Introduction

Intraday traders earn from single-day market changes by opening and closing positions, applying the best indicators for intraday trading. In contrast to long-term investing, intraday trading involves the ability to make quick decisions and have acute market insights. Technical indicators are critical in this area due to its quick pace.

Traders use indicators to understand and analyse market patterns and the most beneficial entry and exit points. Traders use momentum and price patterns to gain success. In today’s fast-paced trading environment, choosing the right signal might mean the difference between seizing a valuable chance and missing it all.

In this article, let us look at and comprehend the most efficient indicators for intraday trading, highlighting the best indicators for day trading .

Understanding intraday trading

To reduce overnight risk, traders liquidate all positions before the market closes, and buy and sell financial instruments intraday to profit from price movements.

Key characteristics of intraday trading are as follows:

- To capitalise on market possibilities, traders must make quick choices and execute contracts.

- Charts and indicators are crucial for trend identification and entry/exit locations.

- Intraday traders win/lose quickly from price movements.

Long-term trading tends to preserve assets and is driven by fundamental analysis, while intraday trading requires quickness. Fundamental aspects of the company matter to long-term investors, whereas intraday speculators focus on volatility and data. Different risk management tactics and skill sets are needed for intraday trading, making it more dynamic and challenging.

Learn more about: Risk management in stock market

Importance of indicators in intraday trading

Indicators strongly influence intraday traders‘ decisions. They provide quantitative information to help traders analyse market behaviour and make smart judgements. Visualising complex data helps traders act quickly and efficiently.

Trend detection is a key function of indicators, making them some of the best technical indicators for day trading. Smoothed price data helps traders spot uptrends and downtrends. Early trend detection can boost price fluctuation profits. RSI and MACD can also indicate reversals by identifying overbought or oversold conditions.

When numerous indications indicate price reversal, traders can position themselves to optimise profits and minimise risk. Data boosts confidence and decreases emotional trading, enabling rational decision-making. Therefore, fast-paced intraday trading demands good indicators.

Best indicators for day trading

A. Moving averages

In intraday trading, moving averages are essential instruments that level price data to identify trends. The 2 most applied types are as follows:

Simple moving average (SMA) :Weighting all data points equally, SMA calculates the average price over time. Volatility delays long-term trends.

Exponential moving average (EMA): Focussing on recent prices makes the EMA more price-responsive. The trader can spot trend reversals faster.

Crossovers of short-term and long-term moving averages are buying signals. In contrast, the occurrence of the converse signals a sell sign.

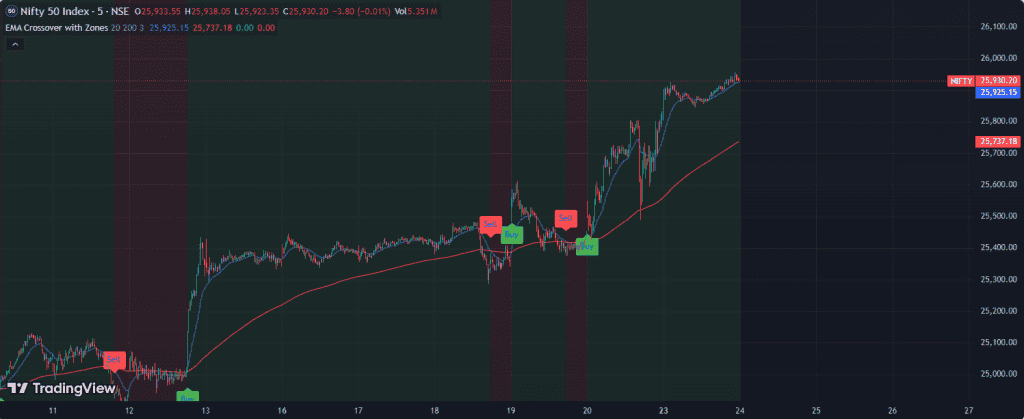

The crossover of the 20-period (blue line) and 200-period (red line) EMA in this Nifty 50 index EMA crossover with zones chart indicates buy and sell signals. Bullish momentum is indicated by the 20 EMA crossing above the 200 EMA, as shown in the current uptrend.

The 20 EMA falls below the 200 EMA sell signal indicating a negative momentum. The visual zones — green for bullish, red of bearish helps traders spot market moves along with entry and exit points.

Learn more about: What is EMA in the stock market?

B. Relative strength index (RSI)

RSI measures price fluctuations, speed and behaviour. The formula computes it over 14 days and ranges from 0 to 100:

RSI = 100 – [100 / {1 + (Average of Upward Price Change / Average of Downward Price Change}]

RSI is the average gain of up periods divided by the average loss of down periods.

RSI effectively identifies overbought (above 70) and oversold (below 30) conditions. When the RSI reaches these extremes, price may reverse.

