Introduction

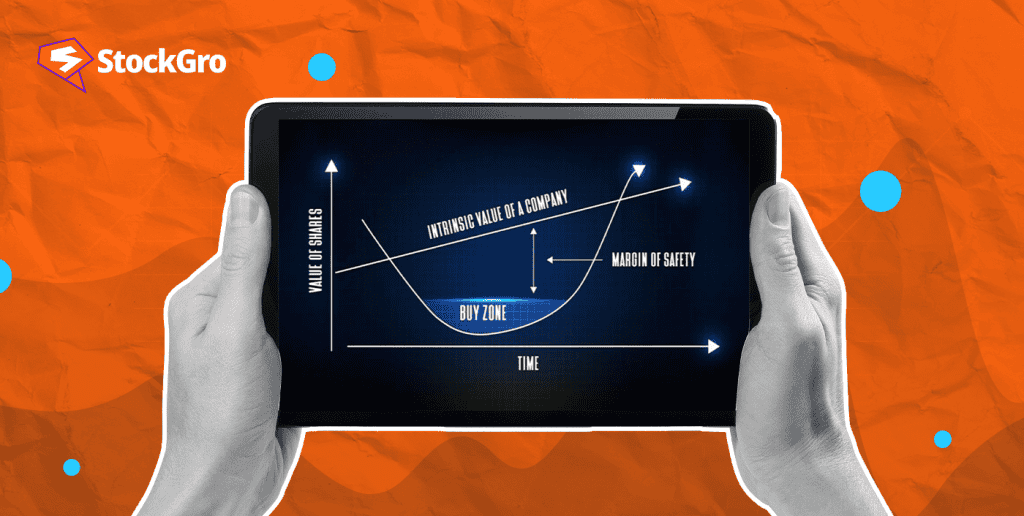

Investments employ the margin of safety to reduce risk by buying assets below their true value. This conservative approach secures long-term gains and reduces market volatility.

Purchasing assets at a discount from their inherent worth creates a margin of safety against market swings. This method helps investors make smart choices and avoid bad investments. By investing carefully and with a margin, investors may handle market swings and avoid major losses.

Definition of margin of safety: A core concept

The margin of safety is an asset’s market price minus its inherent value.

The market price is the asset’s current market price, whereas intrinsic value is its calculated worth based on cash flow, growth, and earnings. Investors use this estimated intrinsic value to determine if the asset is undervalued or overvalued. Investors can avoid market volatility and valuation errors by focusing on financial fundamentals. For instance, a 30% margin of safety means the investor is buying the company at 30% below its true value.

This distinction protects against unexpected downturns or faulty expectations, helping investors to make better judgments. The margin of safety prevents investors from overpaying, lowering loss risk.

Benjamin Graham, the “father of value investing,” formalised this. Graham stressed buying assets cheaply for long-term financial prosperity. His investment technique relied on the margin of safety to let investors focus on value rather than market swings. By favouring conservative investing techniques over risky ones, Graham changed risk assessment.

The major purpose of underpricing in this method is to lessen the likelihood of loss. Investors provide a buffer against market swings or company-specific issues by purchasing assets at a lower price than their actual value. Underpricing protects investors from market volatility while keeping profit possibilities. This cautious strategy prioritises long-term success over short-term gain.

Learn more on : Margin Trading

The importance of margin of safety in market volatility

The margin of safety protects investors by buying assets below their intrinsic value, reducing market volatility. In the case of an asset price drop, this lower entry point protects investors from sharp losses. However, it was able to recover quickly in the coming months.

The Indian stock market fell 39% in March 2020 because of COVID-19. However, the market recouped by the end of 2020. If investors had used a margin of safety approach, they could have avoided large losses during the crash and profited from the quick rebound.

The safety buffer is essential to avoid overpaying for assets. Targeting an asset’s inherent value and margin of safety protects investors from market mania and inflated pricing. This rigorous method ensures investments are based on financial fundamentals rather than speculative trends, protecting wealth over time.

The margin of safety formula: Understanding the calculation

It is imperative to employ the margin of safety formula to invest securely, as it guarantees that an investor acquires an asset at a substantial discount to its intrinsic value. The equation is straightforward:

Margin of safety = (intrinsic value-market price)/intrinsic value

This estimate highlights how much the market price is below intrinsic value.

A hypothetical application of the formula is as follows:

Suppose a company has an intrinsic value of ₹150 per share and a market price of ₹100.

Margin of safety = (₹150-₹100)/₹150 = ₹50/₹150 = 0.33 or 33%

This means the company is trading at a 33% discount to its real value, giving investors a large margin of safety. A greater margin avoids losses in a volatile market or overstated intrinsic worth.

Analysts use earnings, revenue growth, future cash flows, and other elements to evaluate a firm’s intrinsic value. Investors must value it properly to prevent overestimating future success and making bad investments. Overpaying for assets due to an incorrect assessment of intrinsic value may undermine the benefits of the margin of safety.

