By 2070 India has pledged to reach zero emissions in COP26. EVs and EV battery companies will help to achieve this goal. National demand for Lithium batteries is expected to reach 139 GWh by 2035.

Many factors influence the growth of the electronic vehicle battery industry. Some of them are as follows:

- Increase in number of EV models.

- Pollution caused by vehicles.

- Technological advancements.

The Asia-Pacific region is supposed to command the largest share of the EV battery industry by 2037. Many companies in India are trying to get a headstart in this race tomorrow.

Also read: Vishal Mega Mart Sets Mid-December Target for ₹8,000 Crore IPO.

Overview of the EV battery industry

Before jumping into the financials of EV battery company stocks, let us understand what exactly EV batteries are.

EV usually uses the following types of batteries:

- Lithium-ion batteries

This is the most popular battery because it is cost-efficient and has high energy density. Some famous companies which produce such batteries are:

- Exide industries

- Amara Raja Batteries

- Panasonic

- Toshiba, etc.

- Lithium NMC

It is commonly used by the EV industry but has some disadvantages -like, a short life span and less environmentally friendly.

- Lithium iron phosphate

- Solid state batteries

The demand for EVs stems from care for the environment. It is questionable whether NMC will withstand time since it is not good for the environment.

List of Top EV battery company stocks

The EV battery company stocks are selected based on market capitalisation.

Exide Industries Ltd. produces storage batteries and allied items.

The company produces batteries for the following types of vehicles:

- E-rickshaws

- Two-wheelers

- Three-wheelers

- Four-wheelers

- H-UPS

The company is a market leader in storage batteries in India in almost all categories – Automotive, Industrial, and Submarine.

The company is targeting the EV battery industry in the following ways-

- It is entering the segment through Exide Energy Solutions Ltd.

- The company’s lithium-ion cell project is to be completed in two phases with a capacity of 12 GHw in ₹ 6,000 Cr. cost.

- The company produces advanced chemistry cells.

- Cylindrical

- Pouch

- Prismatic

- The company invested approximately ₹ 75 Cr. in ESSL in May 2024.

- The company’s total investment in ESSL and EEPL is approximately ₹2377.24 Cr.

- The company has joined hands with SVOLT (China) to set up a lithium-ion cell production facility in Bengaluru.

The company recently launched the highly efficient Absorbant Glass Mat. Also, signed a memorandum of undertaking with Hyundai Motors and Kia.

2. Amara Raja Energy and Mobility Ltd.

The company is the biggest manufacturer of lead-acid batteries. The company also serves major telecom service providers.

