In terms of consumers and production, India ranks amongst the topmost cotton producers globally. After agriculture, the Textile and Apparel Industry in India emerges as the second largest employer in India. By 2030 India will have reached $250 billion in textiles production and $100 billion in exports.

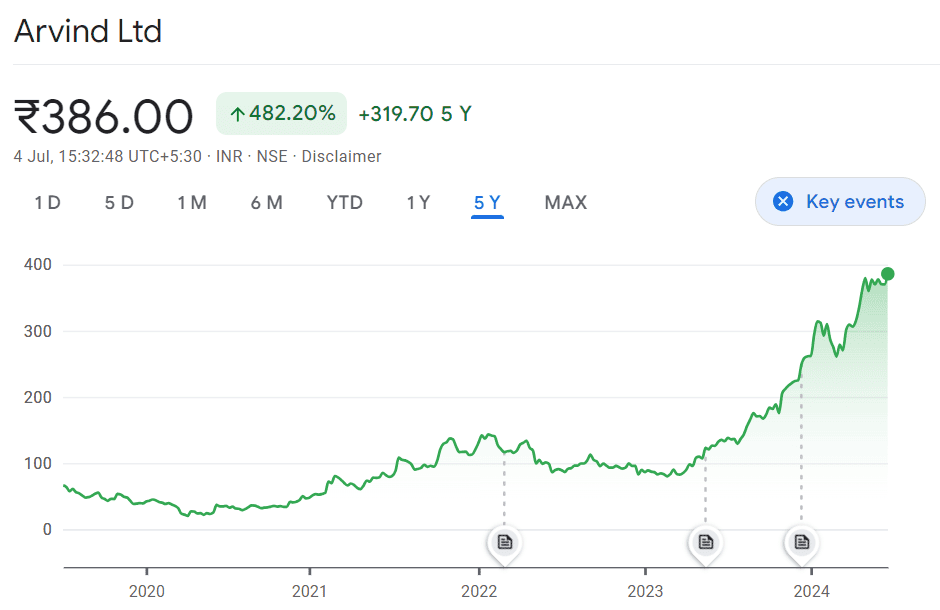

Recently Arvind Limited has been a major topic in the textile and apparel industry following a sharp rise in its share price culminating in a record high for 52 weeks. This good performance has also been supported by Phillip Capital commencing coverage on the stock with a ‘buy’ rating that expects an impressive 35% upside.

This article will look into what is driving this surge, analysis from Phillip Capital and future prospects of Arvind Limited that can be used by possible investors.

Also read: Textile industry in India – The foundation of fashionable clothing trends

About Arvind Ltd

Arvind Limited is a textile manufacturer based in India. It was earlier known as Arvind Mills and it serves as the leading company of the Lalbhai Group. Its headquarters are located in Naroda, Ahmedabad, Gujarat, India while its roots in the textile industry run back for almost eighty years.

Arvind is an all-round business empire that operates in various sectors. These include:

- Cotton shirting: Arvind creates excellent quality cotton shirting fabrics.

- Denim: Arvind is the first denim manufacturer globally and is renowned worldwide for its denim products.

- Knits: This company also specialises in knitted fabrics.

- Bottomweight (khaki) fabrics: The firm produces materials suitable for bottomwear such as khaki fabric.

The impact of Arvind extends beyond Indian boundaries. Through a subsidiary named Arvind Fashions, they oversee international apparel brands. Within its portfolio are brands like Tommy Hilfiger, U.S. Polo Assn., Calvin Klein, Arrow and Flying Machine among others.

This shows how much importance Arvind places on environmental solutions as it registers 22 global patents on them showing commitment to sustainability. Apart from this company being the biggest fire protection fabric maker in India

Arvind share price movement

On July 4, 2024, Arvind’s shares increased by more than 4% leading to a record peak of ₹398.80 per share for the year on BSE after being recommended by Phillip Capital.

In terms of stock-return performance over the previous five years, Arvind Ltd recorded a gain of 482.20%.