This Nifty 50 Index chart shows Momentum and RSI indicators with price activity. Following the session’s upward price trend, the RSI and momentum are approaching the overbought area (over 70 on the RSI), indicating strong bullish emotion.

As price falls, momentum and RSI drop significantly, signifying a bearish trend. The RSI has dropped below 50, confirming the lack of upward momentum and suggesting further collapse. Confirmation of trend strength and potential reversals is facilitated by this combination of indicators.

C. MACD (moving average convergence divergence)

The momentum indicator Moving Average Convergence Divergence (MACD) analyses price patterns to help traders spot buy and sell signals. It has three fundamental components:

-MACD Line: Disparity between 12-day and 26-day Exponential Moving Average (EMA). MACD’s cycles above and below zero imply bullish or negative momentum.

-Signal Line: Trade signals are generated using the 9-day MACD line EMA. When the MACD line crosses the signal line, buying is likely, while below indicates selling.

-Histogram: Histograms quickly determine momentum strength by showing larger bars.

Utilising MACD to Identify Trends and Momentum

Crossovers and divergences help traders use MACD. MACD crosses over the signal line, indicating upward momentum, suggesting bullish momentum. Alternatively, a bearish crossover predicts a drop.

Additionally, MACD divergences—when the price moves against the MACD—may indicate trend decline. Prices reaching new highs without MACD following may indicate a reversal.

MACD signals when applied with other technical indicators can improve intraday traders’ decision-making.

Know more about: Here’s how you can use the MACD indicator

D. Volume indicators

Intraday traders need volume indicators to assess price volatility. For price movements, trading volume in a specific timeframe—is crucial. Trading volume often indicates market interest, validating price fluctuations. Low volume may imply weak trends. Volume dynamics help intraday traders choose entry and exit positions.

The significance of trading value in intraday strategies

Volume is a critical metric for gauging market sentiment in intraday trading. It has the potential to indicate prospective reversals, breakouts, or the continuation of trends. The validity of movements is further substantiated by the presence of high volume alongside substantial price changes, which suggests that traders are actively engaged.

In contrast, speculators may be at risk of acting on false signals as a result of price movements with low volume. Traders can improve their overall strategy by evaluating the severity of a trend by examining volume in conjunction with price action.

| Type of Volume Indicator | Description |

| On-Balance Volume (OBV) | This cumulative volume indicator calculates buying and selling pressure from price and volume. Increasing OBVs implies buyers are willing to boost prices, while falling OBVs indicate selling pressure. |

| Accumulation/Distribution (A/D) | Price and volume determine asset accumulation or distribution. A decreasing A/D line shows distribution, whereas a rising one indicates accumulation. |

| Chaikin Money Flow (CMF) | This volume indicator measures selling pressure over time utilising price and volume. Positive CMFs indicate purchasing pressure exceeds selling pressure, while negative CMFs indicate the opposite. |

| Volume Moving Average | Traders can spot anomalous volume spikes that may indicate market shifts by averaging volume over a period. |

E. Bollinger bands

Bollinger Bands are popular three-line technical analysis tools. A standard deviation is added or subtracted from the middle line is a SMA. Market volatility affects range. Traders get pricing cues from the bands’ expansion and contraction with volatility.

Volatility and price action interpretation of bollinger bands

Market conditions and price variations can be assessed using Bollinger Bands. The asset may be overbought at the top band, suggesting a reversal or retracement. However, the asset may be oversold in the lower band, offering a buying opportunity.

Also important is band distance. The market is more calm with a narrower band and more volatile with a wider band. Investors look for “squeeze” patterns, when the bands converge, to signal a big price move. Combining bollinger bands with other indicators help traders mark entry and exit points.

