In the dynamic world of finance and investing, stocks and bonds are the bread and butter. But perpetual bonds are the cheese. Perpetual bonds are gaining more attention from seasoned investors and newcomers alike. There’s a reason why these assets are carving out a place for themselves in the investment landscape.

Perpetual bonds have one very important difference – no maturity date. Since perpetual bonds are not very well known yet, their potential still remains underestimated and underexplored. This gives you an opportunity to diversify your portfolio with this asset and take a shot at beating the market.

In this article, we’re going to explain what perpetual bonds are, how they’re different from regular bonds, in what circumstances you could consider investing in them, and whether you should. So let’s get right into it.

You may also like: Bond voyage: Unraveling the intrigue of Bonds

An Introduction to Bond Investing

To understand perpetual bonds, first let’s get into how regular bond investing works. Imagine you have ₹10,000 to invest for one year. You decide to invest in bonds. These could either be government bonds or corporate bonds.

‘Investing in bonds’ means that you’re loaning your capital to a large entity that needs your money for a particular time period. This time period is the maturity date. At maturity, you get back your principal along with some interest for your risk. So, at a 4% bond yield, your ₹10,000 turns into ₹10,400 over one year. Bonds hence, at the base level, are special promissory notes that list down the above agreements for both parties.

Also read: SGBs: A smarter way to invest in gold

What are perpetual bonds then?

Perpetual bonds are a little different from these bonds. Instead of lending your money to an entity until a fixed date, it’s more like you saying, “I’ll lend you this money, and you promise to pay me back ₹125 every year for as long as I live. But you don’t have to give me back the ₹10,000 I lent you.”

So, the company that sells you the perpetual bond gives you ₹125 the first year, and then another ₹125, then another, and then another in perpetuity. This goes on as long as you continue to live. Since there’s no specific maturity date, the company doesn’t have to give you the principal back. The only way you get your money back is through these regular payments.

Here’s a difference summary between regular bonds and perpetual investing:

- End date – In a regular bond, there’s a fixed date when you get your money back, but in a perpetual bond, there’s no fixed end date.

- Getting back the principal – In a regular bond, you get back your original ₹10,000 at the end, but in a perpetual bond, you don’t; you keep getting smaller payments (₹125 in the example) indefinitely.

- Risk – While bonds are considered very safe investments (especially government bonds), perpetual bonds carry more risk. If the entity that pays you money goes bankrupt or becomes insolvent at any point during your agreement, you could stop getting your payments irrespective of whether you’ve recuperated your original amount.

Also read: What are inflation-indexed bonds, and why should you care?

Are payments truly unending?

This is a valid concern amongst perpetual bond investors. However, it is a fact that these investments do actually provide an ongoing income stream to their holders in perpetuity.

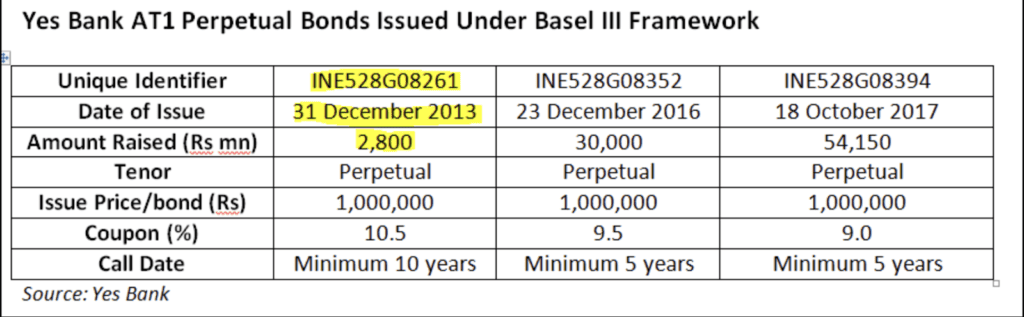

From an optimistic standpoint, issuers of perpetual bonds generally retain the option to redeem these bonds at their discretion, typically after a specified period, which could be as short as 10 years from when the bond is issued. Here, ‘calling’ the bond means that the original principal is returned and the ‘perpetual’ deal is considered null. This flexibility benefits the issuers because perpetual bonds don’t have decided maturity dates, allowing them to use their discretion while redemption.

