The most popular method for companies to raise capital is through issuing shares to the public. But, offering shares to the public comes with advantages and limitations. While it helps to raise funds, it also requires parting the ownership with shareholders. Treasury stocks are one of the ways for issuing companies to regain control over their shares.

In this article, we will discuss why companies maintain treasury stocks and how they buy back shares from the public to retrieve their authority.

What are treasury shares or stocks?

Treasury stocks are also known as treasury shares or reacquired/repurchased shares. In simple terms, treasury stocks are shares held by the company in their treasury.

The treasury shares are part of the outstanding shares which are bought back from shareholders or have been held in the company’s reserve and have not been issued to the public at all.

Here are some significant terms to know before getting into details of treasury stocks:

- Authorised shares: There is a legal restriction on the quantity of shares a company can offer to the public. The shares that can be issued to the public are known as authorised shares.

- Issued shares: They are often known as outstanding shares, too. It shows the number of shares held by all shareholders. Not all shares that are authorised are issued to the public. The company may choose to hold back some of them in its reserve to use them for future requirements.

- Float: Of the outstanding shares, some of them are held by internal shareholders, while the rest are issued to the public. Float refers to the shares moving in the market, accessible for public trading.

Also read: Free float market capitalisation – What is it, and how is it calculated?

- Buyback: Buyback is the process of reacquiring shares from the public. Issuing companies repurchase shares from shareholders to reduce the number of shares floating in the market.

Why do companies buy back shares?

- One of the primary grounds for firms to buy back shares is to regain authority. Issuing shares to the public leads to dilution of power as all the shareholders have a say in the company’s decisions. Repurchasing shares from the public helps in taking the control back.

- Companies sometimes use shares to pay other companies during mergers and acquisitions or to pay employees as part of Employee Stock Option Plans (ESOP). When they do not have enough shares in their reserves to meet these requirements, they may buy back.

- Buying back shares helps in boosting the value of undervalued stocks. When the number of shares in the market decreases, the supply comes down, leading to an increase in share prices.

- Companies repurchase shares when they want to represent ideal values in their financial ratios like Earnings per Share (EPS), Return on Equity (RoE), etc.

You may also like: Joint stock company – Meaning, features and types

How do companies buy back shares?

- One way for companies to buy back shares is through the stock market, like every other investor. Companies place orders to purchase shares from the market at the current market price.

- Another way of buying back shares is through a tender offer. Companies announce tender offers stating the fixed price at which they are willing to buy back shares from existing shareholders. Shareholders can decide to sell shares at their own discretion.

Upon buying back, the companies are allowed to keep them in reserve for an unlimited period. They can also resell them in the market as and when required to raise more capital.

Companies also have the option to retire treasury stocks. Retiring stocks means cancelling them permanently. Such stocks cannot be issued in the future and will be removed from the company’s financial statements.

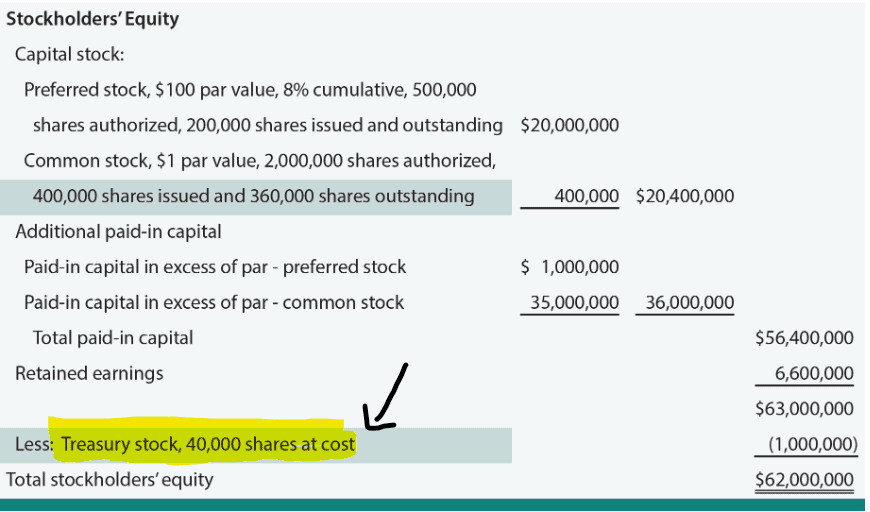

Treasury stocks in balance sheet

Treasury stocks reduce the number of outstanding shares in the market. They are still written under the equity section in the balance sheet but as a negative figure.

Treasury stocks are part of contra entries that offset the equity’s value.

Source: Principles of Accounting

Disadvantages of treasury stocks

- Treasury stocks do not have any voting rights associated with them, which means such stocks are not eligible for the firm’s decision-making.

- Treasury stocks are not entitled to dividends.

- At the time of liquidation, treasury shares do not get rights on selling assets’ proceeds.

- Treasury stocks are not part of outstanding shares, hence they do not impact the financial ratios of the company.

Treasury stock example

The fifth buyback by Tata Consultancy Services:

Tata Consultancy Services is an IT giant in India, that announced its fifth buyback plan in October 2023.

A share buyback is a corporate action that companies opt for, due to various causes. Researchers and analysts believe that this move by TCS will improve the stock’s prices and show better Earnings per Share (EPS).

TCS has bought back shares four times in the last six years. The current proposal for buying back is as below:

Buyback method: Tender offer.

Buyback value: ₹ 17,000 crores

Number of shares: 4,09,63,855

Share value for buying back: ₹4,150 per equity share

The market price of shares at the time of declaring the buyback was around ₹3,610. The repurchase is offered at a premium to attract more shareholders towards selling their shares.

Also read: ESOPs: Empowering employees with ownership

Bottomline

Treasury stocks are stocks repurchased by issuing companies from the public. Repurchasing shares is a strategic corporate action that allows companies to regain control over their management and limit the number of shares floating in the market.

These treasury stocks come in handy for various uses like taking care of future capital expenses, completing corporate actions like acquisitions, etc.