In economics, surplus highlights the gap between cost and value. It exists in two forms. Consumers enjoy it when they acquire goods for less than what they’d initially budgeted. On the other hand, producers benefit when they receive a price higher than the least they’d accept.

This contrast between expectation and outcome drives market interactions and influences decisions on both sides. While both surpluses matter, this blog will focus on producer surplus meaning—a critical concept that offers insight into pricing strategies and business profitability. Let’s break it down and explore further.

What is producer surplus?

In economics, when sellers earn more than their lowest acceptable price, they experience a gain known as producer surplus. It’s essentially the financial benefit producers receive when the selling price of their product exceeds their cost expectations.

For instance, a potter might be willing to sell a vase for ₹500. If buyers are willing to pay ₹700, the ₹200 difference represents the extra benefit they gain from the sale. This additional earning changes depending on market conditions and consumer demand.

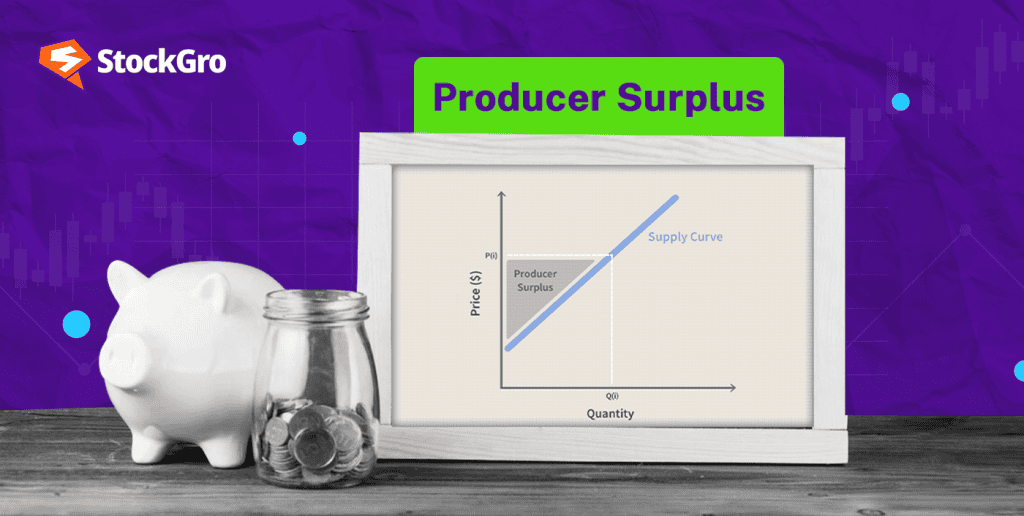

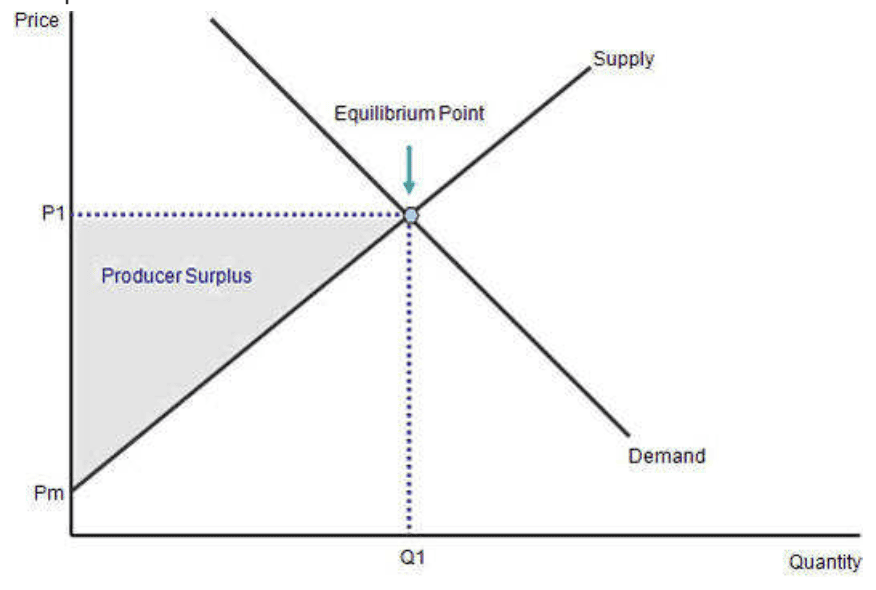

Graphically, this concept is represented by the area between the price line and the supply curve. The larger this area, the more profit sellers are able to capture above their base costs. As the width of the triangle represents the number of units sold, while the height indicates the gap between the selling price and the lowest acceptable price.

However, there are limits. If prices rise too high, buyers may reduce their purchases, and this can cause the advantage to shrink. High prices can diminish demand, ultimately impacting the overall financial gain for producers.

