The auto components sector is one of the most vibrant industries in India at present. If projections made by the Indian Brand Equity Foundation (IBEF) are to be believed, the Indian auto component industry might overtake the world leaders by 2025.

The sector had record-breaking growth of 32.8% in the financial year 2023, reaching ₹5.6 lakh crore, according to the Auto Component Manufacturers Association of India (ACMA).

This rapid growth, together with more disposable income, more investment in infrastructure, and more substantial financial incentives for manufacturers, have sped up the auto industry.

In today’s article, we will look into the auto components industry with a focus on the largest auto parts manufacturers in India. Let’s begin!

Understanding the auto components industry in India

The automotive component business in India produces a vast array of parts for various vehicle types. These parts include castings, forgings, completed and semi-finished sections, assemblies, and subassemblies.

There are two main categories in India’s automotive component industry: organised and unorganised. The organised sector caters to original equipment manufacturers (OEMs), which involve high-value precision instruments, in contrast to the unorganised sector, which primarily services the aftermarket category and contains low-value products.

An increasing number of original equipment and auto component manufacturers emerged as a result of the significant demand for vehicles.

Because of this, India became an expert at producing automobiles and auto parts, which increased demand for Indian autos and parts exports. The Indian automotive sector has had a significant impact on the auto component business because of this.

When it comes to employment and overall economic development, India’s automotive component sector is a significant player. Players in the industry range from considerable enterprises to small startups, and they are located in all corners of the nation.

About 1.5 million individuals in India found direct work in the automotive components business, which contributed 2.3% to the country’s GDP. The automotive parts industry is projected to account for 5-7% of India’s GDP by the year 2026.

Direct additional employment for 3.2 million people is expected to be achieved by 2026, according to the Automotive Mission Plan (2016–26).

Also read: Financing your next car purchase? India’s auto finance sector and lenders

Growth of the auto components industry

The year 1997 was an important one for partnerships in the automotive sector. Around the middle of the 1980s, new players like Hero and Honda entered the market. This is also when Suzuki and the Indian government formed a partnership and OEMs got back on track. But it all came tumbling down in 1999 and then fell apart in 2000.

After this, things were looking up until the Lehman Crash of 2008. Even though it had never seen such economic turmoil before, India bounced back in just a year. This comeback showed that the economy was strong.

Because the industry influenced the economy, the government sought to make it more competitive internationally from 1999 to 2010. When it comes to the aftermarket, India still has a USD 10 billion business that will likely grow even further. However, the sector still needs to be regulated so that safe parts get to the end user.

Today’s auto components sector in India

Auto parts made in India are increasingly being customised to local specifications as a result of the increasing involvement of international Original Equipment Manufacturers (OEMs) in the Indian market. With a 33% increase, the Indian auto component industry achieved a record-breaking $69.7 billion in revenue in the fiscal year 2022–23.

In FY23, the industry’s turnover was 66% from domestic OEM supply, followed by domestic aftermarket and exports. The component sales to original equipment manufacturers in the Indian market increased by 39.5% to 4.76 lakh crore.

The export of automotive components increased 5.2% from 2022 to 2023 to reach ₹1.61 lakh crores. In the fiscal year 2022–23, the aftermarket for vehicle parts reached ₹85,333 crore, an increase of 15%.

Moreover, aftermarket sales for the automotive components business reached $10.6 billion in fiscal year 2022–2023, up from $10 billion the year before.

Also read: Automobile industry in India

Future outlook of the automobile parts manufacturing companies

With more and more people opting for cleaner, safer, and more environmentally friendly methods of transportation, including electric, electronic, and hybrid vehicles, the transportation sector is seeing fresh growth as a result of globalisation.

This shift will open up new markets and prospects for companies that make automotive parts over the next ten years.

The number of electric vehicles expected to be produced in India by 2024 is 5 lakh three-wheelers, 55,000 four-wheelers, and 7,000 buses. Alternatively, there will be four lakh charging stations by 2026, up from 1,800 in March 2021.

By 2026, Indian exports of automotive components might exceed $30 billion, according to the Automobile Component Manufacturers Association (ACMA). Estimates indicate that the automotive component market will reach a value of $200 billion by the year 2026.

In addition, analysts anticipate that India’s automotive component market will surpass China’s and become the world’s third-largest.

