The fact that you can get much more leverage by trading in foreign currencies than you might with equities is one of the main draws for traders of this financial instrument. Although many traders are familiar with the term “leverage,” few understand what it means, how it operates, or how it impacts their profits.

A key idea in trading currencies is forex leverage, which enables traders to take control of more significant market positions with minimal initial investments. Capital brokers provide traders with this option, which allows them to borrow money to boost or reduce their possible gains or losses. As a trader, one needs to become familiar with the concept of leverage in forex to understand the potential risks and benefits fully.

Let’s begin!

What is leverage in forex?

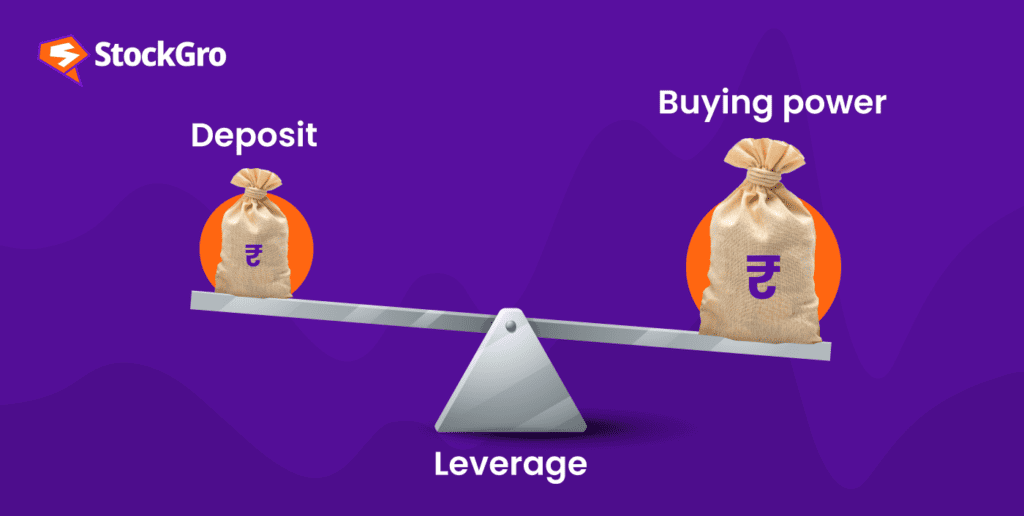

Leverage is the ratio of how much a trading position is magnified compared to the amount one puts up as a margin. When a trader uses leverage in FX, the broker effectively grants them a “loan” that increases their trading capital beyond what they initially placed. Usually, a ratio is used to represent it.

To use leverage in forex trading, a trader must provide a portion of the trade’s entire value as a margin, with the broker covering the remaining sum. As a result, a leverage ratio represents the borrowed money ratio to the trader’s margin.

Also read: All you need to know about the basics of forex trading in India

Let’s say you want to have a position for ₹60,000. Your broker can borrow the remaining funds and set aside ₹1,200 of your own. As a result, your leverage ratio is 50:1, as you can now manage the ₹60,000 with only ₹1,200 from your account.

It is always a good idea to check the maximum leverage ratio you may employ before opening an account with a broker. A greater ratio indicates larger possible profits or losses. The ratios that brokers often provide are 50:1, 100:1, 200:1, or 400:1.

How Leverage Works in Forex Trading

We’ve covered “what is leverage in forex trading.” Now let’s look at how it functions in the FX market. Leverage in forex allows traders to use less money to manage more prominent positions in the market.

One may increase gains or losses by using forex leverage. A trader may make more money if a transaction goes in their favour because of their amplified position. On the other hand, losses are also increased if the deal goes against them. When forex leverage is used excessively, it might result in margin calls, which require the trader to deposit more money to keep the position open.

The idea that leverage indicates risk is a common belief among traders as to why FX market makers give such high leverage. They know that if the account is handled well, the risk will likewise be highly controlled; otherwise, they would not provide the leverage. The ability to initiate and exit a deal at the appropriate level is also considerably more straightforward in the spot cash FX markets due to their size and liquidity compared to other less liquid marketplaces.

Also read: The world of currency fluctuations: How does it impact your investments?

Forex leverage vs. forex margin

The total amount of funds you have put up in a trade is forex leverage, whereas the amount you invested as a security is the margin. In the currency market, suppose your broker deducts INR 100 from your account to manage an INR 5000 position. Now, your leverage, measured in ratios, is 50:1. Now, with INR 100, you are controlling INR 5000.

| Leverage ratio | Margin requirement |

| 400:1 | 0.25% |

| 200:1 | 0.5% |

| 100:1 | 1% |

| 50:1 | 2% |

Here, you must invest a “margin” in the form of an INR 100 deposit to apply forex leverage. Typically, the margin is represented as a percentage of the position’s value, as shown in the table above.

You can determine how much leverage you may use with your trading account based on the margin your broker requires. The connection between forex leverage and margin is inverse. That’s why, less required margin equals more leverage offered, and lower leverage is offered when a higher margin is needed.

The table shows that a higher level of leverage may be used on each transaction where a lower margin is required. Nevertheless, a broker can have greater margin requirements depending on the specific currency being traded. For instance, there might be significant fluctuations in the exchange rate when comparing the GBP to the JPY because of its highly volatile nature. Here, a broker might keep more capital as collateral for more volatile currencies during turbulent trading periods.

Also read: Margin trading: Exploring the risks and rewards

Is leverage a two-edged sword in FX trading?

Risk is not always affected by margin-based leverage, and a trader’s gains or losses may not be impacted by having to put up 1% or 2% of the transaction value as margin. This is due to the fact that an investor may always attribute a position with more than the minimum margin needed. According to this, real leverage is a better predictor of profit and loss than leverage based on margin. Real leverage is the “notional value” that you get by dividing the total value of your transaction by the total trading capital. To put it in a formula:

Real leverage = value of transaction/trading capital

Real leverage has the ability to increase your gains or losses by an equal amount, which is when the two-edged sword emerges. The risk you take on increases with the amount of leverage you apply to your money. Keep in mind that although it may have an impact if a trader is negligent, this risk is not always connected to margin-based leverage.

Conclusion

Leverage is an effective strategy that may help you make significant profits in the FX market. However, traders should choose the leverage level that best suits them. This is why a lower level of leverage, such as 5:1 or 10:1, can be more suitable if you’re risk-averse or if you’re just starting out as an FX trader.