You may also like: What is a budget surplus?

Producer surplus formula & calculation

Producer surplus captures the financial gain a seller enjoys. How to get producer surplus? It can be calculated as:

Surplus = Total earnings – Total expenses

For example, a manufacturer producing 100 units at ₹200 each and selling them at ₹400 earns a surplus of:

Surplus = 100 × (₹400 – ₹200) = ₹20,000

While this shows how one producer benefits from lower costs, market dynamics can vary.

Take a scenario where 12 different manufacturers produce phone cases. Their production expenses range from ₹150 to ₹250 per piece, while the market settles at ₹200. Producers with lower costs, like those spending ₹150, enjoy a ₹50 advantage per unit. Another manufacturer with expenses of ₹180 would gain ₹20. However, those operating above ₹200 would struggle to cover their production costs, experiencing no gains.

This demonstrates how much better off the seller is when the price they charge exceeds production costs. If prices rise, sellers are motivated to produce more, enhancing their benefit. Conversely, a drop in prices would reduce the advantage, possibly leading to reduced supply. Each fluctuation in pricing significantly affects overall profitability.

Factors that influence producer surplus

- Demand fluctuations: When demand spikes, such as during holiday seasons or unexpected events, producers often sell their goods at elevated prices, creating a larger surplus.

- Shifts in input costs: A reduction in the cost of materials or labour enhances profit margins, resulting in greater surplus. Conversely, increased expenses—due to supply shortages or higher wages—can shrink the surplus by narrowing the difference between cost and revenue.

- Pricing power: In industries dominated by a few players, companies often have the ability to set prices above competitive levels, thus securing higher margins. However, in highly competitive environments, such control diminishes, reducing the benefit they can extract from sales.

- Regulatory policies: Government actions, such as the imposition of taxes or the provision of subsidies, can significantly alter a producer’s profitability. While taxes can raise operational costs and squeeze profits, subsidies can lighten the financial load, improving overall returns.

Also read: How Global Economic Events Affect Personal Finances

Importance of producer surplus

- Indicates business profitability: Surplus acts as a measure of how much firms benefit from selling their goods above the minimum price they’re willing to accept. It reflects the overall financial health of companies.

- Promotes technological advancement: Higher profits often encourage firms to invest in better technologies, improving productivity and reducing costs.

- Improves resource efficiency: Higher returns allow businesses to channel their resources more effectively, directing capital, labour, and materials to areas where they generate the most value, leading to better outcomes across sectors.

- Guides policymaking: Surplus levels provide valuable insights for regulators. They help assess where government intervention, such as subsidies or tax reforms, may be necessary to ensure balanced growth and maintain economic stability.

Bottomline

Understanding how much more producers gain above their minimum selling price reveals essential economic insights. It stimulates innovation, encouraging companies to invest in new technologies and improve efficiency. Additionally, it helps authorities assess where interventions are needed to maintain balance, fostering sustainable growth and ensuring competitive environments.

You may also like: How to build financial resilience in times of economic uncertainty?

FAQs

- What do you mean by producer surplus?

When a seller receives a price higher than what they’d settle for, the difference becomes their gain. It reflects how much they benefit from a sale. This concept highlights the advantage sellers enjoy in the market. By comparing what they expect with what they actually make, it shows their profit. It’s crucial for understanding how businesses thrive in various economic conditions.

- What is the consumer surplus and producer surplus?

When buyers pay less than what they were willing to, they enjoy a consumer gain. It reflects the extra advantage they get from the purchase. On the flip side, sellers experience a producer gain when they sell above their lowest acceptable amount. Both show the difference between what people expect and what they receive in trade. These concepts help explain the benefits buyers and sellers achieve during economic exchanges, offering insight into how efficiently the market operates.

- What is a good example of producer surplus?

A farmer is willing to sell onions for ₹40 per kilogram. However, they end up selling them for ₹60. The ₹20 difference represents their additional profit. This happens when sellers receive more than they expected due to market conditions. It shows how producers can benefit when the actual selling amount is higher than what they initially planned for. This extra earning can encourage them to increase their output or maintain their current supply levels.

- What is producer surplus a level in economics?

When sellers receive more than the minimum they were willing to accept, the difference becomes their extra profit. This reflects how much better off they are from the transaction. It shows the advantage businesses gain when they sell at favourable rates. The gap between their expected earnings and the actual amount received highlights their financial benefit. This concept is essential in understanding how producers thrive in various market conditions.

- What is another name for producer surplus?

Another term for the extra earnings a seller makes is producer welfare. It refers to the financial advantage businesses get when they sell goods at prices above their lowest acceptable amount. This concept measures the benefit they receive from favourable transactions. It shows how well producers do when market conditions allow them to charge more than the minimum they were prepared to accept. It’s a key part of understanding how producers thrive in various economic situations.