In July-2023, tomato prices in North India surged to ₹250 per kg, causing concern among consumers. Various factors contributed to this spike. As the situation improved, the rates gradually stabilised. This fluctuation reflects the theory of price in action.

In this blog, we’ll examine how the macro economics & micro economics of price theory works.

What is the theory of price?

The theory of price examines how the cost of products and services is established in an economy. It revolves around the interaction between availability of goods and consumer needs. A balance occurs when the quantity of items offered by suppliers matches what buyers are ready to purchase, often called equilibrium.

Sellers aim to maximise revenue, while buyers want the best deal. Somewhere between these opposing interests, a mutually acceptable value is set, enabling transactions to occur.

But, this value doesn’t stay fixed. Various external influences drive constant changes. By analysing these shifts, price theory not only clarifies why costs fluctuate but also sheds light on how people react in economic environments.

You may also like: How to build financial resilience in times of economic uncertainty?

Key concepts behind the economic price theory

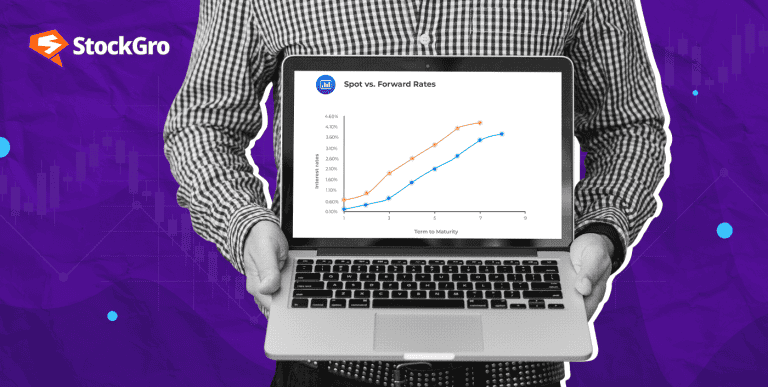

Supply and demand dynamics

Central to the theory of price are the dynamics between availability and desire. Supply refers to the quantity of goods or services that producers are willing to offer and demand reflects consumer interest and purchasing power.

When there’s an excess of a product, its value decreases. On the other hand, scarcity—especially when paired with high demand—naturally drives costs upward.

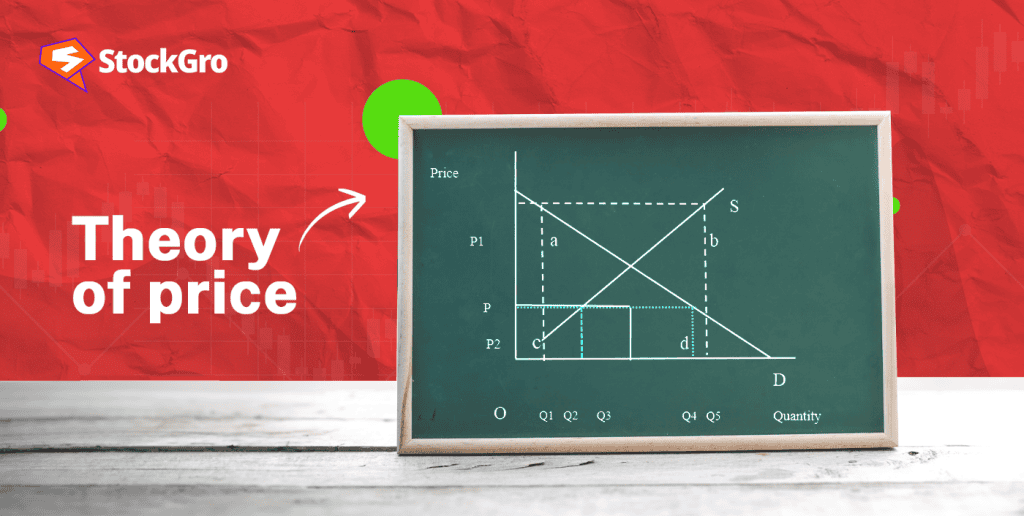

Equilibrium and price adjustment

Equilibrium is reached when the quantity offered by sellers matches what buyers are willing to take. This balance, however, is constantly shifting. When products go unsold at higher rates, adjustments are made to attract buyers.

Alternatively, when shortages occur, upward shifts happen until a new stable point is found. The constant recalibration ensures that no one price remains fixed for long.

