The Indian auto industry started in the 1980s with joint ventures between Indian and global players. Growing trends in electric vehicles, rising demand for car loans in tier 2 and tier 3 cities, and digitization of the auto financing process are some of the main drivers behind the increasing trend of getting auto loans in India.

According to recent data from RBI, it can be seen that people are shifting towards car loans more than home loans nowadays. Demand for automobiles has increased, exceeding the prior interest in owning a house, as vehicles such as SUVs tend to take over the buyer’s wallet share. To manage your car loan better, you can use a car loan calculator to estimate your monthly EMI based on the loan amount, interest rate, and tenure.

With that being said, let’s deep dive into the intricacies of automotive finance, how it works, and the top companies that finance automobiles. Let’s get started.

You may also like: Insurance 101: How to protect yourself and your assets!

What is automotive finance?

The auto finance industry includes companies that offer financial products such as loans to customers to buy or lease vehicles. It allows customers to buy vehicles without making a one-shot payment but through down payments and paying the rest through Equal Monthly Instalments (EMI).

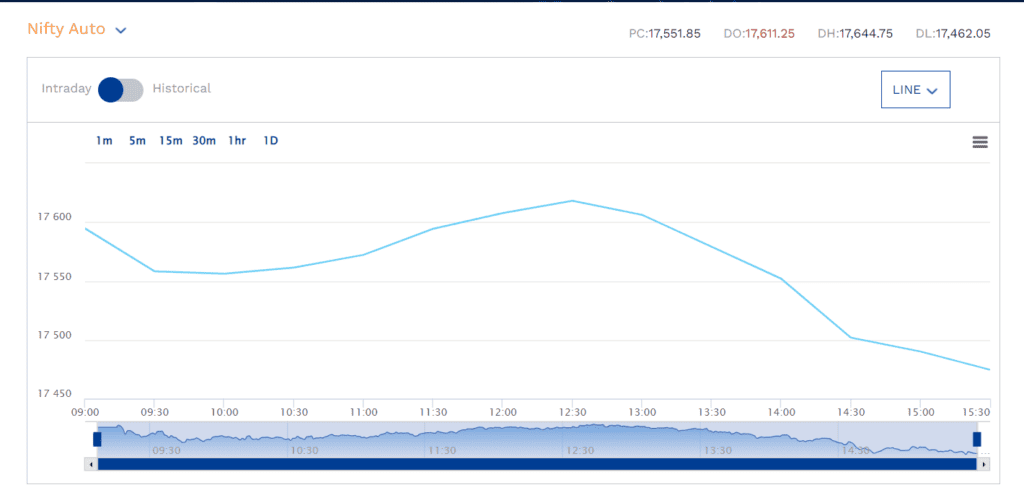

The Nifty Auto Index represents the growth and trend of the Indian auto loan market, as we can see in the graph below.

