The food processing industry will always grow due to the unending need for more and more food varieties. However, people have less time today, and thus, they want instant food items. Also, people these days are paying attention to health since the pandemic. The food manufacturing industry is constantly affected by all these factors.

A food manufacturing company has been in the news recently- Agro Tech Foods Ltd. We all know the company by its popular brand – Act II popcorn. However, the news is a bit gloomy. The company’s consolidated net profit has dropped massively by 95% in the first quarter of FY 2024-25 on a year-on-year basis. Learn more about the company, its financials, and SWOT analysis in this article.

About Agro Tech Foods Ltd.

Movies and Act II popcorn have become close-knit. Also, the Sundrop brand for edible oil and peanut butter has gained popularity. The parent company producing these products is Agro Tech Foods Ltd.

It mainly deals with the trading and manufacturing of food products and edible oils. The company usually gives more attention to the crucial segment of ready-to-eat food. The company has a strong network of 460,000 stores, across the nation as of FY 23. Its products are mainly as follows:

| Category | Revenue share as of Q3 FY 24 | Products |

| Ready To Cook | 26.8% | Act II Instant PopcornSweet CornDiet Popcorn |

| Ready To Eat | 42.5% | Act II PopcornAct II Gift Box |

| Cereal Snack | 5.2% | Popz Centre FillsSundrop Heart Masala Oats |

| Chocolate Confectionary | 20.3% | Due PeanutDuo Gift Box |

| Spread and Dips | 5.1% | Peanut ButterChoco SpreadsDips |

| Staples | N/A | Edible oilsSundrop Heart Plain OatsSundrop Heart Almonds |

Source: Agro Tech Foods Ltd.

The Agro Tech Foods Ltd. has mainly three subsidiaries:

- Sundrop Food India Pvt. Ltd.

- AgroTech Foods (Bangladesh) Pvt. Ltd.

- Sundrop Foods Lanka Pvt. Ltd.

Must read: Agritech landscape in India: The amalgamation of agriculture and technology.

Agro Tech Foods Q1 results FY 25

The first quarter performance of the company, released on July 16, 2024, shows a substantial decline on a consolidated and standalone basis. Following are the updates:

- On a standalone basis, the sales revenue for the company has declined by 3.4% on a year-on-year basis. Similar is the state of consolidated sales revenue.

- The sales and advertising expenses have increased by 9.6%

- Apart from this, a key highlight is the decline in net profit over the last year. On a standalone basis, the decline was 98.9%, while on a consolidated basis, the net profit declined by 95.4%.

- Earnings Per Share (EPS) has dropped by 97.6% to ₹0.04.

- Compared to the previous quarter, the consolidated revenue has increased by 1.38%. However, its net profit has declined by a humongous 86.4%.

| Particulars(₹ Crores) | FY25 Q1 | FY24 Q4 | Change % |

| Sales revenue | 180.30 | 177.96 | 1.38 |

| Gross profit | 67.21 | 64.95 | 3.4 |

| Net profit | 0.20 | 1.48 | (86.4) |

Sources: Agro Tech Foods Ltd Financials Q1 FY 25

Financial performance

The company has had declining financial results for the previous two years. The net profit has been declining for the past two years by nearly 30%. This trend indicates weakness in the financial position. Moreover, its details and margin are as follows:

| Particulars (₹ Crores) | FY 2022-23 | FY 2023-24 | Change (%) |

| Sales revenue | 846.74 | 758.08 | (10.5) |

| Gross profit | 288.23 | 291.02 | 0.9 |

| Net Profit (NP) | 14.98 | 10.41 | (30.5) |

| NP margin | 1.7% | 1.3% | (23.5) |

| EPS | 6.25 | 3.98 | (36.3) |

| Net worth | 485 | 486 |

Sources: Agro Tech Food Ltd Annual Report FY 23, Q1FY25 Report

Also, read: Beat the market: Your ultimate guide for fundamental analysis tools.

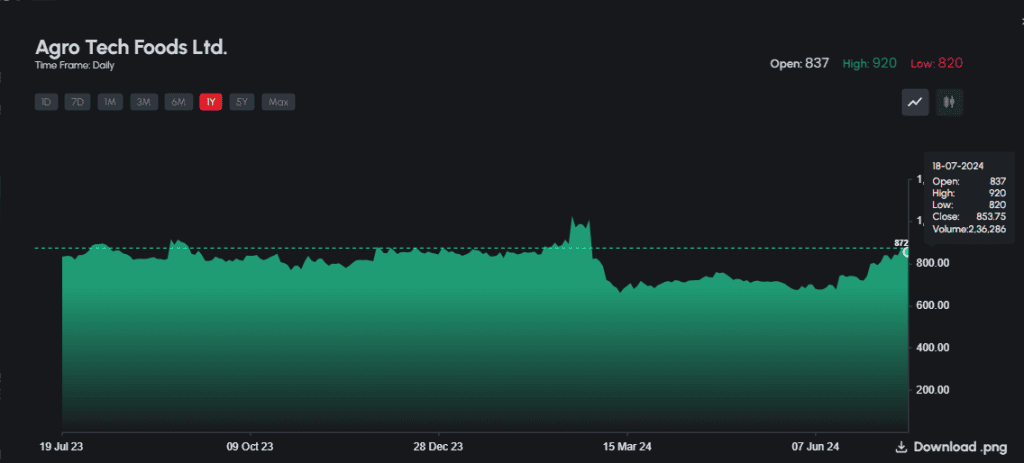

Agro Tech Foods shares performance

The share of Agro Tech Foods Ltd. (NSE: ATFL, BSE: 500215) is trading at ₹853.75 on July 18, 2024.

Source: Cogencis iINVEST

Agro Tech Foods’ share price history has been moderate, with nearly 0.16% returns. Its 52-week High is ₹1090, and its 52-week Low is ₹644.45.

As per a letter filed to SEBI on March 13, 2024, the promoter company Conagra Brands Inc. sold its 100% share of 51.77% to Samara Capital, Zest Holding, and Infinity Holdings at the rate of ₹515 per share.

The announcement was made on February 29, 2024, when the share price was ₹1006.95. Due to the discount, a sharp decline was observed on the following day, and the Agro Tech Foods share price target started falling.

Check this out! Hatsun Agro Q1 Results: A Detailed Look at the Recent Surge

SWOT analysis

Let’s compare the overall strengths, weaknesses, opportunities and threats of Agro Tech Foods Ltd.

| Strength | Weakness | Opportunity | Threat |

| Products have a strong market position in their respective category. For eg, the Act II popcorn and Sundrop edible oils. | Poor financials with constant decline in profits over the past two years. | Stock is in a good trend with moderate to low returns for the past few months. | Agro businesses remain in regulations due to edible oil exposure. |

| The interest coverage ratio is 12.4 times for FY 24, showing resilience. | Key ratios like return on assets (ROA) and return on equity (ROE) are declining trends. | Strong liquidity as cash and equivalents stand at ₹14 crores. | Manufacturing is a highly competitive industry, but the company has a declining return on capital employed (ROCE). |

| Strong support from parent company Conagra’s products like Act II popcorn. | High stock price-to-earning (P/E) ratio of 453 (as of July 19, 2024). Higher than the sector average. | Purchasing power is rising, and the company can expand into premium products. | The recent takeover of the shareholding of Conagra poses an issue. |

Bottomline

The overall position of the Agro Tech Foods share price and financials is currently weak. However, its unique products have a strong market position. The comprehensive analysis, along with Agro Tech Foods Q1 results of FY 25, presented above, evaluates the company in almost all aspects.