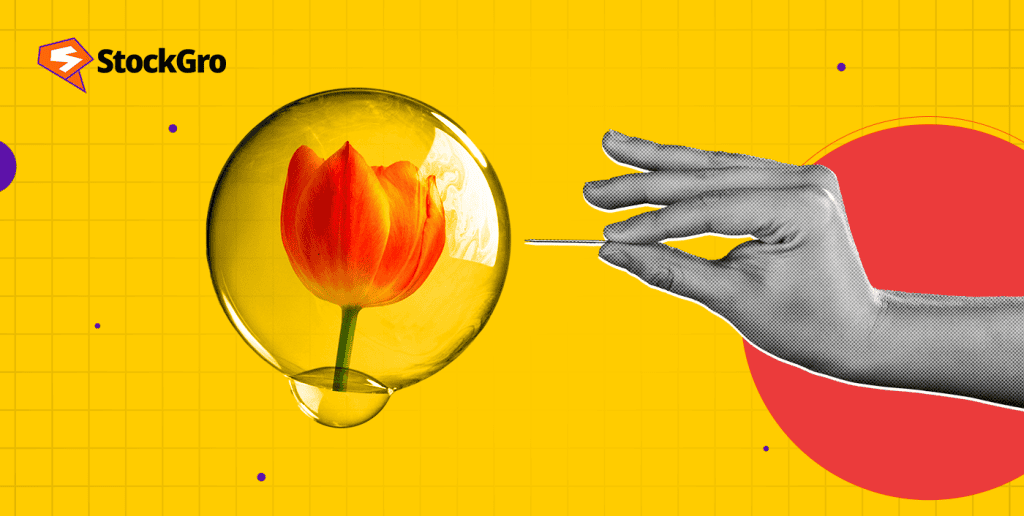

Set in the picturesque backdrop of the 17th century Dutch Republic, a phenomenon occurred, which the great Scottish writer Charles Mackay dubbed as Tulipomania, clubbing the two words ‘Tulip’ and ‘Mania’. Mackay’s Tulipomania refers to a frenzy among ordinary Dutch nationals towards tulip bulbs that led to the creation of a financial bubble and marked the beginning of a long history of stock market crashes.

A financial bubble refers to the unprecedented rise in an asset’s price, causing it to reach unsustainable heights. However, the story of tulip mania does not begin with the financial bubble, but a little before that.

Also read: Why did Pakistan’s rupee, & bonds plunge to record low after Imran Khan’s arrest?

The 17th-century Dutch economy

The 16th to 17th century is considered the golden age of the Dutch economy. The Dutch economy experienced unparalleled prosperity throughout the 17th century, and the Dutch Republic was commonly regarded as the wealthiest country in the world at the time.

Pioneering the trend of globalisation, the Dutch spearheaded international trade along with the financial markets through the establishment of the Bank of Amsterdam.

Tulips made their initial appearance in Europe in the 16th century. Ogier de Busbecq was the ambassador of Ferdinand I to the Sultan of Turkey. The Sultan sent the very first tulip bulbs and seeds to Vienna from the Ottoman Empire.

Since they arrived through the spice transportation routes, they got an exotic feel. These imported blooms resembled no other flower endemic to the continent. Soon, tulips became a symbol of wealth and status in society.

The rise of Tulip Mania

Due to their market positioning, tulips became a staple sight in the gardens of the affluent. Following the rich, the middle-class merchants of Dutch society attempted to mimic their wealthier neighbours by demanding tulips as well.

The expanding demand for tulips even led to the establishment of a successful tertiary industry aimed at managing the fragile plant. These expert cultivators started developing strategies for growing and producing tulips locally.

The fascination with tulips reached such heights that people started to quit ordinary sectors. Some wanted to own them, others hoped to sell them. No one could escape the pull of this enticing plant. This led to the transformation of tulip buds into what Mackay calls a golden bait.

The peak: Tulips worth more than Gold

A single tulip bulb started to cost anywhere from 4,000 to 5,500 florins, implying that the greatest tulips then would cost more than $750,000 today. Everyone was looking forward to making money merely by owning these exotic bulbs.

It was at this point that seasoned traders entered the picture. Regular tulip marts were created on the Amsterdam Stock Exchange. At the moment, it appeared that prices could only rise and the tulip craze would never end. People began utilising margined derivatives contracts to purchase more tulips than they were capable of financing.

However, as swiftly as the tulip mania began, investor confidence dwindled, marking the beginning of a long list of financial bubbles and a history of stock market crashes.

The bubble bursts

Prices started to decline around February of 1637. The steep fall was caused by consumers primarily purchasing bulbs on credit, intending to pay back when they earned a profit.

However, as prices started dropping, holders were obliged to sell their bulbs for any price, declaring bankruptcy in the course of events. By 1638, tulip bulb prices had stabilised to the original value.

Also read: US debt crisis – Is Biden planning on raising the current debt ceiling?

Why did Tulip Mania happen? The psychology of speculation

The tulip mania emerged due to investors’ unrealistic expectations and a positive feedback cycle that maintained the price at a high. A positive feedback cycle is a phenomenon that magnifies the effect of an initial discrepancy. The initial discrepancy here was the rising prices of tulip bulbs beyond their intrinsic value. Market speculation caused the prices to continue rising and reach unimaginable heights.

This fiasco gives market enthusiasts a sneak peek into investment psychology and the psychology of speculations. The unwavering market faith in tulips was not grounded in any quantitative analysis. Investors and traders believed that the tulip mania would never end. Their belief was not driven by any analysis but by a prevalent market sentiment.

Lessons from Tulip Mania: Avoiding investment mistakes

Tulip Mania is not just a unique story of the past that gives a close insight into the thought process of the period. The speculative investor psychology that caused the tulip mania in the 1600s still influences the markets. Investors should learn multiple valuable lessons from the tulip mania.

The most important takeaway is the importance of due diligence. Market trends and sentiments give valuable information on trading patterns and help traders understand which assets can maximise their gains. However, market trends should be validated by due research on the true financial health of the assets. If an asset lacks intrinsic value, its unmatched price will eventually collapse.

Also read: BYJU’s faces ED probe over Rs. 9754 Cr foreign transfers.

Why does Tulip Mania still matter today?

The Chinese stock market bubble of 2015 is one of the many examples of how investors still fail to see the intrinsic value of assets amidst speculative market behaviour. In brief, the Chinese stock market witnessed a dramatic rise due to speculative trading but soon met a sharp decline making investors lose millions.

It is important to not rely solely on the market sentiment to jump on an investment spree. It is important to perform individual research before investing. Markets offer great financial avenues. However, they are often speculative. It is necessary to weed out speculations to make investments that optimise gains while minimising risks.