Arbitrage is a trading strategy that capitalises on price discrepancies of an identical asset across different markets. For instance, say if a stock is cheaper on the National Stock Exchange (NSE) and pricier on the Bombay Stock Exchange (BSE), you buy it on the NSE and sell it on the BSE, making a profit from the price gap.

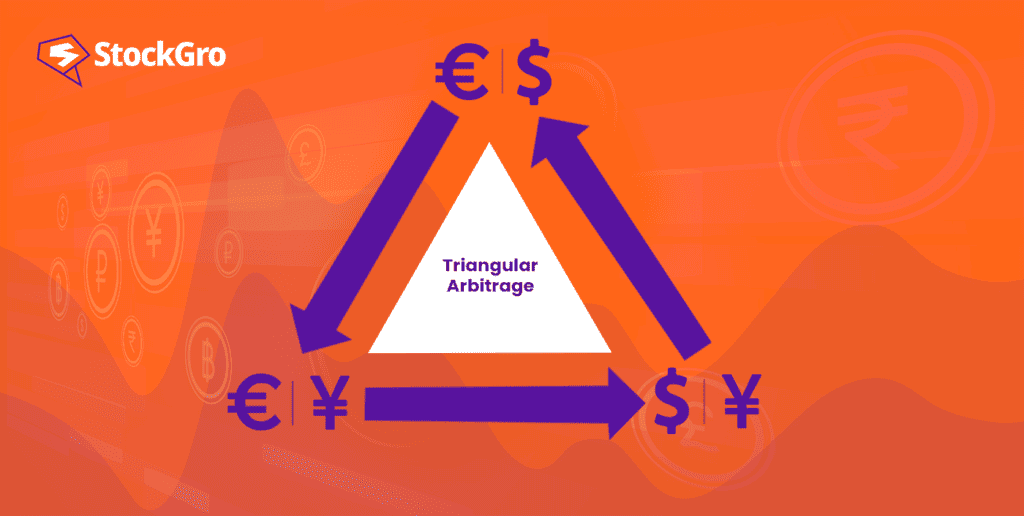

Triangular arbitrage, a nuanced variant of this strategy, is prevalent in the forex or foreign exchange market. This method involves trading between three different currencies to benefit from their changing exchange rates.

In this blog, let’s explore more about triangular arbitrage, breaking down how it works and how you can potentially use it to your advantage in foreign exchange.

You may also like: How does arbitrage trading work?

What is triangular arbitrage?

According to Nasdaq, triangular arbitrage is defined as striking offsetting deals among three markets simultaneously to obtain an arbitrage profit.

The strategy aims to leverage the minor differences in the exchange rates between these currencies to achieve a net profit. This situation arises when one currency is overvalued or undervalued relative to the others in the trading loop. Triangle arbitrage relies on the trader’s quick decision-making skills, which frequently call for sophisticated tools to recognise and seize these fleeting opportunities.

The strategy also assumes that exchange rates between multiple currency pairs remain stable. However, this is not always the case, as global market interconnections can cause fluctuations in exchange rate stability across different currency pairs. These market dynamics can affect the viability and success rate of the triangular arbitrage strategy.

Also Read: All you need to know about the basics of forex trading in India

How does it work?

To understand triangular arbitrage better, consider this example:

Suppose a trader spots an opportunity involving the British Pound (GBP), US Dollar (USD) and Euro (EUR).

Let’s assume the EUR/USD exchange rate is 1.10. The trader starts with $1 and exchanges it for €0.91 (since 1/1.10 = 0.91).

Next, they use these Euros to buy GBP at the rate, say 0.87 EUR/GBP, receiving approximately £1.05 (as 0.91/0.87=1.045).

Finally, the trader converts these pounds back into US dollars. The profit or loss depends on the GBP/USD exchange rate at this point. Let’s consider two situations:

- Suppose the GBP/USD rate is 1.25. This means £1 can be converted to $1.25. Your £1.05 becomes $1.312 (1.05 * 1.25). The trader started with $1 and now has $1.312, making a profit of $0.312.

- If the GBP/USD rate is 0.95, then £1 equals $0.95. The £1.05 now converts to $0.9975(1.05 * 0.95). There’s a loss because you are left with less than you began.

| Currency Pair | Exchange Rate | Purchase | Sale |

| USD/EUR | 1.1 | $1 | €0.91 |

| EUR/GBP | 0.87 | €0.91 | £1.05 |

| GBP/USD | 1.25 | £1.05 | $1.312 |

There are triangular arbitrage calculators that can help you in calculation. In triangular arbitrage, the key is to spot and act on these rate differences quickly, as they usually don’t last long. The profit or loss depends on the final conversion rate and execution speed. However, if the trade isn’t successfully completed, the trader could potentially face a total loss of their funds

Also read: Exploring the art of speculation.

The process of triangular arbitrage

Here’s how it works:

- Spotting the opportunity: First, you need to find an arbitrage opportunity. This happens when there is a mismatch between the quoted exchange rates of three currencies and their cross-currency rates.

- Calculating the difference: Next, work out the difference between the cross-rate and the implied cross-rate. This involves understanding the bid-ask spread in each currency pair. The gap between the two—the “bid” being the highest price a buyer is willing to pay and the “ask” being the lowest amount a seller will accept—is referred to as the bid-ask spread.

- Executing the first trade: If there is a favourable difference considering the bid-ask spreads, start by trading your base currency for another. This is the starting point to utilise the triangular arbitrage bid-ask dynamics

- Making the second exchange: Then, quickly exchange this second currency for a third one. Time is of the essence here.

- Completing the loop: Finally, convert this third currency back into your initial currency. If done right, you should end up with more than you started, earning a net profit after accounting for trading costs.

Remember, in the real world, these opportunities are rare and fleeting. Markets are competitive, with many players constantly correcting inefficiencies. This implies that you must execute trades quickly and accurately. Even in the world of cryptocurrencies, where triangular arbitrage is also applicable, the same principles of speed and precision hold true.

Automated triangular arbitrage

Automated trading platforms have revolutionised triangular arbitrage in the forex market. These platforms, like triangular arbitrage EA, use algorithms to spot and act on arbitrage opportunities in real-time. Here’s how it works: a trader establishes specific requirements for the purchase and sale of currencies. The computer system then executes these trades automatically when the set conditions are met. This method is crucial for triangular arbitrage because market opportunities can appear and disappear in just a few seconds.

The speed of these automated systems is both a blessing and a challenge. They can swiftly capitalise on fleeting opportunities, increasing the potential for profit. However, there’s also a risk. If the system doesn’t execute the trade quickly enough, or if the market moves too fast, the trader might miss the target price, leading to a loss.

Moreover, it’s important to note that price differences in triangular arbitrage are usually quite small. This shows that a significant amount of capital is frequently needed in order to generate a sizable profit. Automated trading helps manage these trades more efficiently, but traders should be aware of the risks involved, including the potential for rapid changes in exchange rates and the need for substantial investment.

Final thoughts

Triangular arbitrage is a chance to make money from small price differences in currency markets. It needs quick actions and smart, automated tools. Though it’s mostly low-risk, you must be fast and accurate to benefit from it.