In the world of technical analysis, traders and investors are always looking for reliable patterns and signals that can provide them with an edge over others. Amongst the plethora of knowledge that already exists in this realm, traders are always looking for precise technical signals that work more often than not — like the triple top pattern.

The Triple Top Pattern is a testament to the intricacies of market psychology and price action. The importance of this pattern cannot be overstated in trading as it offers traders a means to anticipate price reversals reliably and securely.

In this article, we will delve deep into the mechanics of the Triple Top Pattern, exploring why it holds such significance and how it can be harnessed to generate robust technical signals. Whether you’re a novice investor or a seasoned trader, knowing how to identify the triple top pattern with finesse will never go old.

What is the triple top pattern meaning?

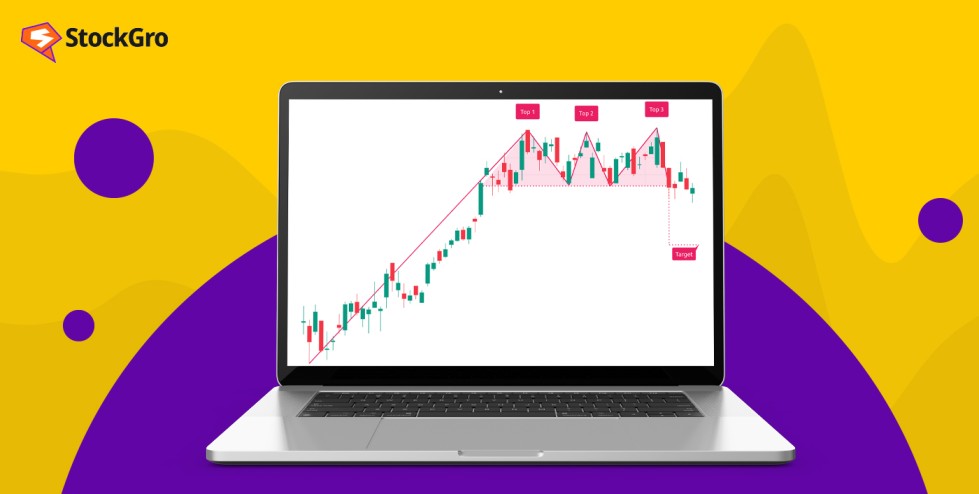

The triple top is a candlestick pattern that’s used frequently in technical analysis to identify a movement reversal – from a bullish to a bearish sentiment. The TTP consists of three peaks and its occurrence might signal that the price rally may no longer continue or that price dips might be imminent.

There are some prerequisites though. For the pattern to be a legitimate triple top, it has to coccue after an uptrend. The opposite of a triple top is a triple bottom, which indicates a downtrend-to-uptrend reversal.

You may also like: How do traders harness the power of Hammer Candlestick patterns?

What does it look like?

The triple top is said to occur when the candlestick price of an asset creates three peaks at roughly the same level. The area where these peaks are formed is called the resistance, because that’s where the market ‘resists’ further price appreciation.

The prices obviously pull back after every peak to go back up again. The intermediate pullbacks are called the swing lows. If the pullback after the third peak goes below all the previous swing lows, the pattern is considered complete. It is then that traders expect the price to fall and the reversal to begin.

Also read: What does the Doji candlestick tell us about the market?

How is this different from other patterns?

- The head and shoulders pattern – The head and shoulders is quite similar to the triple top. However, a subtle difference between the two is that for the latter, the middle peak is created right around the same level as the other two. In the former, however, the middle peak is a tad higher.

- Double top – The triple top has three consecutive peaks at the same level and a pullback, unlike the double top, which only has two followed by a pullback.

Analysing the triple top

Here’s what each stage in the triple top means from a trading perspective:

- The first peak is usually created when the price rallies in a bullish movement and hits a strong resistance level somewhere on the way to the top. It eventually falls into a support area which forms the basis for further pullback references.

- The next step is another rally that goes right up to the last peak but doesn’t break the resistance. The resistance wins and the price falls back to the previous pullback support.

- The third stage occurs when the price tries yet again to break the resistance but can’t. However, this time, the pullback is stronger. If this pullback falls below the support levels of the previous two dips, the pattern is said to have been completed.

This price action that continually tests the resistance and support levels is said to be a game of tug between buyers and sellers. Typically, after buyers fail to break resistance levels for the third time, the market interprets the intense selling pressure as a bearish sign. Since there is a lack of buyers in that price range, increased selling pressure makes the price fall in a downward spiral with heavy volume.

Also read: Deciphering the rising wedge pattern in stock trading

Trading with the triple top pattern

Usually, trading on the triple top occurs when the pattern is completed and the pullback breaks the previous support. At the break, traders will typically enter into short positions or exit long ones. Other traders might want to wait until a trendline that connects the previous two pullback supports is broken.

Hence, there are two main ways of entry in the triple top pattern:

- After the breakout candle closes below the last pullback support (also known as the ‘neckline’)

- After the broken neckline is retested

Using a stop loss – SL placements are very important when trading patterns. Since no pattern is correct a hundred per cent of the time, it is always advisable to trade with proper risk management. In this case, major stop losses are placed right above the triple top resistance levels. This will limit your losses in a short position if the pattern fails and the price rises.

Booking profits – There is a very popular way of ascertaining where you should ideally book profits when trading a triple top. Measure the height of the pattern and project a similar length downwards from the breakout point. The end of this line is considered to be a good potential price target for profit booking.

Looking for volume – To add confirmation to the validity of the pattern, you could also try looking for heavy volume as the price moves below the support. Selling volumes should typically increase right around the time the support gets broken. If volumes don’t rise, the pattern might be prone to failure.

Conclusion

Price patterns are plenty and easy to spot, no matter whether you’re looking at a two minute chart for intra-day trading or a monthly chart for your retirement portfolio. However, you must remember that technical analysis is hardly an accurate science. While your research might be rock solid and everything might be pointing in the right direction, the market might just decide to go the opposite way with no explanation whatsoever.

While losses can never be completely avoided, you can certainly increase your chances of success by using several indicators and metrics to gauge price movements. By never relying on only one pattern (even if it’s the triple top), and incorporating proper risk management, you’d be doing your wallet a favour! Understanding trends will help you make more money, both when investing and trading in equity.