after three months. You have the right to exercise your options contract and buy the asset at ₹ 100, saving ₹40 per unit of stock.

What if your speculation goes wrong and the stock price falls to ₹90?

Since you are the holder of the options contract, you have the option to dismiss the contract and buy the stock directly from the market.

Also read: Option chain for smarter online trading

The meaning of stock options must be clear with this example, as it shows the right and no obligation status of the options holder. It is also essential here to note that the options seller has no option but to execute or cancel the contract role based on the holder’s decision.

Options are traded on the stock exchange, similar to stocks. The holder has the option to exit the contract at any time, on or before the expiration. Similarly, the seller of the options contract can exit by paying a premium to the buyer.

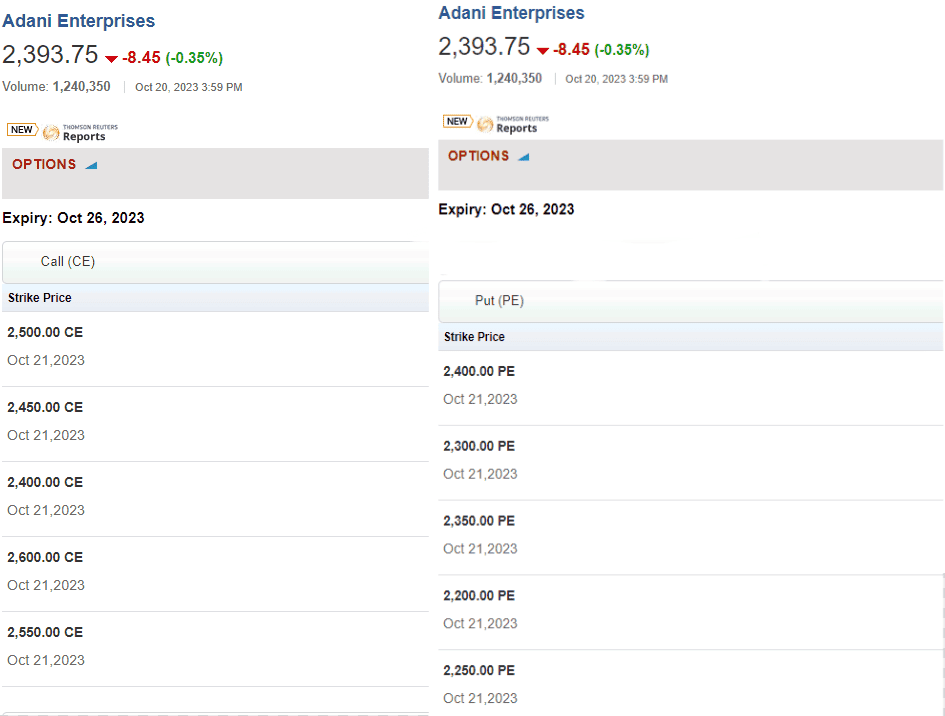

Here is a list of real-time options contracts for Adani Enterprises, listed on NSE as of 21 Oct 2023, with an expiry date of 26 Oct 2023.

₹2,393.75 reflects the spot price which is the current market price, while the list of other prices are strike prices at which options contracts will get executed.

Source: Moneycontrol

Features of options

- Option holder – The trader who buys the option to buy or sell assets.

- Option writer – Writer is the seller of the options contract and must execute or cancel the contract, depending on the buyer’s decision.

- Premium – This is the fee paid by the holder to the writer for getting the authority to exercise or cancel the contract. It is a fee paid over and above the contract price to cover the writer from the risk of non-execution.

- Strike price – The pre-agreed upon price in the options contract to trade an asset on a future date.

- Spot price – The current market price of the underlier.

- Settlement date – The future date for exercising the contract or the date that determines the expiry of the options contract.