Market changes frequently distort stock prices, resulting in overvalued or undervalued stocks. The margin of safety formula helps investors value long-term fundamentals over market sentiment. It protects against downturns and lets investors find purchasing opportunities during volatility.

Key Drivers Influencing the Margin of Safety

- Market sentiment and investor behaviour: Asset prices might fluctuate from their inherent worth due to optimism or dread. The margin of safety is lowered in optimistic markets, whereas fear-driven markets provide possibilities for value investors.

- Macro economic factors: Economic factors such as inflation, interest rates, and economic growth all have an impact on the safety margin. Investors must modify margin limits, especially during economic downturns, as inflation or interest rates rise, lowering an asset’s underlying worth.

- Sectoral distinction: Technology stocks, which are expected to grow significantly, typically have lesser margins of safety due to volatility. Real estate and asset-heavy companies offer higher margins due to regular cash flows and tangible support.

Margin of safety vs. Risk Tolerance

The margin of safety is an objective measure that calculates the gap between an asset’s intrinsic worth and its market price. It ensures an investment has ample margin for losses.

Investors’ risk tolerance depends on their financial goals, emotional resilience, and time horizon. Financial measures and valuation models determine the margin of safety, while risk tolerance is impacted by psychological factors.

| Aspect | Margin of Safety | Risk Tolerance |

| Nature | Objective, based on intrinsic value | Subjective, varies by individual |

| Goal | Minimise investment risk | Reflects investor’s comfort with risk |

| Measurement | Calculated using financial metrics | Personal assessment of risk |

The optimisation of investment strategies is achieved by combining both approaches. Investing safely is facilitated by the margin of safety formula, which also guarantees the emotional fortitude necessary to withstand market fluctuations by aligning with the individual’s risk tolerance.

Investors may be exposed to substantial market risk, particularly during downturns, if they disregard the margin of safety, as they may overcharge for assets without the protection of an undervalued purchase price. This combination is indispensable for a resilient and well-balanced investment strategy.

Learn more about: Key risks in investing in the stock market

Challenges and limitations

- Lost opportunities in growth markets: Focussing solely on the margin of safety may result in a loss of investment in high-quality, fast-growing industries such as technology, which usually trade at a premium. Potential long-term benefits may be overlooked by investors while they wait for significant reductions.

- Balancing financial metrics: To create a comprehensive investment strategy, investors should combine the margin of safety with other financial criteria such as profit growth, cash flow stability, and market trends. Incomplete asset appraisals may result from an overreliance on the margin of safety.

- Intrinsic value assessments are subjective because they rely on predictions about future growth and cash flows. The fact that cognitive biases and individual views can cause investors to value the same asset differently emphasises the need for a more comprehensive strategy. Beyond the margin of safety, decision-making is improved by combining qualitative and quantitative information.

Also learn about : Mastering mutual fund evaluation: 5 Key metrics you need to know

Conclusion

The margin of safety enables investors to buy assets below value to reduce risk. Investors get a cautious buffer. The margin of safety formula protects investors from overpriced assets and market movements, especially during tumultuous periods. As mentioned, focusing entirely on these criteria may lead to missed possibilities, especially in growing areas where pricing value may not be clear.

A mature, strategic investing approach must balance the margin of safety against profit growth and market trends. Understanding that intrinsic value computations are subjective stresses the necessity for multidimensional investing. Incorporating the margin of safety into larger research can help investors achieve long-term, risk-adjusted returns.

FAQs

- What is a good margin of safety in investing?

Investor risk tolerance and asset type are typically the determining factors in determining a suitable margin of safety. A margin of 20-30% below the intrinsic value is generally regarded as wholesome for value investing. This margin serves as a buffer to mitigate any potential valuation errors or unforeseen market events. Nevertheless, the optimal margin is sector-specific, with more volatile industries frequently necessitating a higher margin to mitigate risks.

- What is the margin of safety in simple terms?

The margin of safety is the difference between an investment’s inherent value and market price. By buying assets at a discount, investors reduce risk. This reduces price volatility during market downturns, protecting investors’ capital.

- How much should be the margin of safety?

The margin of safety in investing protects against market volatility and valuation errors by separating an asset’s intrinsic worth from its market price. The optimum margin depends on investor risk tolerance and asset class. More volatile investments require a bigger margin, while stable assets may need less. It protects investors from dangers while seeking long-term returns.

- What does a 20% margin of safety mean?

The market price of an asset 20% below its estimated intrinsic value indicates a 20% margin of safety. To maintain a 20% margin of safety, buy stocks with an intrinsic value of ₹100 at a price of ₹80 or less. In the case of valuation errors or market falls this cushion should reassure investors.

- Is a 50% margin of safety good?

This conservative 50% margin of safety protects against market volatility and valuation errors. This significant buffer means that losses can be avoided if market conditions deteriorate or the underlying value is overestimated. However, in high-growth sectors where prices frequently match intrinsic value, it might be challenging to discover assets with a 50% margin of safety.