A straddle strategy is an approach in trading where you buy a put option and a call option together for the same stock, at the same price and expiry date. This is done when you expect sharp price changes but are unsure of the direction. The cost to enter this trade is called the premium.

In a straddle, profit is made when the stock price moves significantly either up or down from the strike price, more than the total premium paid. The more dramatic the price change, the higher the profit.

Let’s have a look at what is meant by a straddle strategy and how it benefits you.

What is a straddle strategy?

Straddle strategy is a method utilized to manage risk. The term “straddle” implies covering or spreading out, often used to talk about spreading bets, risk, values or ideas.

In the financial world, straddle strategy refers to two separate transactions involving the same security, where both transactions balance each other out. It’s used by investors when they expect a big change in a stock’s price but are uncertain whether the price will rise or fall.

In implementing a straddle, two key insights are gained regarding what the options market predicts about a stock. Firstly, it indicates the expected volatility of the security. Secondly, it shows the anticipated trading range of the stock by the expiration date.

This strategy is adaptable for businesses aiming to mitigate financial risks, especially in volatile market conditions. Through a straddle, one can spread out the risk, making it a practical approach for handling the uncertainties of stock price movements.

You may also like: Risk management in stock market

How to create a straddle?

To work out the cost of a straddle, you need to add the prices of the put and the call options together. Say, a trader expects that a share of an Indian company might be volatile around the current price of Rs 4000, post its upcoming earnings announcement on April 1.

They could form a straddle if they are unsure of the directional bias. The trader would buy one put and one call at the Rs 4000 strike price, both expiring on April 15. To find the cost of the straddle, add the price of one ‘April 15 Rs 4000 call and one April 15 Rs 4000 put.

If both the call and put cost Rs 180 each, the total expense or premium paid is Rs 360 for the two contracts. To know the total cost, you will need to multiply 360 into the lot size of the instrument (eg: 15 for Bank Nifty and 50 for Nifty).

The premium hints that the share needs to move up or down by 9% from the Rs 4000 strike price for a profit by April 15. The expected rise or fall indicates the future anticipated volatility of the share. To figure how much the share needs to move, divide the premium by the strike price, which is Rs 360 divided by Rs 4000, or 9%.