Types of options

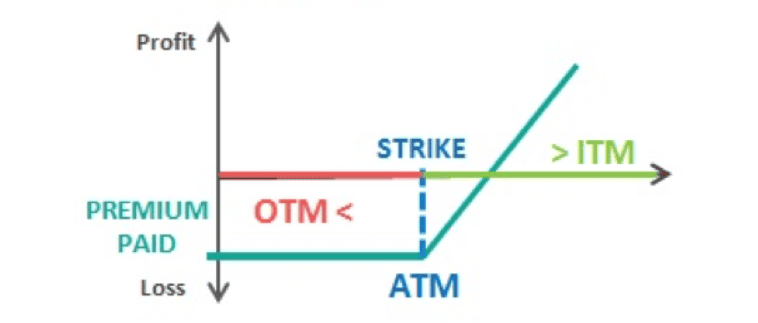

Call options – This is where the option holder has the right to buy the asset on a future date. In a usual scenario, a trader expecting an increase in stock prices enters into call option contracts to buy assets at lower prices.

Also read: What is a straddle option strategy?

They are further classified into:

- In-the-money – Strike price < Spot price of the underlier – Indicates a profitable scenario for the option holder.

- At-the-money – Strike price = Spot price (Excluding premium) – Indicates a scenario of no profit, no loss.

- Out-the-money – Strike price > Spot price – Indicates a loss where the holder may decide to cancel the contract.

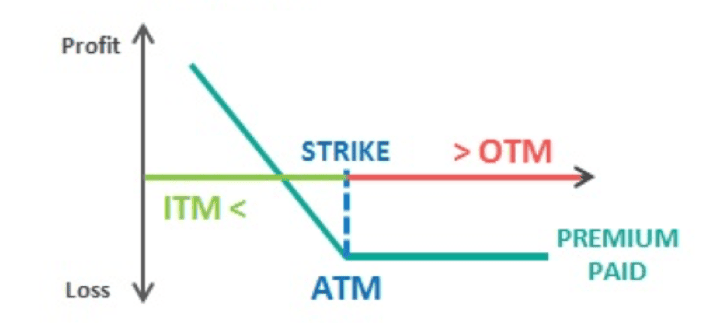

Put options – This gives the option holder the right to sell the asset on a future date. A trader speculating a decrease in the prices of stocks enters into a put option contract to sell the asset at a higher price.

- In-the-money – Strike price > Spot price of the underlier – Indicates that the option holder will profit by executing the put option.

- At-the-money – Strike price = Spot price (Excluding premium) – A scenario of no profit, no loss.

- Out-the-money – Strike price < Spot price – Suggests a loss where the holder may cancel the put option contract.

Benefits and risks of options trading

Pros of options trading:

- The options contracts are a great way to hedge the risk of price uncertainties and limit losses. It helps traders purchase securities at a price lower than the market price, thereby bringing down their expenses.

- It is a beneficial tool for the holders of the contract as they have the right to execute or cancel the contract based on their profit requirements.

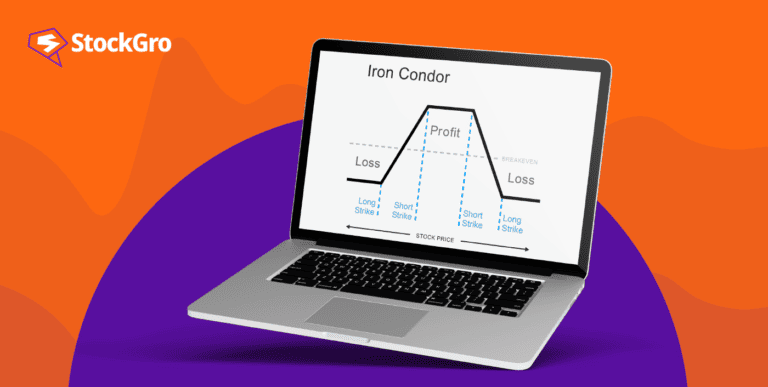

- Various strategies available under option trading, like the iron condor and iron butterfly, help traders earn additional profits in the form of premiums.

Also read: Iron condor – The options trading strategy

Cons of options trading:

- Options are complex securities. Since it involves multiple aspects, it requires thorough market knowledge before entering into options contracts.

- The sellers do not benefit much from the option contracts. Though it is a hedging tool for holders, it is quite risky for option writers as they do not have any control over the execution and cancellation of option contracts.

Bottomline

Options are hence, useful derivative contracts that help in managing price uncertainties in the stock market. Despite its ability to hedge risks, it is not suitable for all traders.

The power of option contracts depends on determining the strike price and expiry date, which requires competence and a strong grip on the market.