In the world of options trading, zero loss options strategy can be made with periods and both call and put options to create a spread that would not only provide profit but also give protection from any downside of the value of the underlying stock.

What is a zero cost collar?

As the name suggests, the zero cost collar or costless strategy is to zero down on the options premium paid for the strategy. To reduce the risk, the trader purchases ‘puts’, which are out-of-the-money and sells the underlying stock at a predetermined price. However, these puts have a premium which is the cost to purchase and maintain them. This premium cost can be offset by selling an “out-of-the-money” call at a price to offset and cancel out both contracts.

You may also like: Index Options: Understanding its types and function

Use of zero cost collar

This strategy is most useful when the “put” option is along with an “out-of-the-money” covered call. The premium received in the “call” option is the same as the premium paid in the “put” option. This “collar” is used as protection in long positions.

- It is essential to understand that while this strategy will limit your downside risk, traders should be ready to have less and limited upside gains. Applying this strategy limits the gains on a stock’s earning potential.

- It is essential to note other charges, such as bid-ask differences, trading charges and other taxes. They add to the overall cost of the trade.

- The zero cost collar trade is one of the most complicated types of options trading. Hence, traders should attempt it only if they have the time to monitor this market movement.

Zero cost collar example and diagram

A trader owns 100 shares of ABC company and trades at Rs 50 per share on the exchange. He wants to avoid any fall in the value of this portfolio, so he purchases a “put” option with a strike price of Rs 45 and sells a “call” option with a strike price of Rs 55. Thus, when the stock price falls to Rs 45, he can exercise the put option at Rs 45, but if the stock rises, his upside is limited to Rs 55.

How will the options P&L move?

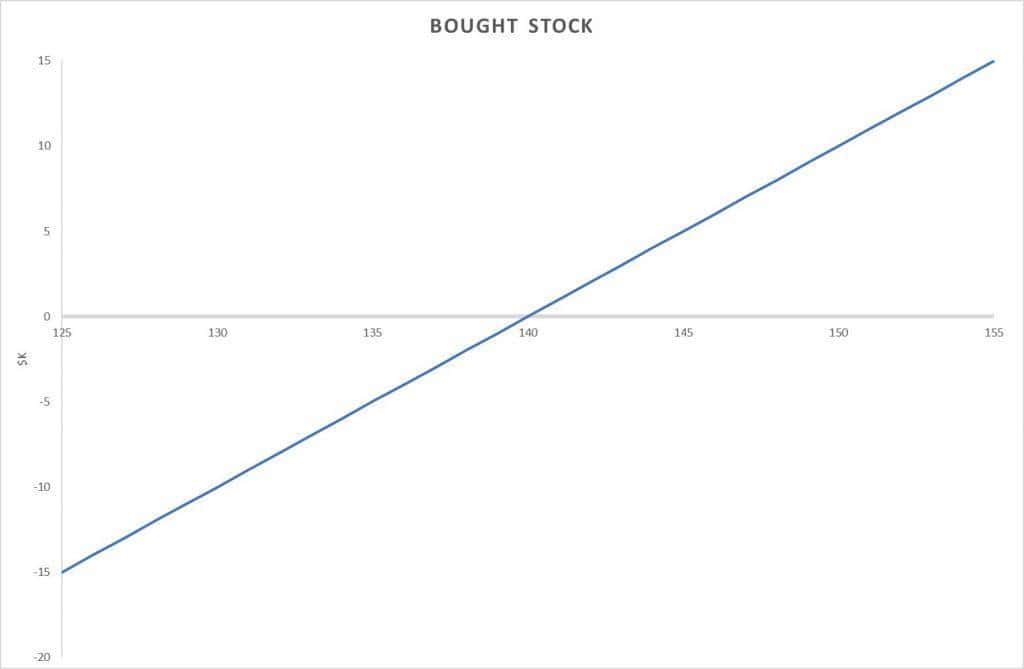

Let us see the diagrammatic representation of the trades with an example. If a trader purchases 100 shares of ABC company trading at Rs 140 per share, the P&L looks like the following –