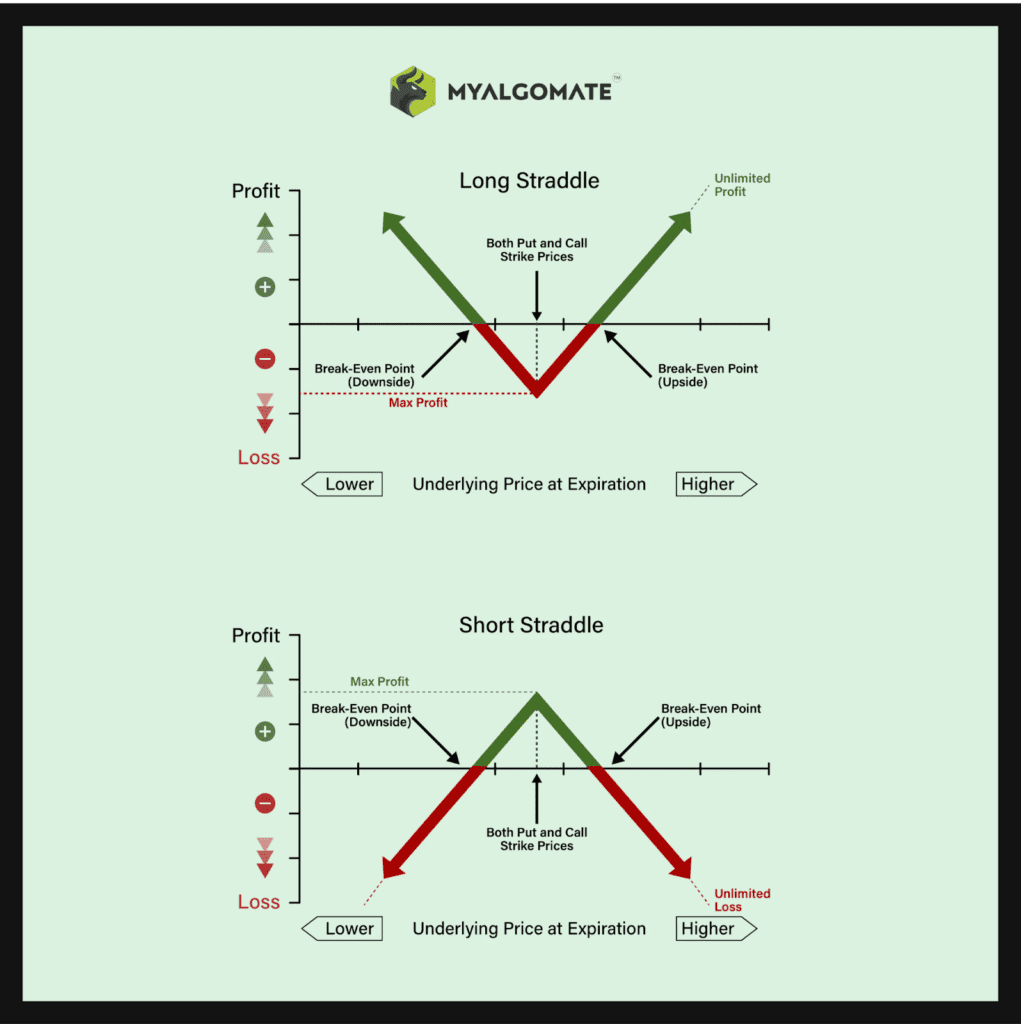

The above example explains long straddles where both put & call options of the same strike price are bought. But if you expect the market to be flat, you can sell both the call & put options are to form a short straddle.

Why Do You Need A Straddle?

Market rates can shift a lot and fast sometimes. That’s why having a “straddle” is good for your investments. This plan involves buying call options at a fixed rate and put options at another rate. This way, you’ll make money no matter where the market goes.

Buy at the market rate for the best results when making a straddle. This will get you the most money with the least risk. Once the market hits the rate of your options, you make your profit. Always check the market and keep your plans fresh to earn the most and risk the least.

Also read: What is the strangle option strategy?

What Is a Long Straddle?

A long straddle means buying both a call option and a put option at the same rate and expiry date. Depending on where you think the stock rate will go, it can be done for a net credit, a net debit, or a limited risk debit. This plan aims to make money from a big change in the stock rate.

Advantages and Disadvantages of Straddle Positions

| Aspect | Description |

| Advantages | |

| Potential Profits | Straddle positions can make money if the stock price goes up or down. For instance, if a share is priced at ₹300, you buy call and put options at ₹300 by paying a premium of ₹10 each. If the stock price increases, you make profit on the call option. If it decreases, you make profit on the put option. |

| Risk Mitigation | Before big company events like quarterly reports, when investors are unsure of the stock price direction, straddle positions can be used to lessen risk. This setup allows taking positions before big price changes occur, whether up or down. |

| Disadvantages | |

| Price Movement Requirement | To make a profit, the stock’s price change must be bigger than the premiums paid. In the above example, you spent ₹20 on premiums (₹10 on call, ₹10 on put). If the stock price only goes to ₹315, you end up with a loss. Profits usually come from big price swings. |

| Guaranteed Loss on Premiums | One option will definitely not be used, depending on the stock price movement, leading to a loss equal to the premium paid. This is more likely when the stock price doesn’t change much, making both options unprofitable. Besides, the transaction costs might be higher since you’re opening more positions compared to just one side. |

| Limited Usage | Straddle positions are best for times of high price changes and don’t work well in stable market periods. Also, they’re more suited for certain investments. Not all investments, especially those with low price fluctuations, will benefit from this strategy. |

Also read: How to trade in options and maximise your profit?

Profits in straddle strategy – how is it achieved?

A straddle strategy involves buying a call and a put option on a stock, both with the same expiry date. The call has a strike price above the stock’s current market price, and the put has a strike price below it.

This setup is like a “long synthetic option,” as mentioned. The idea is to make money whether the stock price goes up or down.

To earn profits, first, you get a call option, which means a chance to buy the stock later at a set price. This price should be more than the stock’s current price. Second, you get a put option, giving you a chance to sell the stock later at a set price, which should be less than the stock’s current price.

For instance, suppose a stock is at ₹100 now. You buy a call option at ₹110 and a put option at ₹90. If the stock price jumps to ₹120, your call option lets you buy at ₹110, making a ₹10 profit per share. If the stock falls to ₹80, your put option lets you sell at ₹90, again making a ₹10 profit per share.

This strategy needs good calculation. If done right, you can earn money regardless of the stock price movement.

Bottom Line

The Straddle strategy in options trading is useful in any market, offering unlimited profit potential with limited risk. It remains neutral to market trends, suitable for both short and long-term use.

By buying a call and a put option on the same stock with the same expiry, traders can earn irrespective of market direction, making it a simple strategy for uncertain market scenarios.