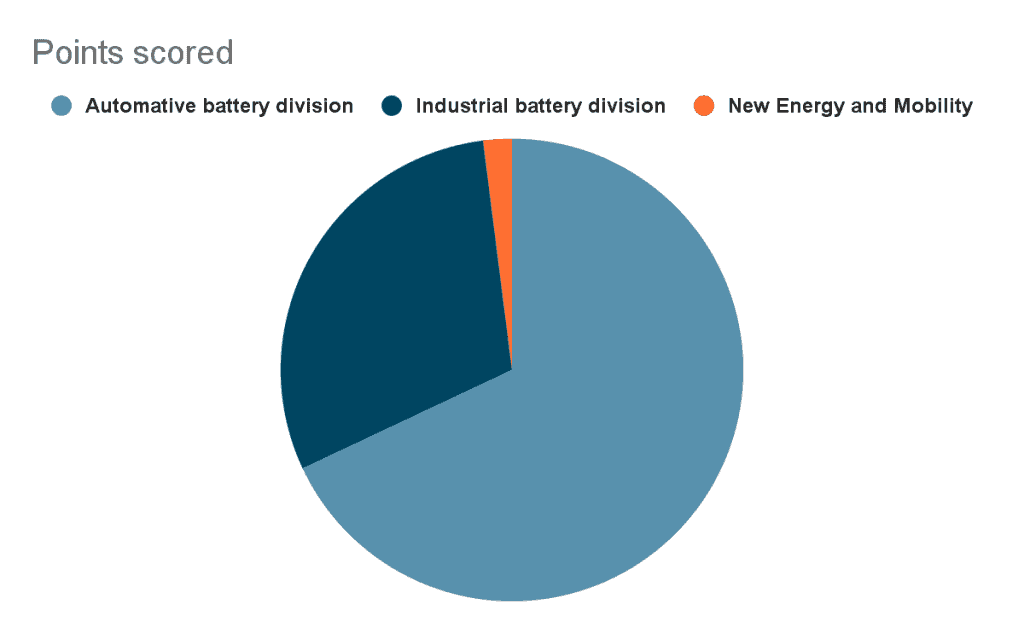

The revenue break-up of the company looks like this.

In the automotive battery division, the company is the biggest exporter of four-wheeler batteries as well as the first AGM producer of two-wheelers.

The new energy and mobility sector consists of the following:

- Li cell and pack manufacturing

- EV charging products

- Energy storage solutions

- Successful powering of e-bike using NMC-based 2170 cells

The company exports its products to 49 Indian Ocean-rim countries.

The company agreed with Inobat AS and Oslo Norway to make a mark in the EV batteries landscape.

The company’s Lithium battery manufacturing has the following points to note:

- Total CAPEX of 9500 crores

- MoU with the Telangana government

- Land allotment of 262 acres

- Customer qualification plant

- Phase 1 commercialization by FY 26

Also read: Adani Infra Invests in PSP Projects with 30% Stake.

3. HBL Power Systems Ltd.

Another EV battery stock to look out for is HBL Power Systems Ltd. The company is a formidable player in this market.

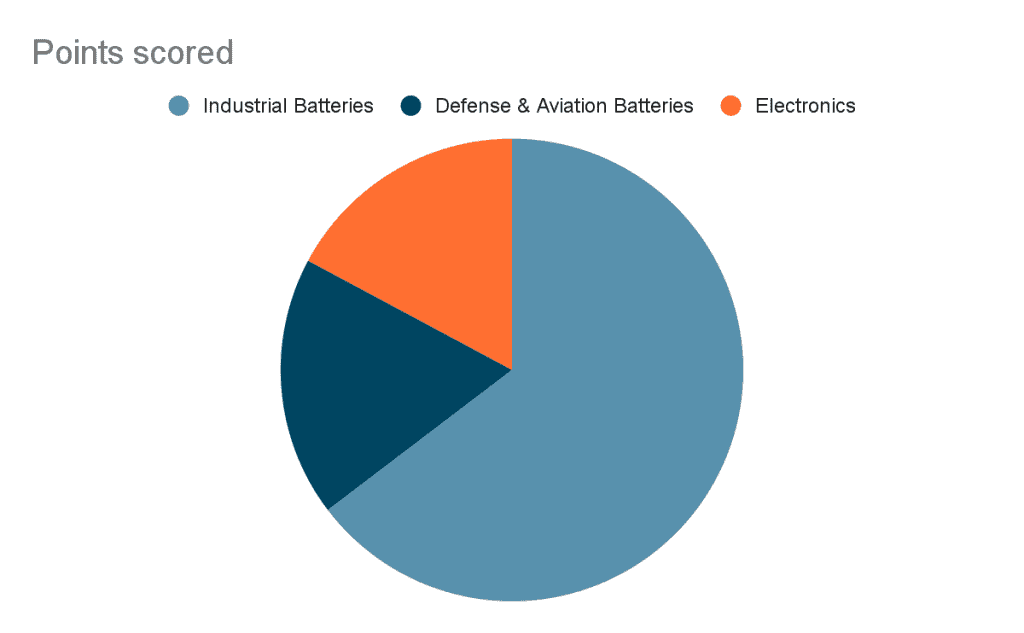

It is the second biggest company in industrial nickel batteries in the world and third in VRLA lead batteries in India.

The company’s business vertical (QIFY25) is depicted in the graph below.

The company has also produced electronic drive trains.

