Investors can usually search for profit-booking strategies and techniques in the market. They seek the secret key to time or beat the market. However, the markets are full of varied attributes. Timing the market can be a confusing task. Therefore, investors resort to some proven strategies that can help them.

When investors are unable to beat the market and have no information to predict future change, they term the market to be inefficient. However, due to different investment psychologies and market forces, there is an opportunity for a potential price gap. Such a gap can be widely regarded in terms of the whole industry.

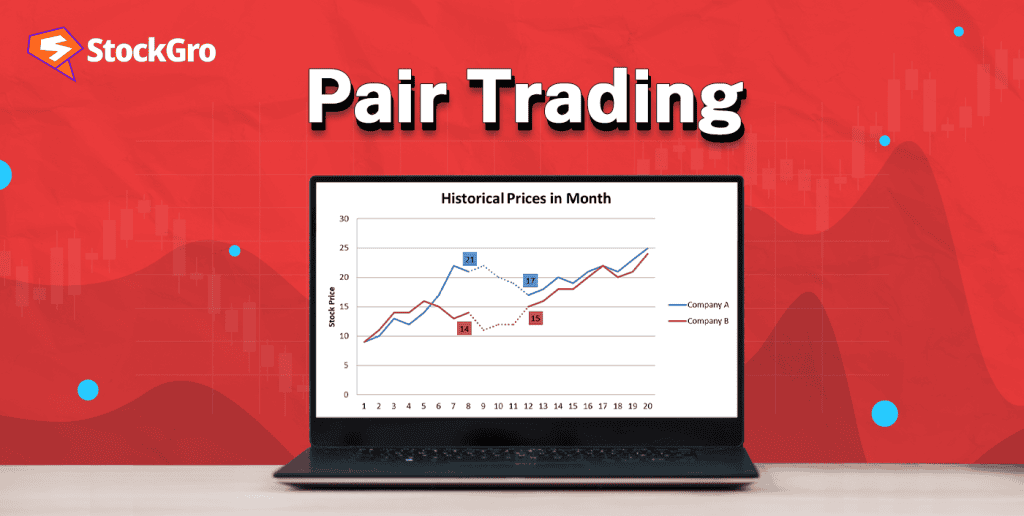

There are several trading strategies that seek to help investors find gaps. Pairs trading or pair trading strategy is one such tool. Let’s explore it in detail.

What is pair trading strategy?

There are several market-neutral strategies. In this, two positions are placed to tap the gap in market pricing of a security. The pair trading strategy is one such market-neutral strategy considering the overall industry as a playground. It finds potential companies in the industry that are positively correlated.

Correlation shows the effect of an instrument’s price movement on the other. When this effect is positive and prices are moving together, it is known as a positive correlation. When it is negative, and prices are moving opposite, it is known as a negative correlation. A statistical formula for the correlation coefficient is available on software like MS Excel and Google spreadsheets.

Taking opposite positions in two stocks of the same industry is a pair trading strategy. However, while employing this strategy, its various components should be checked.

Also, read How does arbitrage trading work?

Components of pair trading

- Asset selection: The industry with companies having ample correlation may be suitable for implementing this strategy. Moreover, the past movement of companies selected from the available options can be analysed.

- Correlation: Selected companies should have a high positive correlation. Its cointegration can show whether they have long-term relations.

- Price spread: This spread can also be termed the gap between the prices of two selected stocks. Spread indicates the potential opportunity for pair trading in those two stocks.

- Entry point: One needs to determine the entry point.Usually, when the spread is shifting from the historical mean, entry can be favourable. A wide price spread can give more entry opportunities.

- Exit point: The spread is low, or at its historical mean point, the exits may help investors. However, deciding on entry and exit points depends on the investor’s aspirations and analysis.

How does pair trading work?

Strategies like pair trading are commonly employed by arbitrage traders. Understanding the mechanism of strategy operation can help investors analyse the opportunity and employ it as required. Usually, the strategy works in the following manner:

- An industry is identified where correlation among the stocks is high.

- Among the available companies in the selected industries, the two stocks with the highest correlation and suitability in other aspects are selected.

