Securities in the stock market are bought and sold at different prices. Spot price is one of them. It is a significant component of the stock market in general and the derivative market in particular.

In this article, we will understand the concept of spot price, its relevance in the stock market and options trades, and the difference between the spot price and other price variants.

What is spot price?

Spot price is the price prevailing in the market in which the actual securities can be bought and sold. As the name suggests, it deals with exchanging securities on the spot and the current market price.

Also read: The market value effect – how can it make or break your investments?

Significance of spot price in the stock market

The spot price is the current market price. It reflects the market sentiments of a security as market prices are primarily influenced by demand and supply factors. The spot price is also called cash price since it deals with on-spot settlement.

Stocks always trade at the spot price, i.e., the current market price.

The actual relevance of the term comes into the picture mainly for securities in the forward, futures and options market. Spot market prices are majorly used to hedge risks and speculate prices in options and future contracts.

Also read: Art of speculative trading

Consider the example of a farmer who grows grains and a wholesaler who sells them. The farmer speculates the spot price will reduce in a few months by the time of harvest. Similarly, the wholesaler expects the spot price to rise by the time of harvest.

So, both of them enter into a future contract to exchange grains on a future date at a pre-determined price.

The influence of spot prices on future contracts can be seen here. It is the basis for traders to enter into future contracts.

Spot prices have similar influence on contracts that deal with foreign exchange.

How is the spot price calculated?

Spot prices do not have any mathematical formula. There is more to do with economics than mathematics in establishing spot prices of securities. Demand and supply quantities of stocks, commodities, forex, etc., determine the spot price and how it will fluctuate in the future.

Take the example of gold, a popular security in the commodities market.

The Indian Bullion Jewellers Association (IBJA) publishes the gold rate in India every day. The IBJA considers the average of quotes by major players in the gold market to decide the daily prices of gold. The buy and sell quotes depend on the quantities of demand and supply of gold.

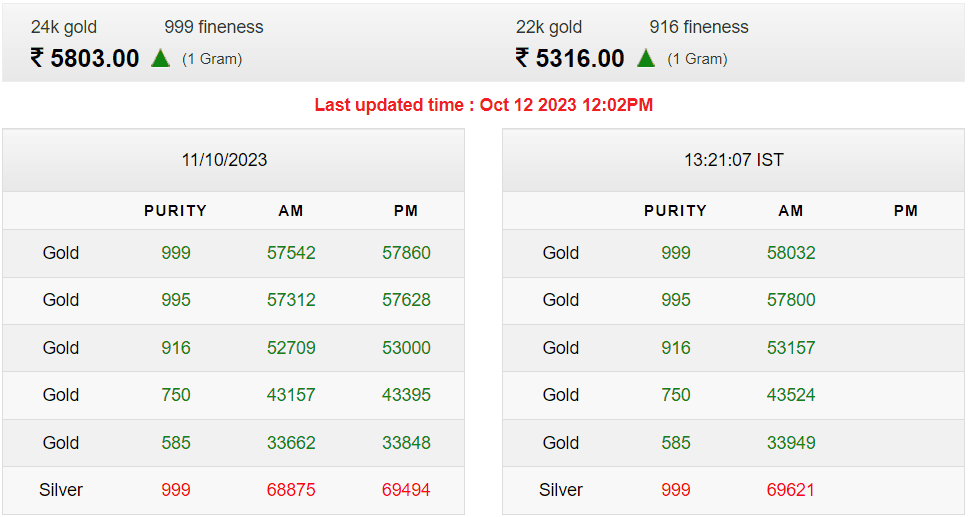

The spot price of gold as of 11th and 12th October 2023 are as follows:

The AM and PM columns represent the open and closing prices of gold on a particular day.

The difference between opening and closing prices on the same day is about ₹ 300, which suggests how fluctuating spot prices are.

Source: https://ibjarates.com/

Spot price vs strike price

Spot prices are relevant in option markets, as well. Options trades are derivative contracts whose prices vary based on the price of the underlying asset. The spot price in options determines the current market price of underlying assets.

Also read: How to trade options

The two critical components of options contracts are spot price and strike price. Strike price refers to the pre-determined price at which options contracts are entered into.

Let’s understand how spot price and strike price influence the execution of options contracts through an example:

The stock of company ABC is trading at ₹100 today. Trader A speculates the prices will increase to ₹150 in a few months. To benefit from the increase, he enters into an options contract today to buy the shares at ₹120 on a future date.

On the date of execution, if the spot price of the underlying asset increases to ₹150, Trader A executes the options contract and buys the asset ₹120. If the spot price does not increase and remains at ₹100, he cancels the options contract and buys the shares directly from the market.

So, the spot price of the asset is one of the key factors in deciding the execution of an options contract. The relationship between strike price and spot price can be determined based on the outcomes of an option contract:

- In-The-Money (ITM) – ITM is a scenario where the options contract is profitable to the holder of the options contract.

- Out-The-Money (OTM) – OTM represents a situation where cancelling the contract is profitable as against executing it.

- At-The-Money (ATM) – ATM is where the option holder does not make any loss or gain by executing or cancelling the contract.

Moneyness | Relationship between strike price and stock price | Interpretation |

In-The-Money | Call option: Spot price > Strike price | Buying the security by exercising the options contract is profitable since the actual market price is higher. |

Put option: Spot price < Strike price | Selling the security by exercising the options contract is profitable since the actual market price is lower. | |

At-The-Money | Call/Put option: Spot price = Strike price | The price of the contract and the market price are almost the same, so there is no impact of executing or cancelling the contract. |

Out-The-Money | Call option: Spot price < Strike price | Cancelling the options contract is profitable as the market price to buy the security is lower than the options contract price. |

Put option: Spot price > Strike price | Cancelling the options contract is profitable as the price to sell the security in the market is higher than the options contract. |

Bottomline

Spot price is hence an essential component in the stock market. Given the significance of this factor in futures contracts, it is necessary for traders to understand this concept well and know how to speculate future prices based on the current spot price. Though the spot price of securities is prone to high levels of fluctuations, it is a useful tool in hedging the risks of trading in the stock market.