Stock comparisons

The EV battery company stocks are listed in the table below.

| Name | Market Cap. (₹ Cr.) | CMP(₹) | P/E | Dividend Yield(%) | NP Qtr.(₹ Cr.) | Qtr. Profit Var. (%) | ROCE(%) |

| Exide Industries Ltd. | 35,453.50 | 417 | 42.38 | 0.48 | 233.40 | -14.15 | 10.15 |

| Amara Raja Energy & Mobility Ltd. | 22652.18 | 137.65 | 23.44 | 0.80 | 240.71 | 6.32 | 18.74 |

| HBL Power Systems Ltd. | 15021.23 | 541.90 | 43.37 | 0.09 | 87.07 | 26.92 | 35.94 |

Also read: Top Airline Stocks to Invest in India

Bottomline

There is no doubt, the EV market is the next big thing. Anyone who puts money on this thunderbolt of the future will get a huge first-mover advantage. However, it is not the right time for us to demarcate the boundaries of this industry. You should tread with caution and make a choice that follows your personal as well as financial aspirations.

FAQs

1. What are the best EV stocks to invest in?

The best EV stocks to invest in based on market capitalisation are as follows-

- TATA Motors

- Concord Control

- Uniparts India

- Hero MotoCorp

The EV market will be the next big thing in Indian markets. It is hard to foretell, who will be the biggest player. It will be prudent to watch out for these stocks because the companies are expected to perform well.

2. What is a good electric battery stock to buy?

The top three companies based on market capitalisation are-

- Exide Industries Ltd.

- Amara Raja Energy and Mobility Ltd.

- HBL Power Systems Ltd.

These companies have the necessary infrastructure, scale, support and know-how to ride the EV wave successfully. However, it might still be too early to decide which companies will be the most successful.

3. What are the top 3 lithium stocks in India?

The top three lithium-ion battery stocks in India based on market capitalisation are-

- Exide industries ltd

- Amara Raja Energy and Mobility Ltd.

- HBL Power Systems Ltd.

Lithium-ion is the most acclaimed energy source for EVs. The companies which already have strong lithium-ion production units will get a headstart in the race.

4. Which battery stock is the best in India?

Based on market capitalisation, Exide Industries Ltd. is the best battery stock in India. The company has made huge investments and agreements to make a mark in this industry. The company’s technical know-how along with its superior production facility sets it apart. However, it is important to note that it is too soon to successfully foretell who will become successful in this industry.

5. Which is the leader in EV batteries in India?

Based on market capitalisation, Exide Industries Ltd. is spearheading the EV battery market in India. Their strong production system and technical know-how give them a competitive advantage over their competitors. It is important to note that although Exide is currently leading the market, it is too soon to conclusively elaborate on who will be the behemoth in this industry.

6. What is the best EV battery stock to buy in India?

The top three companies in the EV battery manufacturing industry based on market capitalisation are Exide Industries Ltd., Amara Raja Energy and Mobility Ltd. and HBL Power Systems Ltd. The choice of the best stock should be made after a thorough fundamental and technical analysis of the stock. The investor should compare the performance of the company and his or her individual financial objectives.

7. What is the EV battery market share in 2024?

Currently, Exide Industries Ltd. has the highest market capitalisation among the top three EV battery manufacturers. The company is a market leader in storage batteries in India in almost all categories – Automotive, Industrial, and Submarine. The company recently launched the highly efficient Absorbant Glass Mat. Also, signed a memorandum of undertaking with Hyundai Motors and Kia.

8. Which EV stock will grow the most in India?

The Electronic Vehicle is expected to play a crucial role in the future. The rise in environmental concerns raised by challenges like global warming has driven successful consumer awareness of the ill effects of fuel-driven automobiles. In such a scenario the position of EV manufacturers is set to rise. The top players in the current market can get a competitive advantage and first-mover advantage in the future. The top three companies based on market capitalisation are Exide Industries Ltd., Amara Raja Energy and Mobility Ltd. and HBL Power Systems Ltd.