One cannot emphasise the value of a well-written trading plan. A well-thought-out trading plan offers a road map, directing decisions and activities among the often shifting economic conditions, market mood, and world events. Your success as a trader depends on your capacity to precisely and foresightedly negotiate the complexity of these markets using appropriate techniques. Spread trading is a trading strategy for using market inefficiencies to your benefit. Find out how spread trading operates and apply it properly in your trading.

Also Read: Tips for Selecting Stocks for Intraday Trading

What is spread trading?

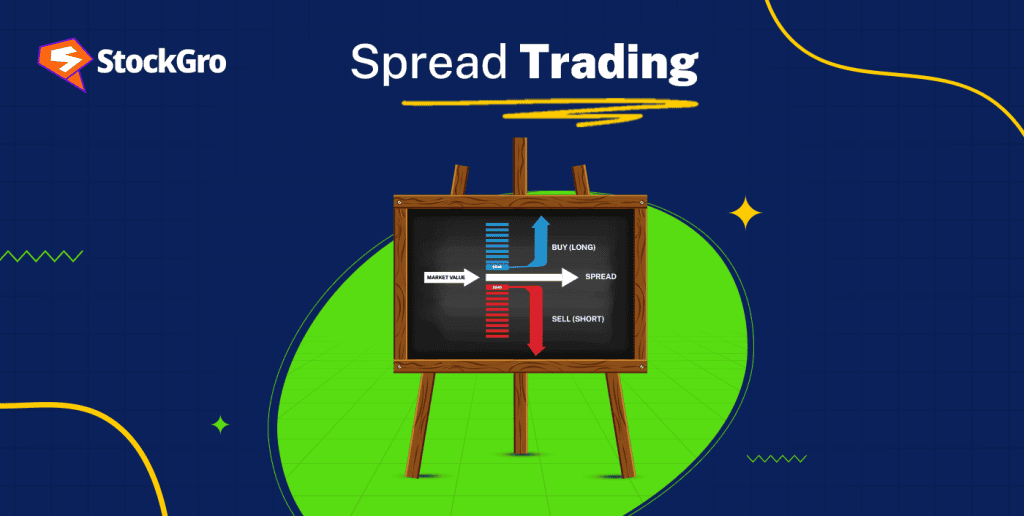

Spread is what separates the bid—buying price—from the ask—selling price. Knowing what a spread trade is helps you to assess your whole deal cost or profit. Under spread trading, traders seek to profit on the price differential between two or more linked assets traded on the exchange. Among these assets are equities, commodities, indexes, and more. Under this trading approach, the trader minimises spread market risk by trying to profit from upward and down price movement.

Strategy and purpose of spread trading

Spread trading gives the investor a net position with a value (or spread) depending on the price difference between the sold securities. Usually, the legs are exchanged as a unit on futures exchanges rather than independently.

Investors want to profit from the spread as it gets bigger or narrows down. Spread trading allows investors to focus on profiting from the price difference between the legs rather than relying on direct price fluctuations of the individual components. Whether the investor thinks he will gain from a larger or smaller spread depends on his needs.

Types of spread trading strategies

The following are the typical forms of spread trading given in lay terms:

- Intermarket Spreads

Traders create spread transactions by buying and selling similar assets on several stock exchanges, such as NSE and BSE. They might trade, for instance, the shares of the same company that both exchanges list.

- Intracommodity Spreads

This is trading futures contracts for the same commodity with different expiration months. One trader might buy a near-month contract, for instance, then sell a later one.

- Intercommodity Spreads

These spreads trade two related but separate commodities. One might trade silver futures against gold futures, for instance.

- Calendar Spreads

Handling futures or stocks of the same commodity or asset, traders deal with different expiry dates. They might acquire a contract expiring soon and then sell one expiring later.

- Options Spreads

Options contracts let traders build spreads. These could be vertical spreads—buying and selling options at different strike prices—or horizontal spreads—variations in expiry dates.

Also Read: How to Trade Nifty Options Intraday: Effective Tips and Strategies

Advantages of spread trading

In the Indian markets, this kind of trading benefits traders. A few among them are:

- Reduced market direction risk: Price differences make traders profit regardless of the spread market’s direction.

- Hedging possibilities: Strategies based on spread can help to offset possible losses in existing holdings.

- Capital efficiency: Some spread trade could be capital efficient since some spreads could demand a smaller margin than straight positions.

- Diversification: Traders can diversify their portfolios by adding other assets or contract months on an exchange.

