On May 28, 2024, Aditya Birla Fashion & Retail Limited released its Q4 earnings. The company reported a year-over-year increase in topline revenue. Still, the quarter’s loss rose compared to the same time previous year.

These figures highlight the growth in certain areas and the financial pressures affecting the company’s performance. This blog aims to provide an analysis of Aditya Birla Fashion Q4 results, offering insights into the factors driving these outcomes.

Company profile

Aditya Birla Fashion and Retail Limited (ABFRL) is a major leaguer in our country’s fashion landscape. It operates under the larger umbrella of the Aditya Birla Group, one of India’s most esteemed conglomerates. ABFRL has solidified its position as the first billion-dollar pure-play fashion powerhouse in India.

ABFRL’s presence in India is extensive. It has 4,664 stores and about 37,205 multi-country outlets. Some of the most popular fashion labels in India, such as Allen Solly, Peter England, Van Heusen, and Louis Philippe, are owned by the firm.

One of the crown jewels in ABFRL’s portfolio is Pantaloons, a leading fashion retailer in India. Additionally, ABFRL’s international brand collection, showcased through The Collective, includes exclusive partnerships with globally renowned names like Ralph Lauren, Hackett London, and Ted Baker.

It also currently holds a strategic position in the ethnic wear segment through its brands, Jaypore, Tasva, and Marigold Lane. The brand collaborates with Sabyasachi, House of Masaba, Tarun Tahiliani, Shantnu & Nikhil, and other designers.

Lately, to cater to the digital-first market, ABFRL entered into a new brand called TMRW. The goal of this initiative is to create a pipeline of new brands that are geared towards the online retail market.

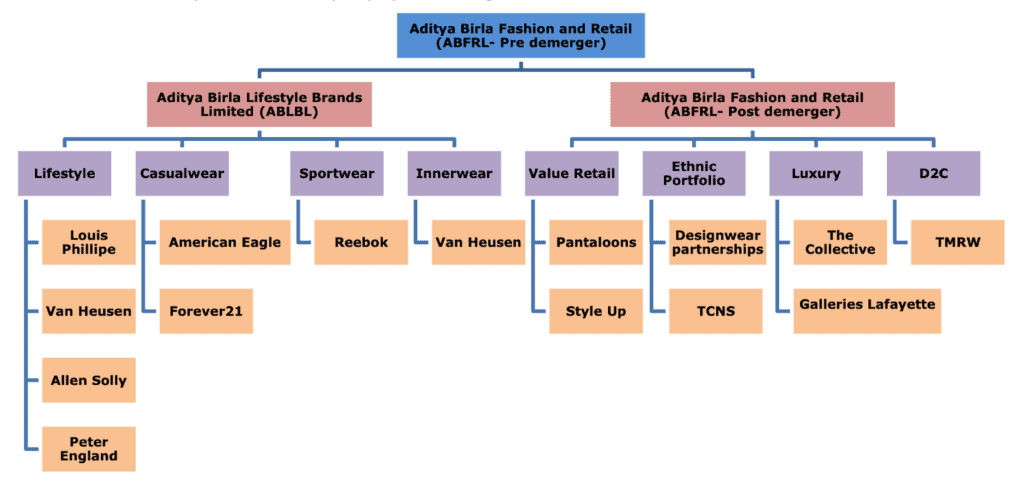

The board has approved the demerger of ABFRL’s Madura business into Aditya Birla Lifestyle Brands Limited (ABLBL), subject to obtaining the required regulatory clearances over the following nine to twelve months. By making this change, the companies hope to establish two independent growth engines with distinct capital structures and attract investors aligned with their unique business models.

You may also like: The Indian fashion industry: A booming sector with huge potential

What do Aditya Birla Fashion Q4 results say?

ABFRL reported an 18% year-over-year (YoY) increase in consolidated revenue for Q4. This growth was accomplished in spite of a slow market that presented difficulties due to persistently low discretionary spending.