The issuer’s ability to determine the timing of redemption may be a primary reason why they opt to issue perpetual bonds in the first place.

How to Calculate Returns on a Perpetual Bond

Just like any other investment, you need to calculate your cost-benefit ratio when investing in perpetual bonds. The formula goes like this:

Present value of a perpetual bond = D/r

Where D = the regular payment of the bond,

and r = the discount rate applied to the bond.

The discount is defined as the amount by which the market rate of the bond (or the current buying price) is lower than the amount one would receive when it matures. A bond issued at a discount creates capital appreciation at maturity.

Hence, if a bond pays ₹400 in perpetuity to the investor and the discount rate applied is 5%, then the current value of the bond should be:

Present value = ₹400/0.05 = ₹8,000.

The bond’s present value is highly sensitive to the discount rate. As the rate increases, the present value goes down.

Should you invest in perpetual bonds?

Investing in perpetual bonds isn’t the right decision for everybody. For lots of people, bond investing in general is not ideal to their personal goals and risk appetite. However, there are some investor demographics that can truly benefit from diversifying their portfolio with perpetual bonds.

- Income-oriented investors – A retiree or someone looking for a steady source of income could invest in perpetual bonds to establish a steady source of passive income in perpetuity.

- Long-term investors with high risk tolerance – Young investors who have several years before retirement and have spare cash can allocate a small portion of their portfolio to perpetual bonds. This is because younger people are less averse to risk and can afford to invest cash into illiquid assets that haven’t been earmarked for something urgent.

- Sector-specific investors – Fund managers or high-net-worth investors who want to stay invested in certain sectors without taking too many risks with their money could diversify with perpetual bonds. This gives them an avenue to extract their initial investment eventually and still stay invested in the market they deem to have potential.

- Investors seeking diversification – Perpetual bonds are also great options for investors who seek to diversify their cash not only across sectors, but across investment vehicles too. By spreading risk across different classes, they hedge their money against bear markets and sudden crashes.

Tax on Perpetual Bonds

Taxes are applicable on the money you make by investing in perpetual bonds. In most cases, these taxation rules are fairly straightforward – whatever you make is added to your yearly income numbers and the final amount is taxed according to the appropriate tax slab. However, in other exceptional circumstances where these bonds are sold to other buyers in a secondary market, capital gains tax worth 10% might also be applicable. We encourage you to consult a tax professional if you’re unsure about your tax liability when investing in perpetual bonds.

FAQs

What risks are associated with perpetual bonds?

Perpetual bonds carry higher risks compared to traditional bonds. These include credit risk, where you may lose money if the issuer defaults, and market risk, as rising interest rates can reduce the bond’s value. They also have liquidity challenges, making it hard to sell them, and the principal is not guaranteed unless redeemed by the issuer.

How are perpetual bonds different from regular bonds?

Perpetual bonds differ as they lack a fixed maturity date and typically don’t return the principal. Instead, they provide indefinite interest payments. Regular bonds, on the other hand, have a set end date and repay the principal, making them less risky.

Can perpetual bonds be redeemed, or are they truly permanent?

Perpetual bonds are designed to pay interest forever, but issuers often include a call option, allowing them to redeem the bonds after a specific period, like 5-10 years. This flexibility depends on market conditions and issuer strategy.

What are the main benefits of investing in perpetual bonds?

The primary benefits include a steady income stream, portfolio diversification, and potentially higher returns due to elevated yields. These bonds are ideal for income-oriented investors and those looking to diversify across asset classes.

How are perpetual bonds priced and valued?

The formula used to value perpetual bonds is: Present Value = D / r, where D is the annual payment, and r is the discount rate. For example, a ₹400 annual payment with a 5% discount rate makes the bond worth ₹8,000. Higher rates lower the bond’s value.