- Possibility of constant gains: Traders could create consistent and predictable returns under stable market conditions.

Risk associated with spread trade

One should consider several risks and factors before starting spread trading. The following are the risks and factors of reference related to this trade:

- Market volatility: Losses may be large if quick and unanticipated spread market swings are not properly controlled.

- Liquidity risk: Certain trades might affect trade execution and pricing by including an illiquid asset or contract on exchange.

- Timing of execution: The trade should be executed precisely to catch favorable price variations.

- Margin requirements: Negative spread movement could result in margin needs, which calls for more cash.

Factors Affecting Spread Trade

Spread trade depends on several elements. Here are the main ones:

- Market conditions: The spread is usually limited in favorable conditions when numerous high buyers and sellers are present. The rationale is that buyer and selling competition rises when the market is dynamic with many players. This results in closer spreads. Conversely, spreads could expand amid the low market activity since fewer players mean.

- Liquidity: The spread is narrow in the market when there is great liquidity. High liquidity indicates a market in which more transactions take place actively. Usually, this transaction produces a lower bid-ask spread. On the other hand, less liquidity results in wider spreads since less trade is involved.

- Volatility: Spreads expand in high volatility and narrow in low volatility. Great market volatility results in uncertainty and risk, which forces market players to expand their bid-ask spread as a means of risk offset. The spread is limited in low volatility since market circumstances are considered constant.

- Political factors: The spread becomes more extensive due to political uncertainty resulting from conflicts, policy adjustments, or elections. Political developments provide market uncertainty that forces traders to change their risk tolerance. The market participant could want a larger spread to control the perceived risk related to political elements as the market uncertainty grows.

- Economic factors: Wider spreads could result from occurrences suggesting economic instability or depression and from economic indicators. Under these circumstances, investors show more risk aversion and help widen bids-ask spreads.

- Creditworthiness: The gap is greater and narrower when an issuer with bad creditworthiness distributes debt instruments. This is true because the perceived risk connected with the issuer’s securities depends on their creditworthiness. Investors who want to offset the risk could seek a larger spread for securities issued by companies with bad creditworthiness. Conversely, securities issued by creditable companies could have a limited spread.

Also Read: Choosing the Best Date for Your SIP Investments

Conclusion

Sometimes investors choose the spread trade to help lower their risk as much as feasible. They can define risk and offset it with their alternative security of preference. Spread trading lets the investor benefit depending on the difference between the prices of the two futures or options. However, since one has to choose two securities with an intrinsic link between them, careful study must go into the two futures or options one uses in the spread trade.

FAQs

- What does spread mean in trading?

The spread in trading is the variation between buying and selling values. It describes this price difference in stocks. Between bonds, it denotes variations between two security yields. While forex traders concentrate on currency pair spreads to discover trading opportunities, options traders use spreads to build superior risk management techniques. Analyzing transaction expenses and possible profitability across different trading instruments depends on an awareness of spreads.

2. What is spread trading strategy?

Spread trading is a common tactic on Indian exchanges like NSE and BSE. To profit from price variances, one buys and sells comparable securities or contracts at once. Profit from the spread is the aim, not depending just on price changes of individual assets. This approach can lower risk and maximise earnings in equities, commodities, FX, and derivatives markets. Traders looking for balanced exposure in uncertain environments find it preferred.

3. What is a good spread in trading?

Usually, a healthy spread runs from zero to five pips. This spectrum strikes a balance, therefore benefiting traders as well as brokers. A smaller spread usually indicates low volatility, more investor confidence, and improved market stability. For instance, the volatility 10 index reflects economic certainty by stressing little market movements. Monitoring spreads is vital as narrower spreads save transaction costs and improve profitability, particularly in fast-moving markets where quick decisions can greatly affect gains or losses.

4. Is spread trading profitable?

Spread trading can be profitable since it lets traders earn from rising or declining markets. One can lessen the effect of market volatility by emphasizing price variations instead of specific asset values. Spreads let traders use hedging techniques and diversify their risks. This method attracts experienced traders and newcomers looking for more predictable changes in unpredictable markets since profits result from precisely predicting spread changes.

5. How much spread is normal?

A regular spread, usually spanning one to five pip, varies depending on the market’s state. Depending on volatility, liquidity, and economic developments, it could narrow or expand. Closely monitoring spreads is crucial since they influence possible gains and trading expenses. Profits in speculative trades have to be more than linked costs and spreads. Managing risk and optimising profitability in active markets depend on an awareness of these characteristics.