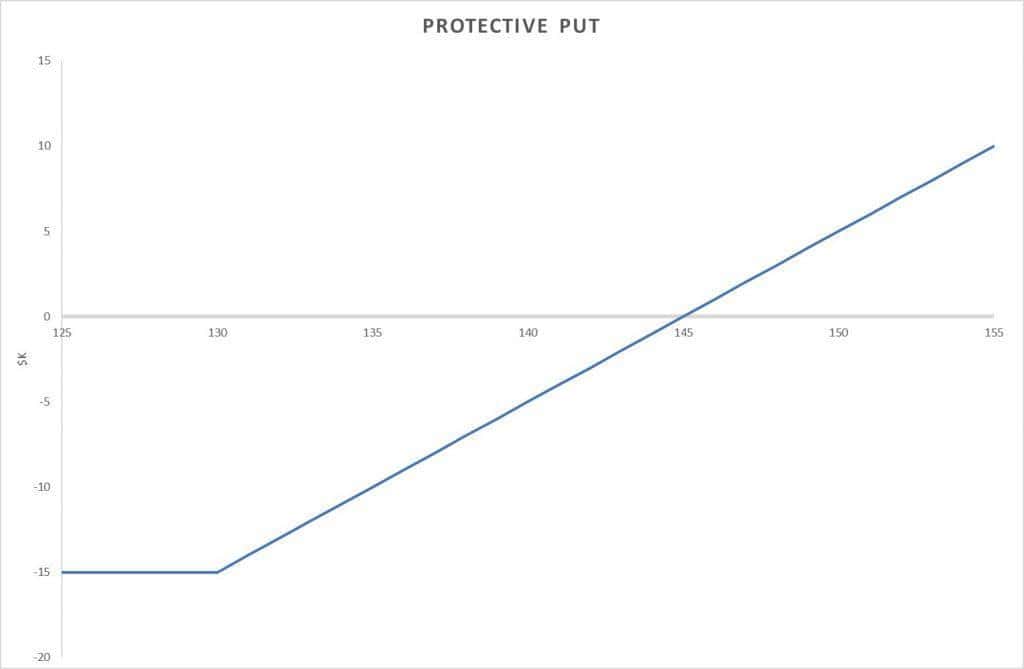

The trader can decide to limit the risk by buying 130 “put” options at the price of Rs 5 per share.

The new P&L will look at follows –

While the stock falls below Rs 130, it will limit the loss to Rs 15. But the Rs 5 “put” premium has caused the position’s breakeven to rise from Rs 140 to Rs 145. Thus, for the cost of option protection to work, the stock value has to rise from its current Rs 140 to Rs145.

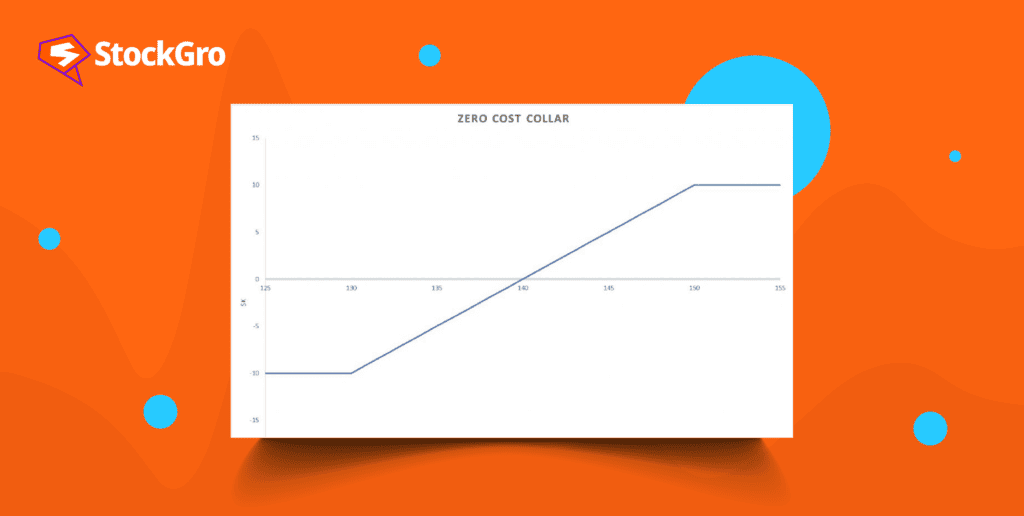

The trader can overcome this cost by selling an “out-of-the-money”150 “call” option for Rs 5.

