In Q4 FY24, APL Apollo Tubes saw a revenue rise of 8% to ₹4,765.7 crore, but net profit fell by 16% to ₹170.4 crore compared to last year. APL Apollo Tubes share also slipped by 1.65% post the result. This blog explores the financial details and strategic moves behind these results.

About APL Apollo Tubes

APL Apollo Tubes Limited is a major-league manufacturer of structural steel tubes in India. Founded in 1986 and based in the Delhi NCR area, the company has an installed capacity of 5 million tons per annum. This capacity is reinforced by 11 manufacturing units strategically set across the country.

The company proffers a myriad of products that include more than 2,500 varieties. APL Apollo’s products find ample applications across several critical sectors, including urban infrastructure, real estate, rural housing, commercial construction, and more specialised areas like greenhouse structures and engineering projects.

In terms of sales mix, the company’s offerings are predominantly ushered by Apollo structural products, which represent 65% of sales. Apollo Z products account for 29%, while Apollo Galv comprises the remaining 5%.

APL Apollo also maintains a rich distribution network, which is a linchpin of its business strategy. As of 9M FY24, the network comprises over 800 distributors and has grown to more than 50,000 retailers across India. This ample distribution system confirms APL Apollo’s presence in over 300 towns and cities nationwide, making its products easily obtainable to a broad customer base.

Also read: India’s billion-dollar infrastructure industry: How to invest in it?

Apollo Tubes Q4 Results

In the final quarter of fiscal year 2024, APL Apollo Tubes claimed a nuanced financial performance. The establishment’s revenue shot up by 8% year-over-year (YoY) and 14% quarter-over-quarter (QoQ), reaching ₹47.7 billion. The upsurge was reinforced by a 4% climb in sales volume, smashing 679,000 tons for the quarter.

Nevertheless, the profitability metrics faced some pressures. The net profit declined by 16% compared to the same period last year, sinking to ₹1.7 billion, though it observed a marginal increase of 3% from the previous quarter.

EBITDA remained flat QoQ at ₹2.8 billion but showed a decline of 13% on a YoY basis. The cost per ton also caught a drop, coming down to ₹4,132, which resulted in a decrease of 17% YoY and 11% QoQ. These figures depict some challenges in cost management and margin pressures that the company faced during the period.

Significant to the quarter’s narrative was the consequence of broader economic factors, including a slowdown in retail spending and the anticipation of general elections, which led to a dampened demand. To get through this, APL Apollo implemented strategic discounts to boost sales volumes, especially within its value-added product range like heavy structural steel tubes and coated products.

Despite these challenges, the company’s strategic initiatives, such as the expansion of its Dubai facility and the operational ramp-up at its Raipur plant, indicate a focused approach to maintaining production efficiency and expanding global outreach.

| (₹ crore) | Q4 FY24 | Q3 FY24 | QoQ % | Q4 FY23 | YoY % |

| Sales Volume (K Ton) | 67.9 | 60.4 | 12 | 65 | 4 |

| Revenue | 4765.7 | 4177.8 | 14 | 4431.1 | 8 |

| EBITDA | 280.4 | 279.6 | 0.28 | 322.9 | -13 |

| EBITDA/ ton | 413.2 | 463.1 | -11 | 497 | -17 |

| Net Profit | 170.4 | 165.5 | 3 | 201.8 | -16 |

Source: APL Apollo Tubes Investor Presentation Q4FY24

Also read: SBI Bank Q4 results – Analysis & highlights

FY24 earnings

For FY24, APL Apollo Tubes documented a notable shift across key financial indicators. The firm achieved a 15% YoY increase in sales volume, reaching 2.6 million tons. The surge in volume was a primary driver behind the revenue growth, which escalated by 12% YoY to ₹181.2 billion.

The company’s EBITDA also saw a positive trajectory, ascending by 17% compared to FY23 to total ₹11.9 billion. The EBITDA per ton also improved slightly by 2% YoY to ₹4,553. Net profit for the year followed a similar upward trend, growing by 14% YoY to ₹7.3 billion.