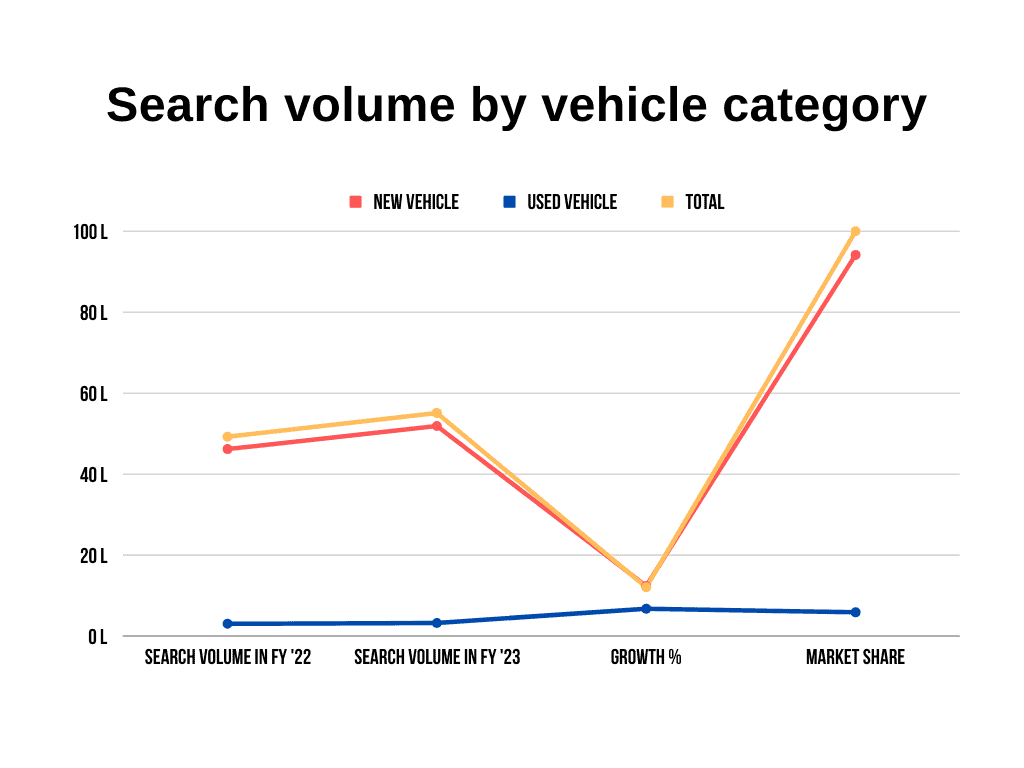

As we can see in the chart, with an overall market share of 94.16% in FY’23, new automobiles are among the most preferred kinds of vehicles for auto financing in India. With a 5.84% market share, used vehicles are the next preferred category for auto financing.

On the other hand, 77.78% of the auto loan market share in India went to four-wheelers, making them the most prominent type of vehicle. At 17.18% of the market, motorcycles rank as the second top-selling vehicle category for car financing.

Also read: Textile industry in India – The foundation of fashionable clothing trends

Analysing India’s auto finance market over the years

Market scenario during the pandemic

The global auto industry went through one of its toughest periods yet in 2020, when the pandemic was at its worst. It was dealing with several issues, such as increasing vehicle emissions regulations and shifting customer demands. Automobile sales were already down when the lockdowns occurred.

For example, Maruti Suzuki noticed a drastic drop of 48% in domestic sales due to the effects of the pandemic. Throughout FY21, the industry had negative growth in sales of every vehicle category. Passenger vehicles dropped by 2.24%, commercial vehicles dipped by 20.77%, 2-wheelers dropped by 13.19%, and 3-wheeler sales were down by 66.06%, respectively.

After the pandemic, the growth in the auto loan sector is getting more prominent day by day. The trend can be seen from the RBI’s release in mid-2022 regarding the expansion of the auto loan portfolio growth by 2.6% month on month.

Today’s market scenario

The COVID-19 pandemic hurt the auto loan industry in India, as many people lost their income or faced uncertainty due to the lockdowns and restrictions.

However, the industry recovered quickly as the government and the central bank introduced various measures, such as encouraging state-run banks to offer loans to both dealers and buyers to support the economy.

As a result, the auto loan industry in India saw a continuous increase in the number of loans taken and the amount of money lent after the pandemic. This also increased the interest revenue of the lenders, which is the amount of money they earn from charging interest on the loans. The result of increasing loans is evident, as the auto industry is one of the major players in India’s economic expansion, contributing 7.5% of the country’s overall GDP.

The dramatic shift in the vehicle financing industry in terms of growth is also due to a number of factors. From changing customer behaviour to the emergence of fintech companies, there is a lot to consider for the main drivers behind this growth.

Additionally, the constant push from the government to make electric vehicles mainstream is also another major factor that is increasing the demand for automobiles and auto financing. Both central and state-level governments are offering strategic policies to achieve maximum EV penetration by the year 2030 at a growth rate of 10 to 15 per cent.

According to a recent survey, India is now more prepared to embrace EVs as personal vehicles. In FY23, EV sales reached 1.16 million units in India, showcasing a 154% YoY growth from FY22.

The future of the market

The global auto finance market is expected to grow at a compound annual growth rate of 6.5%, rising from $245.62 billion to $385.42 billion in just 7 years. It is safe to say that the auto loan industry in India will continue to grow in the future, as the demand for vehicles remains high and a low-interest environment is established.

Also read: The best banks in India: Leading the way in finance

Top auto finance companies in India

During Q3 of the financial year 2023, SBI witnessed a 20.5% YoY growth in its vehicle financing portfolio. For Punjab National Bank and Indian Bank, the numbers are 39.5% and 27%, respectively. ICIC Bank saw 22% growth as a private bank in Q3 2023.

With that being said, here is a list of the top auto finance companies that are offering the best auto loans at this moment, along with their market cap, net profit, and share price (as of December 2, 2023).

| Company | Market cap (₹ cr.) | Net profit (₹ cr.) | Stock price (₹) |

| State Bank of India | 510,264 | 56,609 | 571.75 |

| HDFC | 1,180,512 | 46,149 | 1555.40 |

| ICICI | 663,616 | 34,483 | 946.70 |

| Axis | 340,534 | 10,855 | 1104.65 |

| Kotak Mahindra | 347,917 | 14,780 | 1750.50 |

Conclusion

In the Indian used-car sector, the market is anticipated to reach almost 4.6 million units in FY23. This is mainly because people who live in urban regions and metropolitan centres prefer to own more than a single vehicle, be it for better mobility or convenience.

In addition, the Indian auto market is being favourably impacted by the rise in female labour force participation in India. According to the RBI, the last three years have seen a 137% surge in auto loans, which is expected to increase in the coming years — a prominent example of the growing auto loan market.