Options trading offers a plethora of factors for traders to profit from price movements, volatility, and time decay. One of the essential factors that influence option prices is known as Vega. Traders are of the view that it is not important to predict the market trend to make money in the market. If you can forecast volatility in the price movements, you have a higher chance to profit in the markets.

In this blog post, we will delve into the world of volatility and vega, exploring what it is, how it affects options, and how traders can harness its power.

What is vega in option greeks?

Vega quantifies how an option’s(call, put, futures, swap) premium reacts to fluctuations in implied volatility. Simply put, options vega tells us how much an option’s premium is likely to change for a 1% increase in implied volatility.

You may also like: What is a straddle option strategy?

What is implied volatility?

Implied volatility quantifies what traders and investors anticipate in terms of future price swings for the underlying asset. It reflects their expectations regarding future market volatility. Implied volatility is not visible but it is derived from the changes in current market prices of options. When implied volatility increases, it generally implies that the market expects more significant price swings in the underlying asset, and when it decreases, it suggests expectations of reduced price volatility.

Options vega calculation

Vega is computed using the below formula:

Vega = change in call price/ change in implied volatility

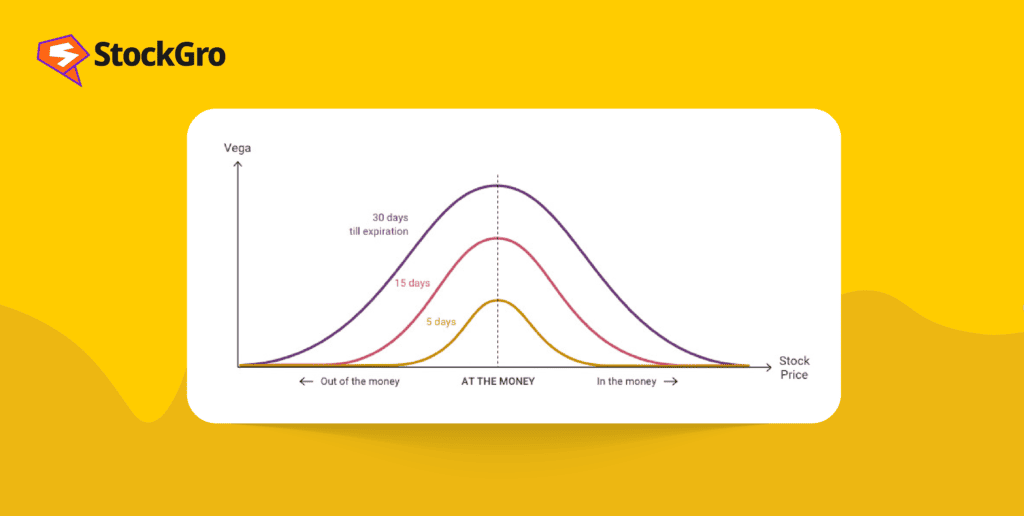

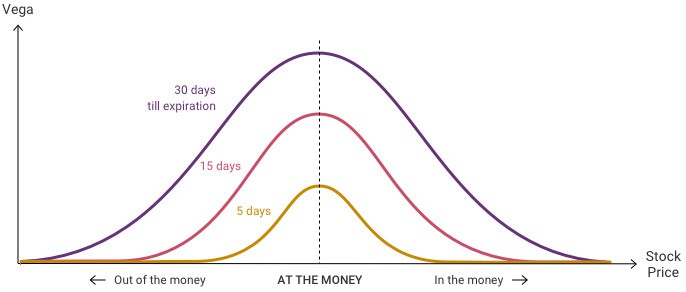

Vega is most pronounced when the option is “at-the-money” (strike price similar to the underlying asset’s price) and diminishes as the option becomes “out-of-the-money” (strike price further from the asset’s price) or “in-the-money” (strike price closer to the asset’s price).

Options with longer expiration periods have higher Vega values, reflecting their increased sensitivity to time and implied volatility changes. Importantly, Vega exclusively affects the extrinsic value of an option’s premium, leaving the intrinsic value unaffected.

A decrease in Vega generally leads to a decline in the value of both call and put options. Conversely, an increase in Vega usually results in an uptick in the value of both call and put options.

Also read: The value add of exotic options trading

Vega strategy in options: long straddle strategy

Objective: To profit from heavy price changes in the underlying share price. In a long straddle, we want the price heavily either in the upper or lower direction, This can happen when there is an expectation of increase in implied volatility.

Strategy components

- Purchase a call option with a specific strike price i.e., “A” as per the above image and expiration date.

- Simultaneously, buy a put option with the strike price “A” and the same expiry date as the call option.

How does it work?

When you implement a long straddle strategy, you are essentially betting on implied volatility. You want to see a higher movement in implied volatility, increasing the chances for the option premium to rise and a potential swing in the stock price.

If the underlying asset experiences a substantial price movement, the option that becomes profitable (either the call or the put) will likely compensate for the loss on the other option.

Profit and loss potential

The maximum potential loss is limited to the total premium paid for buying both the call and put options.

The profit potential is unlimited, as the strategy can profit from a substantial move in the underlying asset’s price in an up move or down move.

Also read: Futures vs. Options: Differences every investor must know!

When to use a long straddle?

Long straddles are used when traders expect to see a high vega in the option prices causing a significant price movement in the underlying asset but are uncertain about the direction of that movement. Vega can help estimate the movement in option prices causing the trader holding a long straddle to ultimately benefit.

This strategy is often employed before events such as earnings announcements, major news releases, or other situations that could lead to increased volatility.

Risks and considerations

- For a profitable outcome, the underlying asset needs to experience a substantial price movement that compensates for the expenses incurred in purchasing both the call and put options, including their premiums.

- Time decay (theta) can erode the value of both options if the expected price movement doesn’t occur within the desired time frame.

- The strategy can be costly due to the purchase of two options, and it may not be suitable for assets with low implied volatility.

Conclusion

Understanding vega strategies in options is a valuable tool for assessing and managing risk. Vega provides insights into how option prices are affected by changes in implied volatility, helping traders make informed decisions about when to enter, exit, or hedge their positions.

Integrating Vega into their trading strategies allows traders to improve their overall trading results and effectively respond to shifting market dynamics. Traders should conduct comprehensive research and assess their risk tolerance before employing Vega-based options strategies.