The financial market offers various facilities to its traders. One of the facilities is allowing traders to settle their transactions in different ways that suit their needs the best.

Based on the time of delivering the security and settling the transaction, the financial market is divided into the spot market, the forward market and the future markets.

In this article, we will deep dive into the concept of spot market, its features and its relevance to traders.

Define Spot market

The spot market, as the name suggests, involves on-spot transactions. This indicates that the delivery of securities and the payment to settle the trade happen almost immediately.

The rate that rules the spot market is the spot rate or the spot price, which is the same as the current market price. Since the spot market deals with the immediate exchange of securities for money, it mostly deals with cash. Hence, it is also called the cash market.

What is spot trading?

The transactions that take place in the spot market are called spot trades. They refer to trades that require instant delivery of securities. The idea is that the transaction is settled “on the spot” or at the current market price, known as the spot rate. This makes spot trading different from futures or options, where the delivery is set for a future date.

While the term “instant” is often used, it doesn’t always mean same-day delivery. Depending on the asset being traded, settlement can take a couple of business days. Some spot trades settle at T+2 i.e., two business days after the trade date. So, the exchange of security and cash takes place two days after entering the trade.

One of the biggest benefits of spot trading is its simplicity. You’re buying or selling at the current market price without the complexity of future predictions or contract expirations. It’s perfect for traders who want quick, tangible results. But remember, since you’re trading based on real-time market prices, the risks can be high if the market moves against you.

You may also like: Futures vs. Options: Differences every investor must know!

How does the spot market function?

Let us understand the functioning of a spot market with a daily life example.

Assume that you are shopping for a book from an online website. You see that the book is priced at ₹250 and will be delivered to you the next day. You place an order, choosing the ‘cash on delivery’ option for payment.

The book gets delivered the next day, and you pay ₹250 in cash.

Now, while taking the delivery, assume that the book’s price has gone up to ₹275. Will the seller expect you to pay ₹275? Or will you be willing to pay the extra money?

No, you placed the order at ₹250 with an understanding to settle the transaction the next day.

So, ₹250 is your spot price. The date you placed the order is your trade date. The day of delivery is the settlement date.

Similar trades involving financial instruments like stocks, commodities, currencies, etc., that have an immediate (or almost i.e., T+2) delivery at spot price come under the purview of spot markets.

There are four exchanges in India that primarily deal with spot trades for commodities:

National Spot Exchange Ltd (NSEL), National Commodities and Derivatives Spot Exchange Limited, Reliance Spot Exchange Limited, and Indian Bullion Spot Exchange Limited.

Features of spot market

The spot market, also known as the “cash market,” is driven by the immediate exchange of financial assets, and this fast-paced nature brings certain notable features. Spot market transactions take place on stock exchanges, as well as on the OTC markets (Over-the-counter market).

Trades on the exchange are fully regulated by the stock exchange, ensuring transparency and fairness. However, trades on the OTC markets are not regulated. They operate with more flexibility, where the terms can be customized between the buyer and seller but lack stringent oversight.

Also read: OTC market – A beginner’s guide to decentralized trading

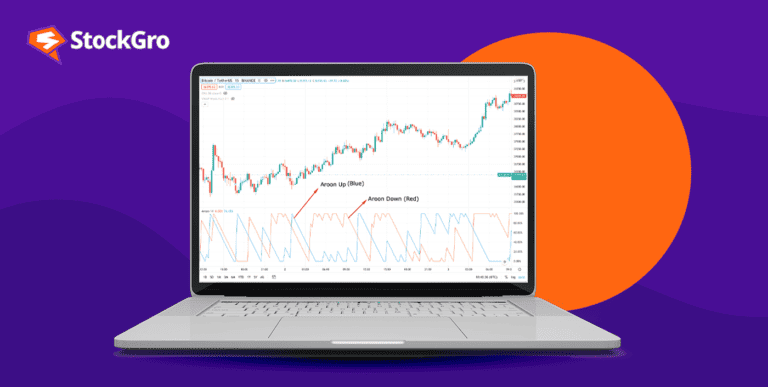

In either case, the spot price, delivery and settlement dates are the key features that distinguish spot market trades from others. A key element is the spot price—the current price at which assets are bought and sold for immediate delivery. This price fluctuates constantly, particularly in highly liquid markets, reflecting real-time supply and demand.

Furthermore, spot market transactions can involve various types of assets, from equities and commodities to foreign currencies. This versatility makes the spot market a critical component of global financial trading.

Advantages and Disadvantages of Spot Market

Pros of spot market trading:

- Trading in the spot market is transparent. Since it deals with current market prices, the possibility for one trader to defraud the other in terms of price is not possible.

- It allows taking immediate delivery of goods.

- While some contracts in other markets have capital requirements, the spot market is flexible and trades can be executed with minimum capital. If you’re investing on a budget then consider these top low cost investment options.

Cons of spot market trading:

- Market prices are prone to high degrees of fluctuations. So, it is possible that the market prices can be misleading at times. The spot market does not allow prices to settle after fluctuating, which may lead to losses for the traders.

- The spot market induces pressure on the traders to deliver almost immediately. While this feature may be favourable to the buyer, it may not favour the seller when the required quantity of securities is not arranged.

- Since the spot market offers a T+2 settlement, the risk of one party defaulting is high.

Spot Trade Example

Consider a jeweller in India who wants to import gold from Dubai for ₹50,00,000. He believes the current rate is ideal as the value of the Indian Rupee may reduce further against the UAE Dirham.

So, he enters into a spot contract with a trader in Dubai to buy gold at a spot price and settle the transaction in T+2 days.

The current exchange rate from INR to AED is 0.044. So, he spends AED 2,20,000 (50,00,000 * 0.044) to buy gold worth ₹ 50,00,000 and receives the delivery in T+2 days.

The current foreign exchange rate used to trade currencies is called the spot exchange rate. So, 0.044 is the spot exchange rate from INR to AED. Understand the advantages of foreign exchange market in India.

Spot market and forward market

The forward market is used across various securities but is significantly used in trading foreign exchange securities.

Forward markets involve trades where the delivery happens on a future date at a pre-determined price. While conceptually, it is similar to the future market, the major difference between the two is the trading platform. Forward markets involve future contracts in the OTC markets, whereas futures markets are part of the stock exchange.

Similar to spot markets, forward markets also deal with various financial instruments. The key differences between the spot and forward markets are the price and delivery date. The spot market uses the current market price and settles the trade immediately. The forward markets rely on pre-determined prices to settle the trades on a future date.

When traders enter into spot trades and forward trades to deal with currencies, they use spot and forward exchange rates. The spot price or rate has an important role in traders determining the price for forwards and futures contracts.

Also read: Forward markets – meaning, types and features

Bottomline

The spot market is a significant tool that maintains liquidity in the financial market. Since it involves the immediate movement of cash, it keeps the money flow active. It is also essential in determining the terms of other derivative contracts like forwards, futures and options.

Hence, it is essential for traders to thoroughly understand how the spot rates impact the financial markets.