It’s time for a revolution in the digital space of India!

The Adani Group, an empire renowned for its ports, energy and infrastructure supremacy, is now targeting a fresh market of online payments and e-commerce. This seems to ramp up competition with other industry bigwigs like Google and Reliance Industries.

This article focuses on analysing Adani’s foray into the digital payments space, its potential consequences, and the plans for this industrial behemoth.

About Adani Group

Adani Group, headquartered in Ahmedabad, is an Indian multinational conglomerate with ten publicly traded companies. Gautam Adani started the conglomerate in 1988, originally as a company trading in commodities.

Today, Adani Group’s company list ranges from electricity generation and transmission, sea and airport management, food, mining, natural gas, infrastructure and weapons. Over the years, the Adani group has become a leading company in transport logistics and energy utilities in India, with a focus on developing large-scale infrastructure projects.

Adani is known for its rapid expansion through strategic acquisitions; it has always sought to diversify its portfolio and exploit emerging opportunities. Having established a strong presence in infrastructure and utility services, the corporation now looks forward to strengthening its position within the rapidly growing digital payment ecosystem.

Also read: Everything you need to know about payment banks in India

Adani One: Adani leaps into digital payments

What is Adani’s weapon of choice? The app named “Adani One” perfectly fits the description. Presently being offered as a travel service, this app is set to grow into an all-inclusive digital payment platform.

- In recent Adani Group news, the conglomerate is said to be in discussion to acquire UPI (Unified Payment Interface) licence, which would allow its seamless integration with India’s widely used online transaction network.

- In addition, the company has engaged in talks with banks to complete previous plans for its own credit card.

- The group is also in talks to provide online shopping services through India’s rapidly expanding, government-supported Open Network for Digital Commerce (ONDC).

UPI and ONDC are components of India’s digital public infrastructure, which draws in hundreds of millions of users each month. This infrastructure has gained popularity among competing groups looking to establish their consumer tech companies.

“Interoperable” networks allow companies to use other providers for payments or online sales, so they don’t have to create their own systems.

However, there are Google and Walmart-supported PhonePe payment apps that are heavily relied upon by masses that use UPI payment gateway. Plus, ONDC enables Paytm and Tata to offer grocery or fashion shopping through its platform.

Once the group gets the licence, they will offer e-commerce and digital payment services through their consumer app, “Adani One”, which was introduced in late 2022. At present, the app offers services related to travel, like booking hotels and flights. Shortly, it will also become a complete solution for digital payments in India.

In light of the recent Adani Group news, many investors are closely watching the movement of Adani Group share prices.

Future plans

To achieve a seamless ecosystem, Adani Group plans to target the existing users of its diverse business portfolios, such as gas and electricity customers and airport travellers. Users can gain loyalty points by making duty-free purchases or paying their bills, which they can redeem for online shopping.

This strategy is perceived as a means for the company to take advantage of its large customer base to win a foothold in the fiercely competitive digital payments and e-commerce spaces.

Besides, there are plans by the company to embed NDTV’s news content on its app this year, which will improve user experience as well as expand the services offered.

These plans come as Gautam Adani seeks to overcome adverse issues and grow his firm into fast-expanding consumer-facing markets.

You may also like: Stock trading will never be the same: UPI’s game-changing move!

Adani’s recent controversies: From Hindenburg to Norway

However, Adani’s journey isn’t without its roadblocks. In 2023, Hindenburg Research accused the group of some financial irregularities. The claims were refuted vigorously by Adani Group, but it still damaged the company’s reputation.

The accusations led to a $150 billion drop in Adani’s listed stocks. Nevertheless, Adani Group’s shares have bounced back and recouped much of their losses.

Another hurdle emerged when the world’s largest sovereign wealth fund based in Norway, Government Pension Fund Global (GPFG) decided to exclude Adani Group’s port arm “Adani Ports & Special Economic Zone Ltd” as an investment in May 2024.

They mentioned “ethical issues” related to the sale of their port in Myanmar last year and a “lack of openness” as reasons for being left out.

These controversies illustrate challenges that need to be addressed if Adani makes a move into digital space.

Industry and peer comparison

The system for digital payments in India has significantly expanded over recent years. This growth is due to government efforts, more people using the internet and smartphones, and the rise in online shopping.

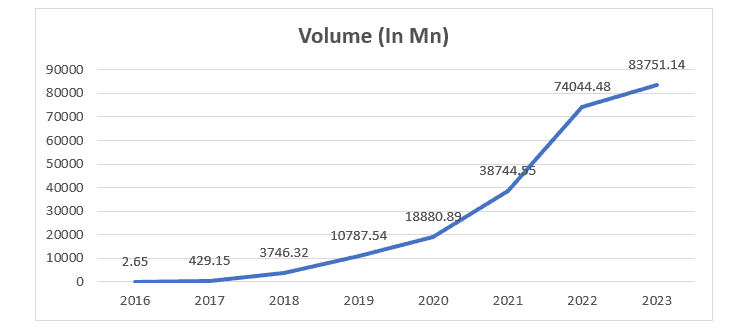

One noteworthy effort is the start of the Unified Payments Interface (UPI). Since the launch of UPI by the National Payments Corporation of India (NPCI) in 2016, it has grown a lot in India.

Must read: India’s UPI expansion and the call for local fintech empowerment

As digital payments grow, Adani Group will face more competition. Its move into digital payments and e-commerce will put it up against big companies like Reliance Industries, Google, Amazon, and Walmart.

Google Pay and PhonePe, supported by Google and Walmart, respectively, are already well-established in the digital payments market. Reliance Jio, part of Reliance Industries, has numerous users and offers many digital services.

Adani Group will need a robust plan and a unique offering to succeed in this competitive market.

Conclusion

Adani Group’s move into digital payments is set to be an interesting journey. Despite the challenges from controversies and existing big players, Adani’s history of rapid growth suggests it’s here to play for keeps.

Whether Adani One becomes a household name or stumbles in the face of competition remains to be seen. But one thing is clear – the fight for the future of digital payments in India is about to heat up.