Long-influencing global markets are geopolitical hazards such as wars, political unrest, and international trade conflicts; one asset typically stands strong in the face of such upheaval. Often referred to as a safe-haven asset, gold shines when uncertainty obscures the economic horizon and provides consistency when other assets fail.

Understanding these processes is crucial for investors as recent world events from trade wars to conflicts have caused notable swings in gold prices.

This article investigates what affects the gold price, and how geopolitical concerns affect gold values and offers useful analysis to enable readers to negotiate these changes in the market.

Understanding geopolitical risks

Geopolitical hazards are social, political, or economic developments endangering the equilibrium of world markets. These comprise conflicts in trade, political unrest, wars, and sanctions. Such events raise uncertainty, which might lead to erratic and unstable markets.

Markets become volatile during geopolitical tensions because uncertainty rises, leading investors to seek safe-haven assets like gold. Such events can disrupt global supply chains, impact economic policies, and affect investor sentiment. The unpredictability causes rapid buying and selling, resulting in price swings and increased market volatility.

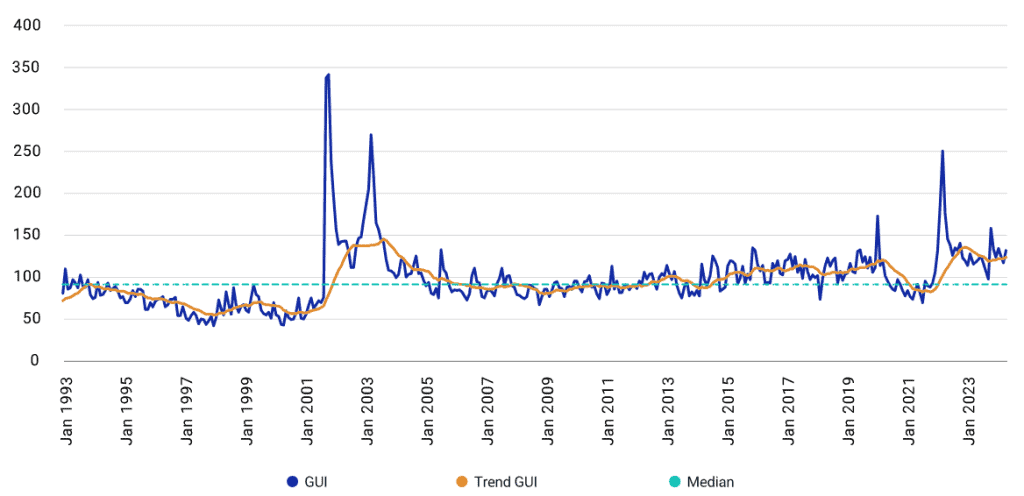

Events like the continuing Russia-Ukraine conflict, U.S.-China trade tensions, and political unrest in the Middle East have caused geopolitical risk to rise historically high in recent months. These changes have set off market swings and upset world supply systems, thus generating a degree of economic instability.

This instability is also depicted in the graph below, over the last 30 years (1993 – 2023). The Geopolitical Uncertainty Index (GUI) is a weighted average of the World Uncertainty Index (WUI) and the Geopolitical Risk (GPR).

Geopolitical concerns are especially important for investors since they often cause markets to be unstable and lower confidence in conventional assets like stocks. Gold usually shines as a safe-haven asset during such times since it provides a consistent substitute to guard against possible losses in other financial markets.

Gold as a safe-haven asset

A safe-haven asset, like gold, retains or increases its value during economic uncertainty or market instability, making it ideal for wealth protection through crises. Gold is a consistent store of value unlike currencies or stocks since its inherent worth stays rather constant.

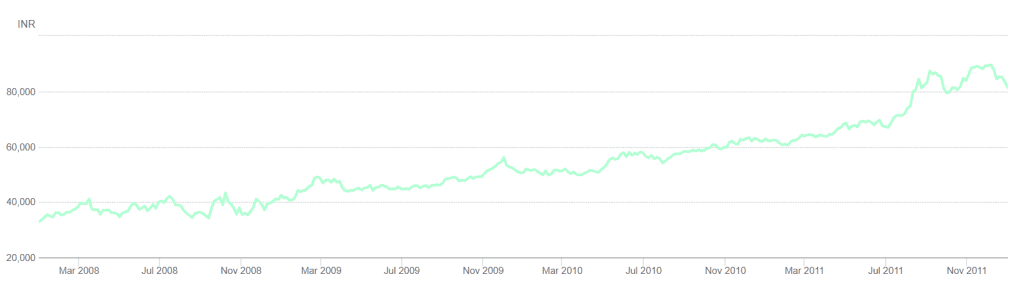

Traditionally, gold values have surged around major geopolitical events. For instance, the collapse of the housing market and the failure of big financial institutions during the 2008 financial crisis caused general economic uncertainty that drove investors away from dangerous assets like equities and into safer substitutes like gold.

Gold prices surged sharply following the crisis. In early 2008, before the crisis, gold was worth around ₹1,056.61 per gram. More than doubled in just three years, Indian gold prices peaked in 2011 at around ₹2,893.60 per gram.

