In the world of online stock broking and discount brokers, traders and investors receive hundreds of emails about various things from their brokers after the end of a trading session. One of these emails contains a contract note that is a very important document.

Let us understand more about contract notes issued by stock brokers and why they are so important.

What are contract notes?

A legal document that contains all the information regarding the trades executed by a stockbroker on behalf of their client is called a contract note. Traders and investors use this document to verify whether all the trades they placed throughout the day have been successfully executed or not. This document contains execution price, quantity, time, taxes, etc.

As the volume of trading increased, so did the number of frauds. The Securities and Exchange Board of India (SEBI) came up with the idea of issuing contract notes.

These contain all the details of trades executed by a broker on behalf of the client. In case of a dispute between the client and broker, this note can act as legal evidence and can also be used to legally challenge or sue the broker.

With the shift from manual to electronic form of trading, traders receive contract notes on their emails from their brokers at the end of the trading day. This email is password-protected for data security. Contract notes are also used for calculating capital gains while filing taxes.

Also read: The Indian tax year unveiled: A guide to AY and FY timelines

Format of a contract note

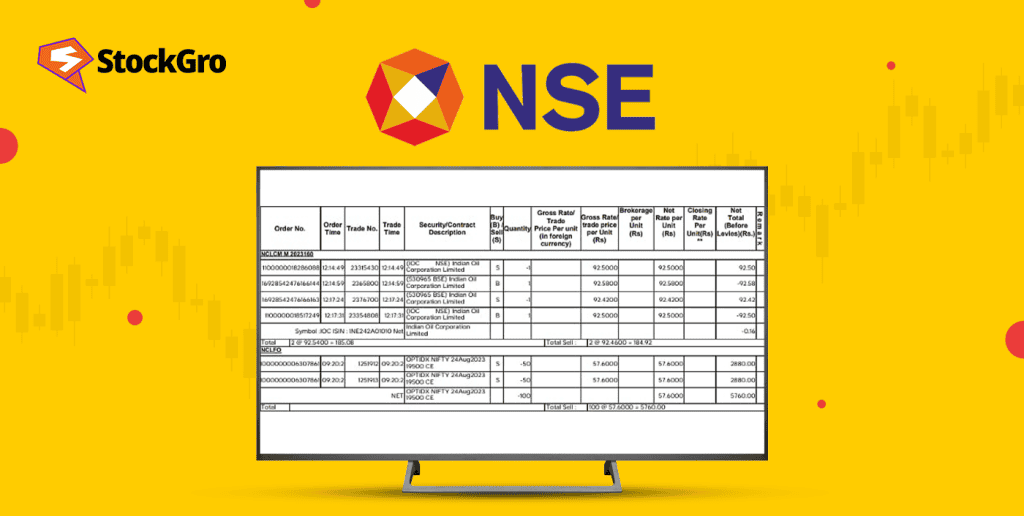

Beginning on August 1, 2024, the SEBI established a new structure for the contract note. (Source: NSE)

The first page of a contract note contains information about the client and the broker. It contains basic information like address, GST number, details of a compliance officer, digital signature, etc, about the broker and information like PAN card details, address, name, brokerage account number, etc about the client.

The second page contains information about the segment (equity or derivatives), securities ISIN number, weighted average price, etc. in a tabular format. Let us look at how weighted average price is calculated for both the equity segment and derivatives segment.

WAP for cash segment:

For buy the formula is, WAP = Total buy trade value for ISIN across exchanges / Total number of shares bought across exchanges.

For sell trades, the formula is, WAP = Total sell trade value for ISIN across exchanges / Total number of shares sold across exchanges.

WAP for derivatives segment: WAP = Total buy/sell trade value for common contract across exchanges / Total quantity bought/sold across exchanges.

The third page contains details like exchange transaction tax, clearing charges, STT, SGST, CGST, UTT, SEBI turnover fees, stamp duty, etc. The net payable or receivable amount, if displayed in brackets would mean payable by the client. If not in brackets would mean receivable by the client.

Also read: Understanding GST: The tax superhero of India

The next and last page of the contract note contains Annexure-A which contains the details of the trades. The items of Annexure A are listed below:

- Order number(no.) – For each trade executed, the exchange assigns a unique order number.

- Order time – Order time displays the time of execution for your order.

- Trade no. – Displays the trade number of the transaction

- Trade time – Displays the exact time an order is executed on an exchange. Order time and trade time can differ because, for limit orders, the trade might get executed after a while.

- Security/contract description – displays the name of the security.

- Buy/Sell – Letter ‘B’ suggests that a buy transaction is executed and ‘S’ suggests a sell transaction is executed.

- Exchange – Displays the exchange on which the transaction got executed (NSE/BSE)

- Quantity – Displays the number of shares (cash segment) or lots (futures) traded.

- Gross rate/ unit – represents the rate at which the order was fulfilled.

- Brokerage per unit – displays the brokerage charged per unit.

- Net rate/ unit – This is usually the same as the gross rate because brokerages are not mentioned elsewhere in the contract note.

- Closing rate per unit – This section is only for futures contracts and displays the closing price of the contract.

- Net total (before levies) – This shows the total amount due or to be paid to the client before any taxes or charges.

- Remarks – Displays remarks if there are any.

The contract note does not display some charges like details of DP charges and margin details. For that client has to see the fund statement.

Also read: What is expiry day trading?

Bottomline

Now you know everything about the stock trading contract notes. Even if you buy a single share, the broker sends you a contract note. Since the format has been changed from 1st August 2024, you will see a different format in contract notes prior to that date.

A contract note is a crucial document that any trader or investor needs to download or carefully save. This document must be properly checked and verified after each trading session. All individual trades must be carefully examined for quantity, price, etc.

FAQs

1: What are contract notes?

Contract notes are documents issued by a stock broker to the clients for verification of all the trades executed on a particular day. These notes are official records that provide all the information about the trades that were carried out, including the quantity, name of security, and specifics regarding taxes and charges.

2: Why do brokers issue contract notes?

The concept of contract notes was to avoid fraud or scams. Suppose a broker deducts money for 50 shares but actually delivers 5 shares to the client then contract notes can be used to verify the details of the trades executed and also the client can sue the broker based on the contract note.

3: How long is a contract note?

A contract note is four pages long. The first page contains the details of the broker and client. The second page contains details of transactions, the third page contains taxation details and the last page is Annexure A, containing all the details about the transaction.

4: Do I get a contract note daily?

You will only get a contract note for days when a buy or sell transaction has been executed from your trading account. If no transaction is done, you will not get a contract note. You can check your email ID or contact your broker for this document.

5: What to do if I don’t get a contract note?

If you don’t get a contract note you can communicate with your broker about the same because brokers are bound by SEBI rules to provide this document for transparency. A broker can either send an email or give the document physically to their clients.