Phillip Capital’s coverage and analysis

Arvind’s Phillip Capital assigned a ‘buy’ recommendation on shares with a target price of ₹514.0 per share, which suggests that there is an upward potential of almost 35% from the previous close on Wednesday, July 3, 2024.

The company is poised to grow within textiles in its garments division. The division has witnessed a growth of 9 per cent during FY21-24 because of capacity constraints, and the new capacity will clocked at 25% growth between FY24-FY26E due to increased volume & improved realisation led by a better product mix.

Given the vertical integration and long-standing supply contracts with global retailers, Arvind could be the preferred player in the garment space.

Its debt-to-equity ratio improved from 0.7 times to 0.4 times for every rupee invested into equity. Also, it has done no meaningful capex in textiles said the domestic brokerage.

You may also like: Understanding the basics of the broking industry and its recent trends

Arvind Financial performance

Let’s break down the key points from the financial performance of Arvind Ltd. during FY2024:

- Revenue trends:

- Textile revenues: Arvind faced challenges due to high customer inventories and uncertain demand. Despite healthy volumes, textile revenues declined by 14% primarily because of decreased fabric volumes.

- AMD revenues: On the other hand, the advanced material division (AMD) witnessed growth. AMD revenues increased by 14%, with a volume growth of 18%.

- Operating margins:

- Textile margins: Arvind’s operational efficiency led to an improvement in textile margins. They were higher by 126 basis points (bps).

- AMD margin: The AMD division’s margin improved to 15.6% (from 13.2%) due to lower raw material (RM) prices and operating leverage.

- Debt reduction:

- Arvind successfully reduced its overall debt by ₹78 crore during the year.

- Long-term debt (LT) saw a reduction of ₹253 crore, bringing it to ₹399 crore by year-end.

Arvind Future outlook

Diversification and innovation

When Arvind strategically changed its focus to asset-light businesses including the garment sector and the advance material division (AMD), it indicated a conscious effort to make operational efficiency more profitable. This AMD segment, which specialises in technical textiles, is an area of immense growth potential that currently serves a global market worth $100 billion.

Through this diversification, Arvind is not only freed from relying on traditional textiles but also put at the cutting edge of high-value sector innovation. The company’s dedication to research and development in technical textiles guarantees its continued competitiveness and enables it to take advantage of new market possibilities.

Garments business expansion

A major growth driver for the company is projected to be Arvind’s garments division. This category has a positive outlook for big growth with projections of a 25% increase in revenue due to higher volumes and better realisation rates.

Long-term growth is expected from Arvind’s strong reputation and positioning as a preferred player in garments, as well as strategic investments in capacity expansion and modernisation. The company’s market share and profitability will likely be improved by its focus on sustainability and quality in this segment.

Market expansion and global reach

Within the global market, Arvind has a strong distribution system which puts it in an advantageous position when it comes to expanding its operations to other countries.

The firm is expected to register substantial growth on account of its strategy that emphasises building up its presence in major global markets especially advanced materials and garmenting segments. The company aims at capturing a bigger portion of the fast-growing market for innovative textiles as well as superior quality clothing through leveraging its access to global markets.

Sustainability and ESG focus

Arvind’s future strategy is anchored on its commitment to sustainability and environmental, social and governance (ESG) principles. The company’s emphasis on going green in its manufacturing operations, reducing carbon emissions as well as supporting sustainable practices has been in sync, especially with the global increasing clamour for sustainability.

Arvind investments in renewable energy, water-saving efforts, and waste management programs have not only improved its ESG rating but also made it a responsible and forward-looking industry leader.

Also read: ESG: A new formula for investing success?

Bottomline

Arvind Limited’s outstanding performance and strategic initiatives make it an appealing investment opportunity within the textile and apparel industry. The company’s recent surge in share price on Phillip Capital assigning ‘buy’ with a possible upside of 35% indicates that it is well placed in the market for growth.

The future looks bright for Arvind Limited because they have pursued strategic diversification, are financially strong, expanded their markets, and are fully committed to sustainability.