One of the most crucial reasons for India’s development is its strong and developing infrastructure. A better infrastructure facilitates easy business, better transportation, improved public places, etc. All this infrastructure is the product of high-quality raw materials produced in the country.

India’s power to become the manufacturing powerhouse lies in its raw material industry. One such raw material needed almost everywhere is – Cement. The product is required from an individual building his/her house to an MNC building its new expansion.

Construction experts usually have a strong preference for which cement to use as it is the binding element for any structure. Thus, there is fierce competition in this sector. Let’s explore in detail about this crucial industry and its two mega giants- ACC Ltd and UltraTech Cement Ltd, in this article.

The cement industry

In recent years, as the per capita income has grown, the housing need has also experienced a rise. Preference for the rural settlements of better housing, government schemes like Awaas yojanas, and the plan for nearly 98 smart cities in the nation have fueled this growth of the cement industry.

The cement is mainly manufactured in Rajasthan, Madhya Pradesh, Chhattisgarh, Odisha, Tamil Nadu and Andhra Pradesh. As of FY 23, the Indian cement-producing capacity in the country is divided as follows:

- South India – 32%

- North India – 20%

- Central India – 13%

- East India – 20%

- West India – 15%

Being the second largest cement producer in the world, India’s demand for raw materials grew by 9% in FY 24. This core raw material industry has a massive market size of 3.96 billion tonnes. Moreover, in 2025, the industry is expected to grow at 6-7% CAGR.

Check this out: Exploring Cement industry in India: A comprehensive overview

Company overview

The cement industry is oligopolistic due to some key players at the national (spanning to international) level and some locally organised but lesser-known brands. The top 4 companies in the cement industry are:

- UltraTech Cement

- ACC- Ambuja Cement

- Shree Cement

- Dalmia Cement.

Rest are different companies with sales in particular regions or markets. India’s cement production capacity is 374.55 million tonnes per annum (MTPA) as of FY 23.

ACC Ltd

It is part of the Adani group under the Ambuja cement cluster, which includes Ambuja Cement, ACC and Sanghi Cement. The full form of ACC Ltd is Associated Cement Companies Limited. In 1936, when ten cement companies came under one umbrella, the ACC Ltd was formed. In FY 23, the company produced 8.8% (33.08/374.55) of the total cement produced in the country.

Products of ACC are as follows:

- Cement: Gold (ACC water shield cement, ACC concrete + extra strong), Silver (ACC Suraksha Power, ACC HPC long life)

- Ready-Mix Concrete: ACC ECOMaxX, ACC PERFORMaxX

- Construction Chemical: LeakBlock Cement Mix, LeakBlock Cement Coat

- Dry-mix Range: Retail, Institutional customer

It has a presence in over 7 states in India, with a production capacity of 38.55 MTPA. The company caters mainly to domestic needs. Moreover, the strength of other brands gives an edge in raw material availability and a strong customer network.

UltraTech Ltd

It is the largest company in the country, with a production capacity of more than 100 MTPA (Only in India). The company is a significant part of Aditya Birla Group of Companies. In FY 2023, the company produced nearly 35.8% (134.38/374.55) of the cement in the country. Its products are as follows:

- Grey cement: Portland cement ordinary and varieties

- White cement: Wall care putty

- Ready-mix concrete: 24 speciality concretes

- Building products: Waterproofing, dry mix mortars

Apart from India, it spans countries like Bangladesh, Bahrain, Sri Lanka, and the United Arab Emirates (UAE). Moreover, the recent acquisition of a 23% stake in India Cements, provides it a strategic edge over other companies in the industry. The company has a production capacity of 140.8 MTPA as of FY 24.

A recent development must read: UltraTech Cement’s bold move: A 23% stake in India Cements.

ACC Ltd & UltraTech Cement Ltd financial performance (FY 2023-24)

| Particulars (Amount in ₹ Crore) | ACC Ltd | UltraTech Cement Ltd (domestic only ) |

| Revenue from Operations | 19,958.92 | 71,240.60 |

| EBITDA Margin | 17.8% | 19.1% |

| PAT Margin | 11.7% | 9.83% |

| Net worth | 16,330 | 60,228 |

| Earnings Per Share | 124.42 | 242.93 |

| Return on Capital Employed | 17.27% | 15.26% |

| Debt to Equity Ratio | 0.02 | 0.19 |

- Revenue from operations

The revenue of UltraTech Cement is very high compared to ACC due to its wide product range, network and strong market position.

- EBITDA Margin

Its full form is earning before interest, tax, depreciation and amortisation margin. It indicates a company’s efficiency in earning profit from its revenue. UltraTech Cement already has better revenue, which in turn also increases its margin, compared to ACC.

- PAT Margin

It is the final profit after tax margin, indicating the final clean profit margin of the company. The ACC has a slightly higher margin which is a good sign for a company in a growing stage.

- Net worth

The net worth is the sum of equity and reserves & surplus. It indicated the company’s value after paying all of its obligations. The net worth also indicates the size of the company. Ultratech has a comparatively higher net worth than ACC.

It is the total earnings divided by the total number of shares outstanding. Ultratech has higher EPS owing to better earnings, along with a higher number of shares.