Price floors

A price floor is a government-set minimum price for goods or services, intended to ensure that sellers earn enough to stay viable. While this protects producers from unsustainably low prices, setting the floor above the natural market level can lead to surpluses. Suppliers are willing to offer more, but demand may fall since buyers aren’t willing to pay the higher rate.

Examples of price floors include the Minimum Support Price or MSP for agriculture yields, ensuring farmers receive a fixed price for their crops, even during market downturns.

Sensitivity to price changes

The concept of elasticity measures how sensitive buyers are to fluctuations. For some items, even minor adjustments can dramatically influence how much people purchase—this is high elasticity. Essential goods, like medicine, tend to exhibit low elasticity, meaning purchasing behaviour doesn’t change drastically with higher costs. Recognising elasticity helps forecast how shifts in pricing affect market behaviour.

Production costs and external influences

Costs associated with creating a product— like raw materials, energy, or labour—are key drivers of the final amount charged. If inputs become more expensive, producers might pass these increases to consumers. External events, such as policy changes, supply chain disruptions, or natural disasters, can also significantly alter production expenses and, in turn, impact the final price.

Role of competition and perception

The level of competition in any given industry plays a large role in how much companies can charge. More competition often results in price reduction to capture buyers’ attention. Meanwhile, perception can elevate the value of a product. Established brands or highly sought-after items can command higher figures based on reputation or perceived quality alone, regardless of actual production costs.

Also read: How Global Economic Events Affect Personal Finances

Challenges and limitations of the theory of price

Market distortions

Monopolies and oligopolies undermine price theory by controlling markets. Instead of allowing competition to set fair prices, these firms limit market entry and raise prices beyond what a competitive market would allow, resulting in inefficiencies that impact consumers directly.

Ignored externalities

Prices fail to account for externalities—those costs or benefits that spill over to third parties. For instance, air pollution from factories isn’t factored into product pricing. Without proper intervention, these hidden costs lead to economic inefficiency and environmental damage.

Incomplete information

The assumption that buyers and sellers have perfect knowledge rarely holds true. Consumers may not know the true quality of a product or its health implications, while businesses may misjudge demand. This gap between knowledge and decision-making skews market outcomes.

Assumed rationality

The theory rests on the belief that decisions are rational. Yet, human behaviour is often irrational—driven by emotions, habits, or short-term thinking. Shoppers might overspend on unnecessary luxuries or ignore future consequences, complicating the clean logic of the theory.

Intervention and controls

Government policies, like price floors and ceilings, interfere with natural price adjustments. While aimed at protecting certain groups, these interventions can lead to unintended consequences, such as shortages, surpluses, or economic inefficiency, disrupting market equilibrium.

Also read: Cultivating positive money attitudes: How to shift your money mindset?

Bottomline

The theory offers valuable insights into how the value of goods and services is shaped. However, it operates within a broader context where external forces, imperfect competition, and regulatory actions often complicate its predictions. While useful, its ability to fully explain every price movement in the real world is limited.

FAQs

- What is the theory of prices?

This concept explains how the value of goods and services is determined. It studies how buyers and sellers interact in the marketplace. When availability meets consumer interest, balance is achieved. However, factors such as competition, production expenses, and market preferences affect value. Broader economic shifts and outside forces can also play a role. This idea helps us grasp the changes we see in everyday costs.

- Who is the founder of price theory?

Adam Smith is considered a key figure in early economic thought. He introduced principles related to how markets function, focusing on supply and demand in the 18th century. Later, economists like Alfred Marshall developed these theories further. Smith’s contributions laid the foundation for modern market analysis.

- What is the economic price concept?

In economics, value refers to what consumers exchange to obtain goods or services. It’s shaped by the interaction between availability and consumer demand. If something is scarce and highly desired, its value increases. On the other hand, when there is more than needed, it tends to decrease.

- What are the 4 main economic theory?

Four key economic theories shape our understanding of how economies work. Classical theory believes in minimal interference, trusting that supply and demand balance naturally. Keynesian theory suggests government action is crucial during downturns. Monetarism focuses on regulating the money supply to control inflation. Lastly, supply-side theory argues that cutting taxes and easing regulations can stimulate growth by encouraging production. Each offers a unique perspective on managing economic systems.

- What is price elasticity?

The concept refers to how much consumer behaviour shifts when the cost of a product is adjusted. If a slight increase or decrease in cost leads to a significant shift in buying habits, it is considered highly elastic. If consumer purchases remain mostly unchanged despite a price adjustment, it is inelastic. This concept helps businesses understand how sensitive buyers are to price shifts, which influences their pricing strategies and market planning.