Historically, the Indian auto industry has always been a good barometer of the state of the economy because it is one of two main engines for macroeconomic growth and technological development. Due to its growing middle class and a significant number of young people within its population, volume-wise, the two-wheeler segment dominates the market.

Passenger vehicles, three-wheelers, two-wheelers, and quadricycles produced 23,28,329 units in January 2024. The leading performer in this vast industry happens to be Bajaj Auto Ltd. For June 2024 alone, Bajaj Auto announced an impressive 5% rise in total sales compared with last year’s figures, reaching 3.58 lakh units.

This rise shows notable improvement compared to the previous year and, therefore, affected stock price, which saw gains after being announced. This article gives an account of Bajaj Auto’s recent sales performance, followed by stock performance thereafter.

Also read: Rise of automobile industry in India

About Bajaj Auto Ltd

One freedom fighter, philanthropist, and confidante of Mahatma Gandhi, Jamnalal Bajaj, established the Bajaj Group, which is one of India’s most respected business houses. Almost eighty years ago, it started with a sugar factory in Lakhimpur Kheri, Uttar Pradesh.

Seeking to expand its portfolio, the group has ventured into many areas of operation. One such area is Bajaj Auto, which is involved with the manufacture, development, and sale of motorcycles, commercial vehicles, electric vehicles, and other spare parts for these automobiles.

Bajaj Auto exports its two-wheelers and three-wheelers to 79 countries around the world, including most Latin American nations, Southeast Asia, and others. It is headquartered in Pune, India.

Sales performance

On Monday, 1st July 2024, Bajaj Auto announced a 5 per cent increase in month-on-month total wholesales. The total sales of the company rose to 3 58,477 units for June 2024 from 3,40,981 units sold during a similar month in the year before.

Two-wheeler segment

Bajaj Auto showed a 3% increase in total sales for the two-wheeler category. There was a remarkable increase of 7% in the home market, where sales increased to 1,77,207 units from 1,66,292 units in June 2023.

However, the overseas market witnessed a slight decline of one per cent as their shipments reduced from 1,27,357 last year this month to their current levels of 1,26,439 machines. In general terms, the total number of two-wheelers sold for this segment reached 3,03,646 units compared to June, where it was at a lower point of 2,93,649 bikes.

Commercial vehicles segment

The segment for commercial vehicles showed good performance, with the total sales going up by 16% y-o-y. In June 2023, domestic sales of commercial vehicles rose to 39,244 units from 33,691 in June 2022. The increase was primarily due to increased exports of commercial vehicles.

Exports of commercial vehicles also saw a significant increase of 14%, with 15,587 units exported compared to 13,641 units in June 2023. In terms of total sales, however, there were about four point seven thousand more cars sold last year in this segment than is seen now.

Combined sales performance

Among two-wheelers and commercial vehicles, the summation of Bajaj Auto’s entire domestic sales in June 2024 was 2,16,451 units, representing an increment of 8% from 1,99,983 units in June 2023. Export sales amounted to 1,42,026 units, which is a rise of one per cent compared to those sold during the same period in the previous year.

Therefore, it accumulated total sales for June 2024, which stood at a figure of 3,58,477 units. Thus, a growth rate of about five per cent above that recorded in June 2013 when only about three hundred forty thousand six hundred eleven were sold.

| Particulars | June 2024 | June 2023 | Change (%) |

| 2-Wheelers | |||

| Domestic | 1,77,207 | 1,66,292 | 7 |

| Exports | 1,26,439 | 1,27,357 | ‐1 |

| Sub-total | 3,03,646 | 2,93,649 | 3 |

| Commercial vehicle | |||

| Domestic | 39,244 | 33,691 | 16 |

| Exports | 15,587 | 13,641 | 14 |

| Sub-total | 54,831 | 47,332 | 16 |

Source: Bajaj Auto Ltd

Stock performance

Bajaj Auto’s share price jumped from the previous close of ₹9,501.65 a piece to ₹9,693.95 a piece on July 1, 2024, after the sales performance press release. This was a significant intraday rise of 2%.