A manufacturing company needs better ROCE. The ratio is calculated as total earnings divided by the average capital employed. So, the ROCE indicates how much of earnings is invested back into the company’s capital. The ACC has this ratio higher than UltraTech Cement, which shows that to grow its scale, considerable investment is made in its capital. This investment also eliminates the need for debt to a certain level.

This ratio indicates the capital structure (proportion) of a company. Usually, this ratio can be 2 – debt is twice the equity. More than this level indicates excess debt exposure. Here, both the companies – ACC and UltraTech have this ratio at satisfactory levels.

ACC Ltd & UltraTech Cement Ltd Stock market performance

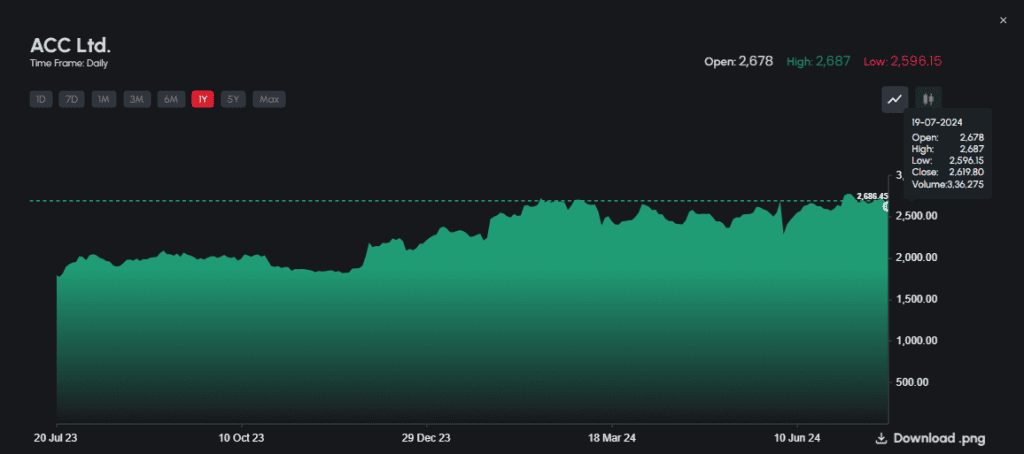

ACC Cement share price (NSE: ACC, BSE: 500410)

The ACC share price is trading at ₹2619.8 as of July 19, 2024. The 52-week high of ACC Cement share rate is ₹2844, while the 52-week low is ₹1762.5.

The stock price-to-earnings ratio (P/E) is 22.8, which is comparatively lower than the industry average, indicating ACC share price target is higher than the current price. However, the stock is trading at nearly 3 times its book value. The return on equity (ROE) is 14.2%.

Also, read: Cementing Success: Adani Group’s Journey to Capture 20% Market Share by FY28.

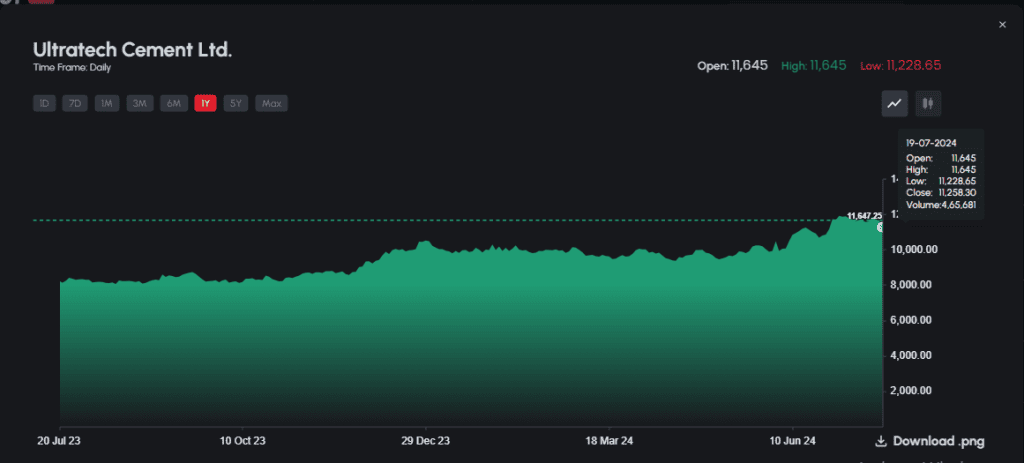

UltraTech Cement share price (NSE: ULTRACEMCO, BSE: 532538)

The UltraTech Cement share is trading at ₹11258.3 as of July 19, 2024. The 52-week high of UltraTech Cement share rate is ₹12078, while the 52-week low is ₹7987.65.

The stock price-to-earnings ratio (P/E) is 46.7, comparatively higher than the industry average. However, the growth and volume are the reasons for the high P/E in this stock. Its price target may increase over time. The stock is trading at nearly 5.5 times its book value. The return on equity (ROE) is 12.3%. The UltraTech Cement share price target shows investor’s confidence in the cement industry.

Bottomline

The growth of the cement industry indicates that development is getting a better push from the country. Moreover, the companies – ACC Ltd and UltraTech Ltd are some of the most popular and crucial brands in the industry.

Both companies have their respective moats. ACC Ltd gets support from Ambuja Cement and Sanghi Cement, a better network and a classic product line. However, UltraTech is the largest company producing cement at humongous levels, spread across several countries and has strong financials. It has a comparatively larger structure than ACC Ltd.