Risk is an inherent feature of instruments in the financial market. There are various kinds of risks, like the risk of volatility, liquidity, and counterparty defaults, to name a few.

While some risks are avoidable, others are not. The financial market has different instruments that help traders control the risk, if not avoid it wholly. Synthetic trading is one such option that aids traders in restricting their losses.

In this article, we will learn what synthetic trading means and how this strategy works on different instruments.

You may also like: Futures vs. Options: Differences every investor must know!

What is synthetic trading?

Synthetic trading is a strategy that helps obtain the benefit of investing in a financial instrument without making an actual and complete investment. The concept revolves around making customised transactions concerning the cash flow, expiry date, etc., to imitate the results of an actual transaction.

For instance, a trader enters a transaction that helps in getting the benefit of a futures trade without spending the money required for a futures trade.

Let us go through the workings of synthetic trade under different financial instruments to understand the concept better.

Synthetic futures and options trading

Though the entire financial market is subject to price fluctuations, the stock market, in particular, has the highest degree of price fluctuations, given the volatility of stocks to the economic conditions. So, synthetic trading on equities is a strategy used by traders to balance the risk. Similarly, the strategy works on commodities or any other instrument.

Futures and options are popular instruments for synthetic trading. They generally go hand-in-hand when it comes to synthetic trading. It is where traders enter multiple options contracts to have the same result a futures contract would have.

Before we dive deeper into this technique, let us understand the primary differences between futures and options contracts.

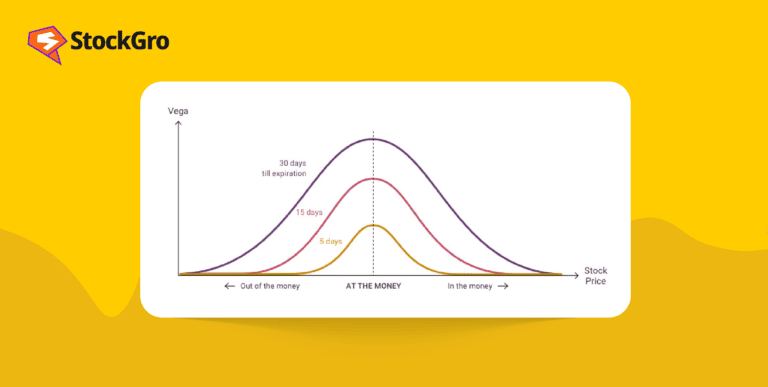

Both futures and options are derivative contracts that help investors hedge the risk of future price fluctuations. While a futures contract does not involve a premium, an options contract includes a premium to compensate the seller of options for the loss.

Another significant difference between the two is the treatment of the margin money and the practice of mark-to-market (MTM). Futures and options settle on a future date, hence a margin is deposited to keep the account active till the contract is closed. The margin amount is adjusted every day until the contract is open. While options contracts do not need cash settlements, futures contracts mandate cash settling of margin daily. This leads to an increase in cash expenses for traders.

To get over the margin expense and maintain liquid cash, traders opt for synthetic futures trading over regular futures contracts. The pay-off diagrams for synthetic and regular futures are identical.

Below is an example of synthetic futures work:

You are bullish on the stock of Company ABC, and you expect the prices to go up to ₹150. The current price is ₹100.

In a regular futures contract, you enter a contract to buy the stock at ₹110 after one month. After a month, you must buy it at ₹110, irrespective of the market price, along with the expense of MTM on margins.

Consider you enter a synthetic futures contract:

You enter two options contracts with the same strike price and expiration date to give you the same result as the futures contract.

With a strike price of ₹110 expiring in one month, you buy a call option and sell a put option.

If the price goes up to ₹150, as speculated, you exercise your call option and buy the stock at ₹110.

If the price goes down to ₹95 against your speculation, the buyer of your put option exercises the contract and sells the stock to you at ₹110.

Either way, you end up paying the same amount that you would have paid for a futures contract. However, buying the options contract helps you gain profits and selling the options contract helps you earn extra money through premiums.

Also read: Hedging 101: Protect your investments from market surprises

Synthetic trading in the forex market

Synthetic trading in forex refers to strategising trading in currency pairs that do not exist in the foreign exchange market. It is done with the help of an intermediary currency.

Consider the forex market in India, where the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) allow trading in 7 currency pairs: USD/INR, EUR/INR, JPY/INR, GBP/INR, EUR/USD, GBP/USD, USD/JPY.

Traders who want to trade other pairs than the above cannot do so. For example, a trader who wants to trade GBP/JPY cannot do so, as it is not a listed pair. So, traders involve an intermediary currency and enter into two transactions, with the end effect being GBP/JPY.

For example, a trader can enter into two trades with pairs GBP/USD (Buying GBP and selling USD) and USD/JPY (Buying USD and selling JPY). So, the position of USD is closed and GBP/JPY remains.

Also read: All you need to know about the basics of forex trading in India

Pros and cons of synthetic trading

Traders prefer synthetic trading over regular trading, given the advantages with respect to saving costs and providing liquidity. The time value of money suggests that a rupee today is more valuable than the same rupee tomorrow. So, synthetic trading gives traders the option to hold liquid cash and invest it elsewhere.

Gaining additional money on premiums by selling options contracts is an added advantage of synthetic trading.

However, every form of trading is risky in different capacities. Unexpected and high fluctuations in prices can be detrimental to synthetic trading. Also, formulating synthetic trading strategies is complex. It requires thorough knowledge, skill and practice. Incorrect strategies can lead to losses instead of gains.

Bottomline

Synthetic trading is one of the various hedging tools offered by the market. Though it does not cancel out the risk, it helps in minimising the degree of risk to a large extent.

Synthetic trading works on the concept of planning trading strategies that mimic the results of regular trades and also restrict losses. However, it requires immense practice before traders can use this comfortably.