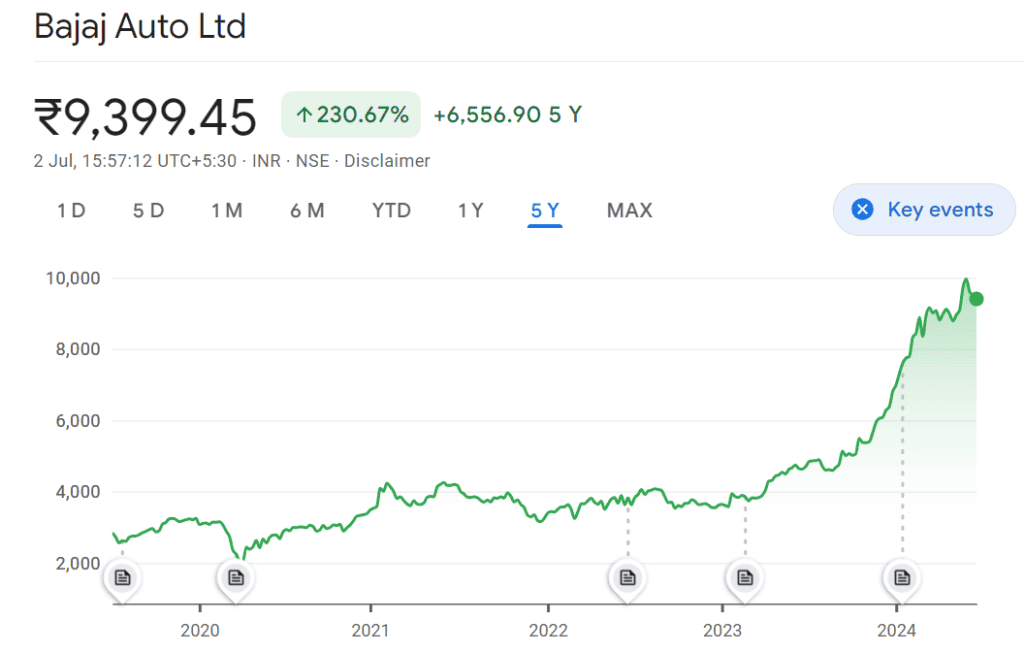

When looking at the stock price history of the company, Bajaj Auto’s stock has given a return of 230.67% over the previous five years.

Bajaj Auto’s target price for the shares is ₹9,984 per share, according to Prabhudas Lilladher Private Limited. This target price has been re-estimated upwards from the previous targets to suggest improvement in business and performances across different segments like electric vehicles (EVs) and premium motorcycles.

The analysis of Bajaj Auto indicates a bright future with expectations of both revenue and profit growth in years ahead that are still ongoing.

You may also like: Understanding the basics of the broking industry and its recent trends

Future outlook

The future outlook of Bajaj Auto is characterised by optimism and strategic planning, aiming at solid growth in FY’25. The company is concentrating on top-line expansion without compromising profitability. A projected growth rate of 7% to 8% p.a. for the domestic industry sets a positive tone for the years ahead.

Bajaj Auto will take a differentiated approach across different markets. In stressed markets, the company’s stance will remain cautious to mitigate risks while, in recovering markets, it will use an aggressive strategy to exploit emerging opportunities. Also, Bajaj Auto intends to make a powerful entry into new markets using its wide range of products and firm brand name.

To drive its growth, Bajaj Auto plans to introduce new models and expand its focus on different market segments. This includes upgrades as well as new products in both the traditional product segment and the electric vehicle (EV) category. Through keeping track of market trends and consumer demands, the firm aims to enhance its market position and capture a significant portion of the growing market share.

Must read: What does the EV boom mean for auto stocks?

Peer analysis

Let’s look at a few of the metrics of the company as compared to its competitors:

| Company | CMP (₹) | Market cap(₹ crores) | P/E | Earnings Yield (%) |

| Bajaj Auto Ltd | 9,395 | 2,62,459 | 34.0 | 3.84 |

| Eicher Motors Ltd | 4,626 | 1,26,724 | 31.7 | 4.14 |

| TVS Motor Company Ltd | 2,338 | 1,11,102 | 65.9 | 3.79 |

| Hero MotoCorp Ltd | 5,567 | 1,11,321 | 28.8 | 4.79 |

Bottomline

Bajaj Auto has performed strongly, has shown great insight into future strategies, and has won investors’ trust, resulting in its becoming one of the strongest players in the Indian automobile sector. It is positioned well for further innovation and expansion that will enable it to exploit emerging opportunities to create substantial value for stakeholders.