This opposing trade will offset the purchased “put” option cost. The flip side to this is the rise in stock price above Rs 150 will not be of any use.

This is a “zero cost collar” with both loss and gain limited to Rs 10.

Also Read: How to trade in options and maximise your profit?

Benefits of zero cost collar

The primary benefit of this strategy is protecting a stock’s loss potential at zero net cost.

This strategy helps employees with vested stocks accessible after a few years only to protect valuation. Using zero cost collar the employees can help offset the future fluctuation in price within a small price range.

This strategy will still allow the trader/investor to keep accumulating dividends, unlike other option strategies.

Disadvantages of zero cost collar

This is a cashless mechanism to lower risk with zero to low gains with an opportunity cost. The decision of length of time to keep the collar in place is also a tricky one. It involves the use of knowledge about market movements of the stock and awareness of any important related happenings.

The main disadvantage is the limited gain potential of the stock position once a collar has been put on. It is a complex spread with two option positions with each of its trading costs and premiums.

One practical limitation is that the premiums of appropriate puts and calls will normally not be as equal as our example. The out-of-the-money puts have relatively high implied volatility, thus affecting the price and cost of the position.

Also Read: At-the-money options: A beginner’s guide to trading options like a pro

Should you use a zero cost collar?

It is a great strategy to customise depending on an individual’s risk capacity and investment goals. The limits of the collar can be with a wide range if you are a conservative trader and if you wish to go aggressive, you can take a narrow range. This strategy can also be combined with other trades – protecting long-term investments while indulging in short-term risk-taking.

Things to Consider Before Using the Zero Cost Collar Strategy

When it comes to options trading, the zero cost collar strategy can be a powerful tool for limiting potential losses, but it’s crucial for you to consider many key factors before implementing it. Here’s what you should keep in mind before using the zero cost collar strategy:

Risk tolerance and investment goals

The zero cost collar is a conservative strategy and it is ideal for traders who are looking to reduce downside risks. This method is especially useful if you have a low-risk tolerance or are aiming to protect your long-term investments.

However, this strategy also limits potential gains and it may not be suitable for you if your investment goals involve higher returns. You must ensure that this approach aligns with your financial objectives.

Market conditions and stock volatility

The performance of a zero cost collar strategy depends on the volatility of the stock and market conditions. When volatility is high, put options may be priced higher due to increased demand, potentially impacting the “zero cost” aspect.

Also, if market conditions shift significantly, such as during economic downfalls, a collar may limit your losses, but it could also stop you from capitalising when the stock value bounces back. You should research current market trends and volatility levels to help decide if the strategy fits your financial goals.

Understanding of bid-ask spreads and trading costs

While theoretically zero cost, this strategy comes with bid-ask spreads, brokerage fees, and other trading charges that may affect your profitability.

Trading costs can vary and these factors may add up, impacting your trade’s overall benefit. Make sure that you are mindful of these charges and how they might influence your returns over time.

Length of time to keep the collar

Choosing how long you want to maintain a collar position requires you to carefully consider your market outlook and stock’s movement. A short-term collar may protect against temporary dips, while a long-term one is suitable for conservative, longer-term investments.

However, keeping the collar in place too long may also limit potential profits if the stock appreciates over time.

Conclusion

While option spreads are commonly used – knowing where to minimise costs is a great asset in building a successful options portfolio. The zero cost collar is a complicated yet much-needed quiver in the arsenal of an options trader to create multiple combinations of strategies.