In the world of trading, where every millisecond matters, traders are always looking for innovative ways to seize market opportunities. Weekly options have emerged as a game-changer in this landscape, offering a dynamic and agile approach to trading. These short-term derivative contracts offer a unique window of opportunity, allowing them to harness market fluctuations with precision and efficiency.

What are weekly expiry options?

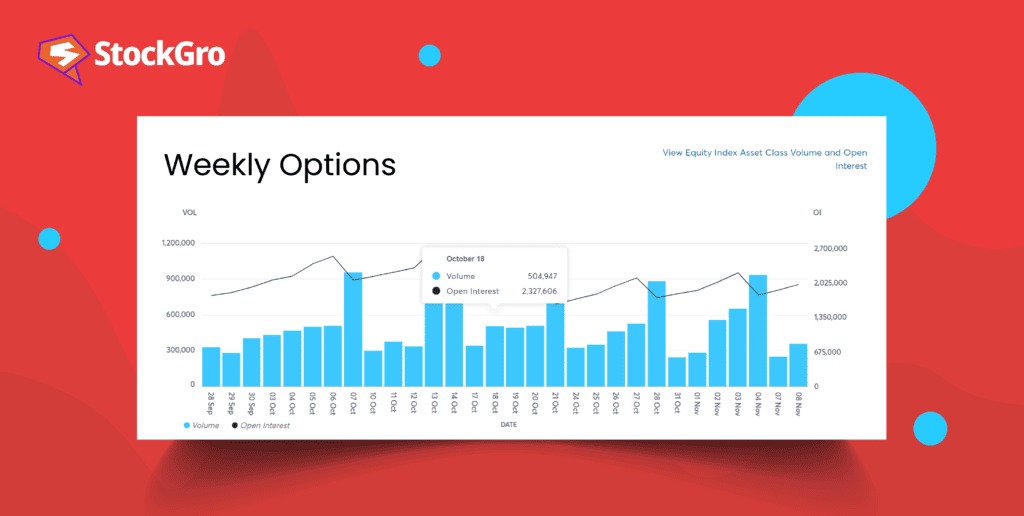

Weekly expiry options, as the name implies, are option contracts that expire in just a week. While their expiration period is significantly shorter than traditional monthly options, most other aspects remain the same. Trading strategies used for monthly options can also be applied to weekly options. Due to their shorter duration, the premiums for weekly options are lower. This reduced cost is a compelling factor that attracts traders who prefer to buy options or engage in options trading on the expiration day.

Also read: Understanding option Greeks: Delta, Gamma, Vega, Theta, and Rho

Types of weekly expiry options in India

Weekly options are available only for stock market indices in India. Weekly options are available for indices like Nifty 50, Bank Nifty, Fin Nifty, and Nifty Midcap. Let us understand them closely:

Nifty 50 options

These weekly options are centred around the Nifty50 index, which serves as a benchmark index. It comprises 50 prominent Indian corporations that are publicly listed on the National Stock Exchange (NSE). For Nifty50 weekly options trading, the standard trading size is set at 50 units per lot.

Nifty50 weekly contracts expire every Thursday. If last Thursday happens to be a holiday, the contracts will reach their expiration on the preceding trading day.

Bank Nifty options

Bank Nifty options are tied to the Bank Nifty Index. It comprises the 12 most liquid and large-cap stocks from the banking sector traded on the NSE. The lot size for Bank Nifty weekly options is 25.

Bank nifty weekly contracts expire every Wednesday of the week. In the last week, weekly options will expire on Thursday. If last Wednesday happens to be a holiday, the contracts will reach their expiration on the preceding trading day.

FINNIFTY options

FINNIFTY was introduced in January 2021 as a new benchmark index for the financial sector. FINNIFTY index tracks the performance of various financial services like banks, NBFCs, housing finance, and insurance corporations in India. The lot size for FINNIFTY options is 40.

These weekly options contracts expire on every Tuesday. If last Tuesday happens to be a holiday, the contracts will reach their expiration on the preceding trading day.

Nifty midcap options

Nifty midcap options are derived from the Nifty Midcap Select Index. It is designed to monitor the performance of 25 stocks within the Nifty Midcap 150 index. Midcap stocks include companies with a market capitalisation between ₹5,000 crore to ₹20,000 crore. The lot size for Nifty Midcap options is 75.

Nifty midcap weekly options contracts expire every Monday of the week. If last Monday happens to be a holiday, the contracts will reach their expiration on the preceding trading day.

Also read: sHow to trade in options and maximise your profit?

Weekly options trading strategy

When engaging in weekly options strategy, it’s crucial to recognise the inherent risk associated with “options buying”, which is higher compared to “selling weekly” options. Option buyers can profit only when the price movements are rapid.