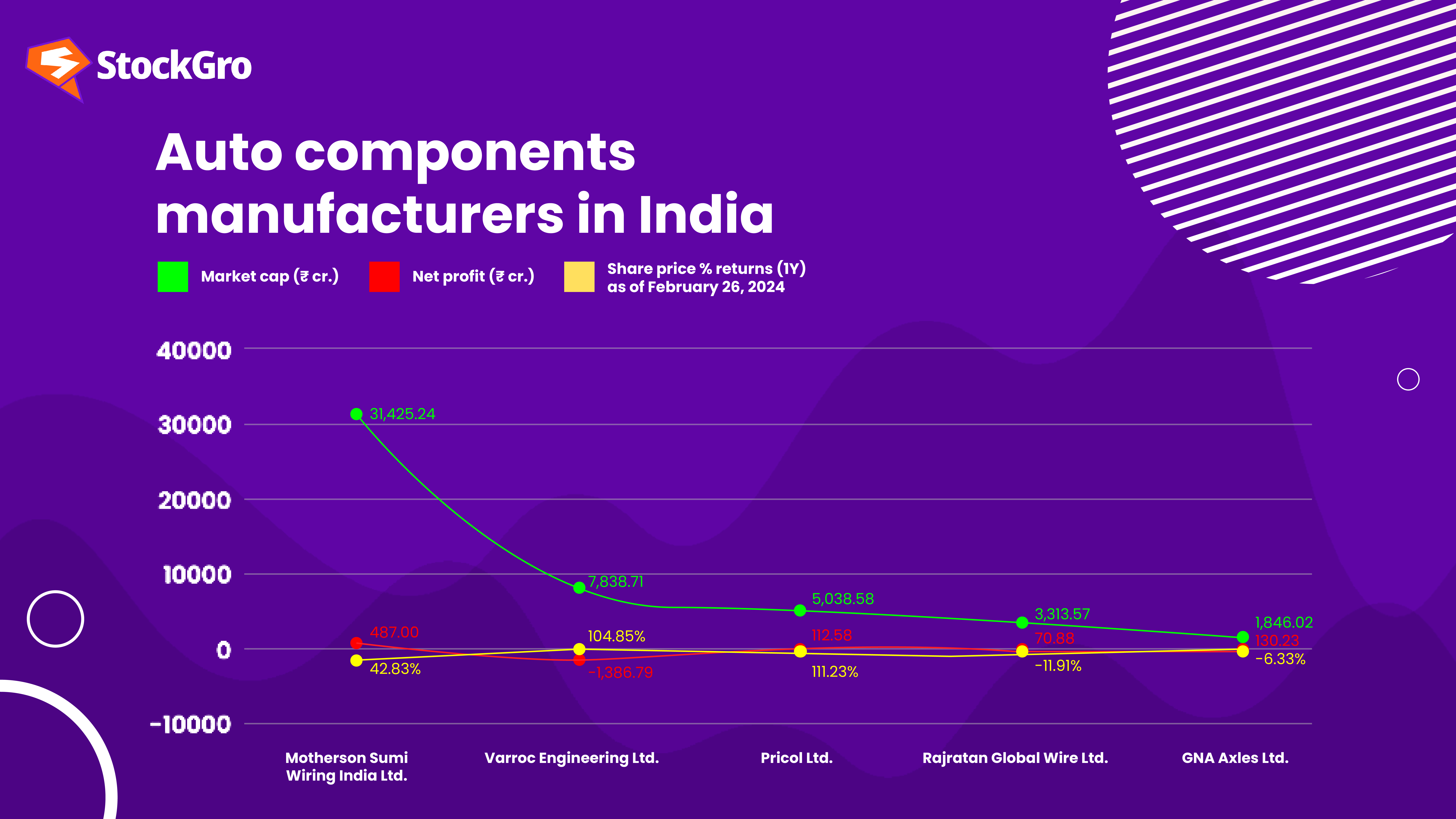

List of auto components manufacturers in India

Below is a list of the top auto component manufacturers in India ranked by market capitalisation as of February 26, 2024.

Also read: Micro, Small and Medium Enterprises in India – Here’s all you need to know!

Conclusion

India’s plans for EV usage and its expansion in the international auto component production sector are significant shifts in the worldwide automotive market. The automobile industry is a major force in the country’s economic growth and technical advancement, accounting for 20.1% of the manufactured GDP.

International corporations and small and medium-sized enterprises (SMEs) involved in the production of automotive components are well-positioned to thrive in the Indian market with the right combination of capital, creativity, and business strategy.