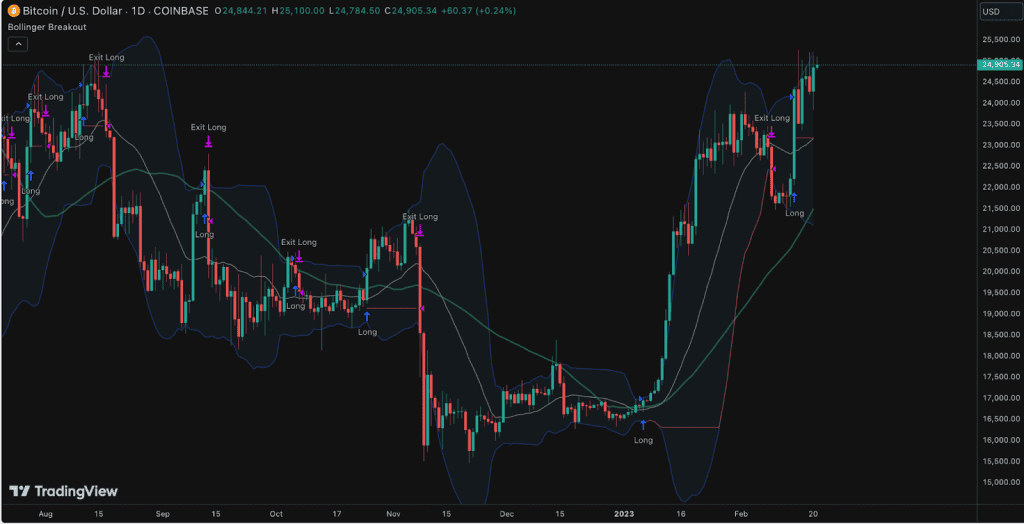

Bitcoin Bollinger Band Breakout chart shows the primary long and exit long indications when the price crosses above or below the Bollinger Bands. The price breaks above the lower band, indicating potential bullish momentum, resulting in the observation of numerous long entries.

The subsequent exit long signals are generated when the price reaches overbought conditions, crossing above the upper band, and subsequently reverting, indicating a pullback. Bollinger Bands are a valuable instrument for detecting potential breakouts and reversals in price trends, and this pattern underscores Bitcoin’s volatility.

Combining indicators for enhanced trading strategies

Trading requires multiple indicators to increase prediction accuracy and decision-making. Market congestion or anomalies might cause misleading signals from a single indicator. By cross-checking signals with multiple indicators, traders can increase transaction success and reduce false positives.

When paired with RSI, MACD is a powerful approach. Traders use the RSI to identify overbought or oversold circumstances by examining price variations. Assets are overbought if their readings exceed 70 and oversold if they are below 30.

Traders can create synergy using MACD, which shows trend direction and momentum. The MACD line crossing below the signal line when the RSI is overbought strengthens the sell signal. A strong purchase opportunity arises when the MACD line crosses the signal line and the RSI is oversold.

Adding these indicators to their systems helps traders make more educated judgements based on market emotion and momentum. Ultimately, this combination approach enhances trading results by improving market dynamics understanding.

Tips for effective use of indicators

It is imperative to steer clear of common pitfalls to optimise the efficacy of indicators in trading. Overreliance on a solitary indicator is a significant error. As each signal has pros and cons, using a mix can provide a more complete picture. Instead of reading indicators alone, traders should consider the market backdrop, including economic news and price activity.

To optimise trading techniques, use paper trading and backtesting. Your plans are back tested using historical data to determine their viability. This procedure identifies vulnerabilities and implements modifications before trading. Paper trading lets merchants test their tactics without risk. It boosts confidence and provides real-time market indicator performance data.

By improving indicator proficiency, a systematic strategy and focused testing can help traders enhance their trading performance and make better selections.

Conclusion

Intraday trading requires Bollinger Bands, MACD, RSI, Volume Indicators, and Moving Averages, which are among the best indicators for intraday trading. Each indicator helps traders make decisions by presenting market trends, momentum, and probable reversals.

By examining indicator interactions and using these tactics, traders can improve their performance and confidence in a fast-paced market. Implement these tactics and watch your intraday trading improve.

FAQ’s

- Which indicator is best for intraday option trading?

Intraday option trading works well with RSI. Traders can use this momentum oscillator to determine overbought or oversold circumstances and strategic entry and exit points. Verifying trends and reversals with RSI and moving averages improves decision-making. Open interest and volume let options traders analyse market sentiment and liquidity, providing a complete picture of price fluctuations.

- Which indicator is the most effective for day trading?

The MACD is a popular day trading indicator. MACD and signal line crosses indicate momentum, trend direction, and possible reversals. MACD and volume indicators are often used by traders to verify trends and ensure price changes are supported by trading activity. This combination helps traders make informed market mood and momentum-based judgements.

- Which indicator is the most accurate?

The Moving Average is often used to identify trends, but no indicator can guarantee accuracy. By smoothing price data with the SMA and EMA, traders can spot trends. Signal accuracy can be increased by integrating indicators like MACD and RSI to check them over several data points. Speculators can make better selections with this holistic strategy.

- Which are the best indicators for trading in India?

Moving averages, Bollinger Bands, and RSI are popular Indian trading indicators. Moving averages help spot trends, whereas RSI detects overbought and oversold levels. Price changes must be verified using volume indicators like On-Balance Volume (OBV). Additionally, Fibonacci Retracement levels are often used to identify support and resistance zones, providing traders with unique insights particular to the Indian market.

- What is the best leading indicator for trading?

Highly efficient trading indicators include the Relative Strength Index (RSI). The velocity and change of price variations indicate overbought or oversold levels before trend reversals. Traders use RSI readings above 70 to predict overbought conditions and below 30 to predict oversold ones. Other indicators, such as MACD, which confirm price reversals boost RSI’s effectiveness.