In this context, here is a strategy centred on option buying. This strategy helps you identify these price surges in stock prices, particularly in the context of weekly expiry options.

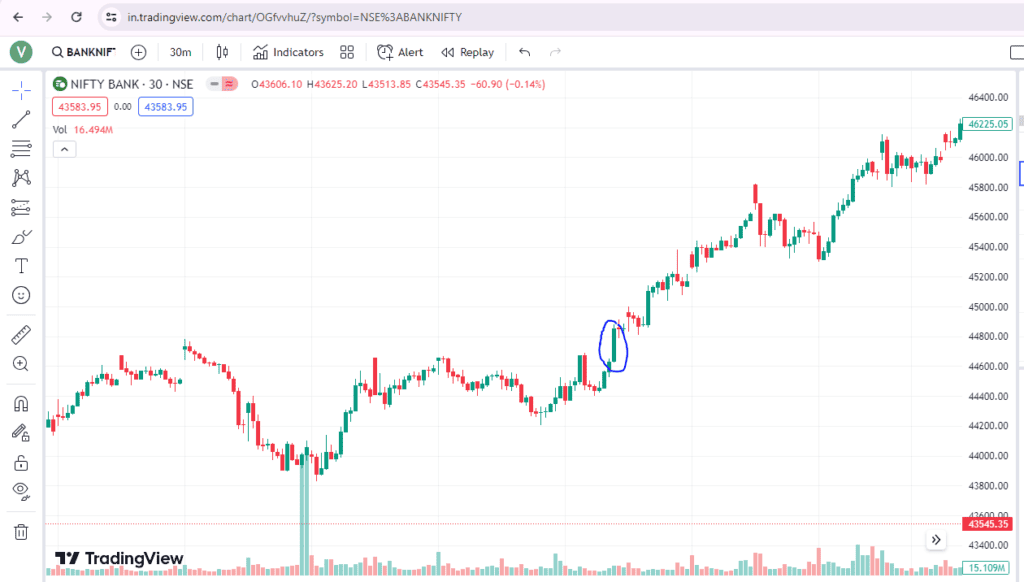

Step 1: Set the trading time stamp to 30 Minutes

This is a Bank Nifty weekly expiry options strategy, and it begins by configuring your trading time frame to 30 minutes.

Step 2: Identify the trend and potential reversal

The first task is to ascertain the prevailing market trend, whether it is upward or downward. Once the trend direction is established, you should be on the lookout for indications of a trend reversal.

Step 3: Identify blow-off candles

The subsequent step involves identifying “Blow Off Candles,” which are characterised by substantial price movements typically spanning 300 points on the Bank Nifty Index. When these candles appear on the chart, it presents an opportunity to initiate an option position. In the case of a green candle, consider entering a weekly call option, while for a red candle, enter into a weekly put option. The objective is to anticipate a directional price movement of approximately 200 points, which can result in favourable outcomes for the call-and-put options.

The rationale behind this strategy is that when a significant green candle materialises, it often triggers a sense of urgency among call option sellers. To offset their positions, they tend to enter into selling weekly options i.e., selling call options which further propels the price upward. Consequently, by entering a buy position at this juncture, you position yourself to benefit from the ensuing upward movement.

It is essential to recognise that there exist various weekly option trading strategies, each with its own characteristics and risk-reward profiles. However, it’s important to emphasise that no strategy is foolproof. Implementing risk management measures, such as placing a stop loss, is equally important. In the strategy outlined above, consider placing a stop loss just below the blow-off candle to protect your positions from adverse market movements.

Calendar spreads with weekly options

A calendar spread strategy is the purchase or sale of an option with a longer expiration date while simultaneously taking the opposite contract with a shorter expiration date.

This strategic move helps traders remove the impact of time decay. By creating a calendar spread, traders can structure their trades in a way that reduces the erosion of value caused by the passage of time.

The optimal scenario for a calendar spread to yield profit is when the underlying asset remains relatively stable, with no substantial price movements in either direction, at least until the near-month option reaches its expiration date. In such cases, the trader can capitalise on the time decay of the near-month option they sold, while the longer-dated option they bought retains its value. This combination of stability and time decay can lead to a favourable outcome for the calendar spread strategy.

Also read: Option chain for smarter online trading

Conclusion

Weekly options have emerged as a versatile tool for traders seeking short-term opportunities in the financial markets. With their lower premiums, distinct strategies, and the ability to leverage market movements over a brief period, these options have garnered significant attention among traders.

It is essential to approach weekly options trading with a well-thought-out strategy and an understanding of the unique risks associated with their shorter expiration timeframe. By mastering the art of weekly options trading, traders can add a valuable weapon to their financial arsenal and navigate the market with greater precision.