- Moreover, mispricing opportunities are also checked in these stocks.

- Identify the spread and its historical meaning.

- The trader will take buy and sell positions in the two selected stocks, simultaneously.

- If the stocks deviate from this mean or investors find a potential opportunity, one can enter the trade.

- One needs to monitor the correlation and spread between these stocks constantly.

Let’s understand with an example

Suppose, in the fast-moving consumer goods (FMCG) industry, there are two companies named ABC and MNO. These two companies have shown significant comovement for the long term in history. Currently, the companies ABC and MNO have a correlation coefficient of 0.90, which is significantly high.

The spread was favourable between these two companies, and the sector was moving positively. The correlation between them is reducing. Therefore, Mr Shah hypothetically took the following positions:

- Buy in the stock of ABC as he expects it to rise and

- Sell in the stock of MNO as he expects it to fall.

Further, Mr Shah will constantly check the prices, correlation, spread and historical mean.

Must read: Top 10 ways to learn stock market trading

Advantages and disadvantages of pair trading strategy

Like every coin has two sides, the pair trading strategy also has positive and negative sides, accompanied by it.

| Advantages | Disadvantages |

| It is a market-neutral strategy, and such strategies can be employed when investors/traders are not clear about potential market movement. Moreover, one can seek profit with both the positions taken. | Trading strategies may require extensive research and data analysis. One needs to put time and effort into finding the gap in pricing and searching for potential opportunities in the market. |

| When an investor takes two positions in different stocks, one can gain diversification benefits in the portfolio. | The effectiveness of trading strategies also depends on the trader’s skill to time suitable entry and exit. Lack of it may affect the trade. |

| Algorithmic trading or algo trading can automate this market-neutral strategy, which can efficiently execute the trades. | If an investor misses checking proper fundamentals for the stock and the stock has insufficient liquidity, then the sell position can be risky. |

| Simultaneous buy and sell positions may lower the overall execution cost for such trade. | The assumption of historical mean reversal can pose a potential threat. If the stock doesn’t perform as per expectations, then the spread and mean will be affected. |

| Risk is minimised to a certain level due to positions of buy and sell in two different securities. | High market volatility may confuse traders with potential entry and exit for the trade. |

| The systematic or market risk is reduced due to such strategy. | Unsystematic or particular stock/industry risk usually hovers over such trade. |

Summary

The stock market is a complex investment avenue, and finding suitable strategies and tools can be difficult. However, some trading strategies are unique and can profit investors in any market condition. Such strategies are known as market-neutral strategies.

A pair trading strategy is a market-neutral tool that takes buy and sell positions simultaneously in two stocks of the same sector. In this strategy correlation spread between the stock prices and their reversal to the historical mean are crucial components. However, investors should analyse its pros and cons well before taking market trade with it.

Check this out! 7 Options trading strategies for beginners

FAQs

- How does pair trading work?

In the pair trading, an investor selects two stocks from the same industry. These stocks have high correlations and potential spread in their prices. The investor takes the buy and sell positions in these stocks based on their analysis of market movement. One should constantly check the correlation and spread to avoid missing potential exits.

- Is pair trading risky?

Pair trading has many benefits, but it is accompanied by some risks. The unsystematic and industry-specific risks, along with high volatility, may complicate the trade. Moreover, trading needs potential research, time and effort for the selection of pairs of two stocks from the industry. Lack of potential planning may risk the trade.

- What does pair trading strategy assume?

The pair trading strategy assumes that the historical mean of the long-term price spread between the pair may be the reversal base. Their exit and entry strategies are based on this assumption.

- What are the various components of pairs trading?

The pair trading strategy has various components that together catalyse the trading process. Therefore, investors need to analyse them all before entering or exiting the trade. The components are asset selection, price spread, correlation, etc.

- What is the time frame for pair trading?

The time involved can vary. Some positions last a few hours, while others extend over several weeks. It depends on how quickly the price gap between the two assets closes. Shorter trades target quick movements, while longer ones wait for gradual adjustments. Factors like market volatility and liquidity play a role in determining duration. The timing isn’t fixed but rather depends on specific conditions in the market.