The company saw its EBITDA margin expand by 300 basis points. Despite the revenue growth, net profit was affected by higher interest costs stemming from increased borrowings due to the TCNS acquisition.

ABFRL’s established businesses, such as lifestyle and Pantaloons, showed significant profitability improvement. EBITDA for these segments grew by 36% and 49%, respectively. Newer ventures, including TMRW, also contributed to growth. TMRW’s sales doubled, benefiting from both organic and inorganic growth.

| (₹ crore) | Q4 FY24 | Q3 FY24 | QoQ % | Q4 FY23 | YoY % |

| Revenue from operations | 3,406.65 | 4,166.71 | -18.24 | 2,879.73 | 18.30 |

| Total expense | 3,813.87 | 4,302.93 | -11.37 | 3,177.64 | 20.02 |

| Profit Before Tax | -314.14 | -84.91 | -269.97 | -828.90 | -62.10 |

| Profit After Tax | -266.35 | -107.60 | -147.54 | -194.54 | -36.91 |

Source: ABFRL Financial Results Q4FY24

Aditya Birla Fashion annual performance

ABFRL demonstrated solid performance in FY24. Consolidated revenue reached ₹13,996 crore, marking a 13% year-over-year growth.

The company continued to expand its ethnic wear segment, which more than doubled compared to last year. Additionally, TMRW, ABFRL’s digital-first brand initiative, saw sales increase by nearly 290% YoY. This highlights the company’s successful diversification and strategic investments.

The newly formed ABLBL achieved an annual revenue run rate (ARR) of over ₹8,000 crore. This entity focuses on profitable and cash-generating lifestyle brands and high-growth segments like youth fashion, innerwear, and sportswear.

The demerged ABFRL now has an ARR of over ₹7,000 crore, playing across high-growth segments. It includes major retail formats like Pantaloons and Style Up, the super-premium segment with The Collective, and a robust portfolio of ethnic brands generating over ₹2,000 crore in ARR.

| (₹ crore) | FY24 | FY23 | YoY% |

| Revenue from operations | 13,995.86 | 12,417.90 | 12.71 |

| Total expense | 15,075.09 | 12,623.64 | 19.42 |

| Profit Before Tax | -828.90 | -82.44 | -905.46 |

| Profit After Tax | -735.91 | -59.47 | -1137.45 |

Source: ABFRL Financial Results Q4FY24

Also read: Textile industry in India – The foundation of fashionable clothing trends

Aditya Birla Fashion share price performance

ABFRL has shown significant movement in its share price over the past year. As of May 29, 2024, Aditya Birla Fashion share has recorded a 52-week high of ₹297.8 and a low of ₹192.95.

When we look at the Aditya Birla fashion share price history, the company’s stock has provided a notable return of 52.21% over the past year.

Over a five-year period, Aditya Birla Fashion share has delivered a return of 44.30%, indicating consistent long-term value creation.

Current financials

| Metric | Value (as of May 29, 2024) |

| Market Cap | ₹ 30,427 Cr. |

| Book Value | ₹ 39.7 |

| ROCE | 0.40 % |

| ROE | -18.2 % |

You may also like: Grasim Industries unveil ambitious plans in the paint industry

Future outlook

ABFRL plans to take advantage of the expanding Indian clothing market, which is being fueled by favourable demographics and rising wages. The business has developed several high-growth platforms across a range of channels and sectors.

Even with the recent slowdown in consumer spending, ABFRL is steadfast in its long-term goal of creating enduring, powerful brands. The market for organised clothing is anticipated to expand at a double-digit CAGR, offering substantial growth prospects.

Bottomline

ABFRL has navigated a challenging market environment with notable revenue growth and strategic expansions. Despite increased losses due to higher interest costs, the company’s focus on profitability and diversification into high-growth segments like ethnic wear and digital-first brands has shown positive outcomes.

The recent demerger and creation of ABLBL aims to unlock further growth potential and attract targeted investments. Investors should monitor the company’s strategic initiatives and market responses as ABFRL continues to adapt and evolve in the dynamic fashion retail sector.