Apart from world demand, the devaluation of the Indian rupee from ₹43.30 in 2008 and ₹44.65 in 2011 drove this notable rise in domestic gold prices.

During times of geopolitical uncertainty, investors swarm to gold since it provides a hedge against declining currencies, inflation, and unstable finances. The worldwide appeal and physical character of gold provide one with a sense of security and a barrier against the volatility of conventional financial markets.

Must read: Investing in Gold: From Tradition to Modern Value

Case studies of geopolitical events and gold prices

Example 1: Russia-Ukraine conflict

Beginning in 2022, Russia’s conflict with Ukraine disrupted world markets and drastically changed the value of many commodities, including gold. Investors sought cover in gold as tensions grew and Russia came under sanctions, thus driving its price higher.

For instance, early conflict months saw gold prices increase by ₹151 in India, reaching ₹51,806 per 10 grams in March 2022. Investors seeking gold as a safe-haven commodity driven by worries of lengthy geopolitical strife and market volatility created continuous demand and rising prices.

Example 2: Brexit

The outcome of the Brexit referendum in 2016 would determine how much gold changed. Leading up to the referendum and especially in view of the surprising “Leave” outcome, global markets were erratic and the British pound sank to historic lows. Investors crowded to gold as a consistent asset in the face of this erratic money.

Gold was trading at $1,256.50 per ounce on the evening of the referendum; nevertheless, the decline in the pound rapidly propelled it to $1,336.66, a 6.3% rise in dollar terms and a 22% increase in sterling.

Also read: What is Brexit all about? How is it affecting India and the globe?

Factors influencing gold prices during geopolitical risks

Several important elements are quite important in determining gold prices in times of geopolitical concern:

- Interest rates: Gold pricing is strongly influenced by changes in interest rates. As geopolitical issues grow, central banks may lower interest rates to stimulate economic growth, therefore attractive non-yielding assets like gold become more important. Conversely, higher interest rates might lead to reduced gold prices since they increase the opportunity cost of maintaining gold instead of interest-bearing assets.

- Currency fluctuations: Usually traded in US dollars, gold’s value of the currency fluctuates. Gold gets cheaper for holders of other currencies when the dollar depreciates because of geopolitical unrest, which drives demand and higher prices. On the other hand, a rising dollar might reduce gold demand, therefore lowering prices.

- Inflation: Geopolitical risks can lead to inflationary pressures as supply chains and energy costs become more of an issue. Many view gold as a means of inflation protection, which attracts investors to flood it at rising rates. Gold prices usually climb as investors try to maintain buying power when inflation projections grow.

- Market sentiment: Geopolitical tensions depend much on investor attitude. Rising demand for gold as a safe-haven asset driven by increased fear and uncertainty can drive prices upward. Conversely, if investors believe the geopolitical environment will stabilise and hence reduce the gold prices, they may migrate their money back to riskier assets.

- Global economic data: During geopolitical crises, key economic data such as employment numbers, GDP growth, and manufacturing statistics can affect gold prices. While favourable data may cause demand for gold to decline as trust in riskier investments rises, negative economic data might help gold prices as investors search for safety.

Also read: Inflation and deflation: The yin and yang of economics

Bottomline

As an indication of economic stability, geopolitical concerns greatly influence gold prices. Such occurrences have increased demand for gold, as historical case studies show, therefore underlining its position as a safe-haven asset in uncertain times.

Knowing geopolitical changes and their possible influence on gold price fluctuations will help investors make strategic judgements as world events continue to develop.

FAQs

How does geopolitics affect gold prices?

Geopolitical events including wars, political unrest, and trade disputes raise economic uncertainty and cause investors to hunt safe-haven assets like gold. Lower interest rates and currency swings resulting from these developments often help to drive gold prices even further. Gold basically becomes a favoured asset for wealth preservation during times of geopolitical uncertainty, which drives price swings because of increased demand and lower market trust.

What is causing the gold price to fluctuate?

Factors include geopolitics, changes in interest rates, inflation forecasts, currency values, and supply-demand dynamics that affect gold prices. Investors seeking safe-haven assets from geopolitical concerns often drive gold prices higher. On the other hand, a strong US dollar or higher interest rates may make gold less appealing, which would lower prices. Gold prices can change with seasonal demand, particularly during celebrations and weddings.

What causes gold to drop in price?

Rising interest rates cause gold prices to fall; so, other investments become more appealing. For non-dollar investors, a strong US currency lessens the value of gold. As confidence in other assets rises, good economic data can lower gold demand. Lower gold prices might also result from more gold supplies or less demand from important markets like China or India.

Why does the price of gold fluctuate?

Factors including geopolitical tensions, economic data, interest rate changes, currency strength, and supply-demand dynamics that affect gold prices. While good economic statistics and rising interest rates can lessen its appeal, geopolitical crises raise gold demand as a safe haven. Price volatility also stems from changes in gold output or consumption as well as from currency swings.

How does geopolitics affect the stock market?

Geopolitical events such as wars, trade disputes, and political upheaval create instability affecting financial markets. Often moving from growth stocks to safer assets, investors cause market turbulence. Changes in trade policies and economic sanctions can also affect company earnings, thus influencing stock values. Geopolitical concerns generally raise investor risk aversion, which drives market swings.