APL Apollo Tubes share price performance

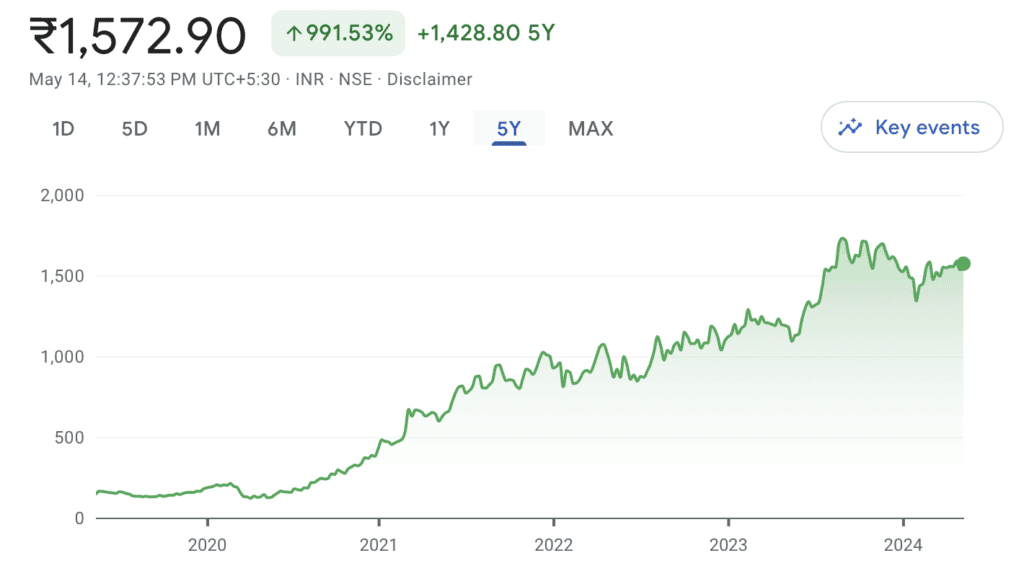

APL Apollo Tubes’ share took a slight drop of 1.65% to ₹1,509 following the announcement of its Q4 results. This movement reflects the market’s reaction to the company’s 16%YoY decline in profit after tax for the quarter. Despite this recent drop, the stock has shown robust growth over extended periods.

The company currently has a market capitalisation of ₹42,969.13 crore. It has seen significant fluctuations over the past year, with a 52-week high of ₹1,800 and a low of ₹1,047. Over the last year, the share price has increased by 36.53%, highlighting a strong upward trajectory despite periodic volatility.

Source: Google Finance

Looking at a longer timeframe, over the past five years in APL Apollo Tubes Ltd share price history, it surged by 991.53%. This substantial growth indicates strong investor confidence and a positive market reception to the company’s strategic initiatives and financial performance throughout this period.

Source: Google Finance

You may also like: Is Vibhor Steel Tubes IPO the next big hit in 2024? Find out!

Strength & weakness

Strength

- Continued revenue growth: In Q4, APL Apollo reported an 8% shove in revenue YoY. This constant growth in revenue indicates the company’s sturdy business model and market demand for its products.

- Strategic operational expansion: The commissioning of the new plant in Raipur and the expansion in Dubai are strategic moves that sweeten APL Apollo’s production capabilities and global footprint. These actions are likely to sustain long-term growth and facilitate access to new international markets.

- Diverse product range: APL Apollo’s scaling up of its product portfolio, including value-added products like colour-coated pipes and large-diameter tubes, lets it meet diverse consumer needs and tap into new market segments, potentially improving profit margins over time.

Weakness

- Profitability concerns: The company caught a 16% decline in net profit and a 13% drop in EBITDA YoY in Q4, echoing challenges in maintaining profitability. These figures extend concerns about cost management and operational efficiency amidst erratic market conditions.

- Vulnerability to raw material prices: APL Apollo’s profitability is highly liable to fluxes in steel prices, which can affect cost structures unpredictably. This dependency on raw material outlay adds a layer of risk, particularly in volatile economic climates.

- Competitive market pressures: The structural steel tube market is enormously competitive, with numerous players in both organised and unorganised sectors.

Bottomline

APL Apollo Tubes is overcoming various market challenges with strategic expansions and a diversified product portfolio. However, its profitability and cost management continue to be tested by external market volatilities and competitive pressures. As the company moves forward, it will need to balance growth initiatives with effective cost-control measures to maintain its market position and shareholder value.