Bajaj Finance Ltd, a key player in the financial services sector is known for its innovative offerings including the Ecom and Insta EMI Card services. However, in November of 2023, RBI imposed restrictions on these services. The central bank’s decision was based on the non-adherence to the existing provisions of digital guidelines by the company.

Specifically, Bajaj Finance did not provide Key Fact Statements (KFS) to borrowers for these two lending products. The market reacted swiftly to this development. Bajaj Finance’s share price experienced a dip, declining by 2.01%.

Fast forward to the present day, and the clouds of uncertainty have departed. The RBI has lifted the restrictions, and the market has responded with a resounding cheer. Bajaj Finance’s share price has jumped by 7%, a clear indication of the market’s faith in the company’s potential.

Join us as we unpack this exciting development, exploring its impact on Bajaj Finance, its shareholders, and its customers. We’ll delve into the details of this decision and what it means for the future of Bajaj Finance and the financial sector at large.

About the company

Bajaj Finance Ltd. stands as a significant entity in the financial services landscape of India, celebrated for its wide-ranging services and pioneering stance towards consumer lending. With a legacy extending beyond thirty years, the company has played a crucial role in meeting the lifestyle desires of the middle-class demographic across a variety of consumer sectors.

Bajaj Finance Ltd. has pioneered a variety of product innovations, including EMI cards and Flexi loans, transforming how consumers obtain and handle credit. These products have been crafted to keep the customer’s ease in focus, facilitating flexible repayment alternatives and effortless access to capital.

Bajaj Finance Ltd. prides itself on a remarkable customer base of 69.1 million, reflecting its broad appeal and reliability. With its footprint in 3,733 locations and more than 154,650 distribution points, Bajaj Finance Ltd. guarantees that its services reach a large segment of the Indian populace. The dedication of its substantial workforce of 43,147 employees further emphasizes the company’s commitment to delivering superior service and assistance.

Bajaj Finance Ltd. serves a broad spectrum of financial requirements through its diverse service categories, encompassing Consumer Lending, SME Lending, Commercial Lending, Rural Lending, and Deposits (Public and Corporate).

The company also partakes in collaborations and provides supplementary services, underscoring its flexibility and readiness to adapt to the constantly changing financial environment.

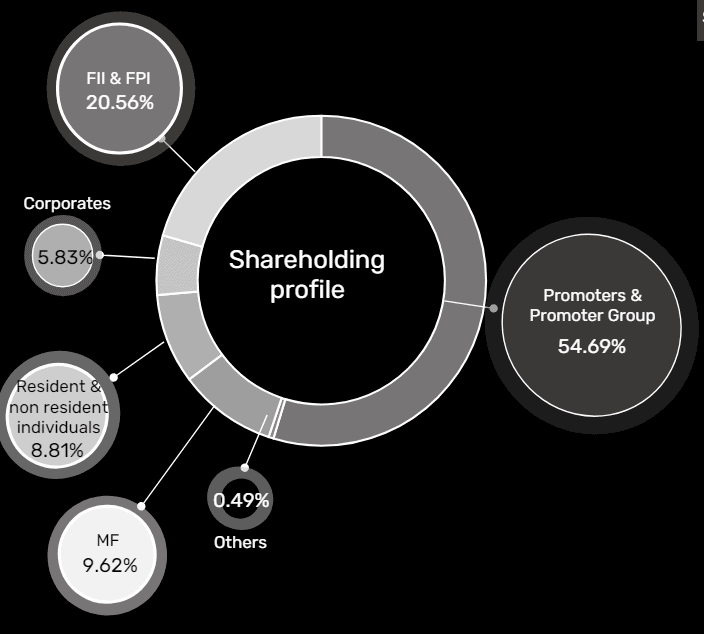

The shareholding pattern of the company:

RBI Regulations

Initially, the Reserve Bank of India (RBI) placed constraints on Bajaj Finance due to its failure to comply with the existing Digital Lending guidelines. This was particularly due to the non-provision of Key Fact Statements (KFS) to borrowers availing the ‘eCOM’ and ‘Insta EMI Card’ lending products.

A KFS is a crucial document that provides essential loan details such as the loan amount, tenure, interest rate, fees, and penalties. As per RBI regulations, it is mandatory to provide these details in a clear and concise format to customers availing digital loans.

These restrictions had a substantial impact on the operations of Bajaj Finance. The company was compelled to put a temporary halt on issuing Existing Member Identification cards (EMI cards) to new customers until the issues identified by the RBI were addressed.

This had a direct effect on the company’s capacity to approve and distribute loans under its ‘eCOM’ and ‘Insta EMI Card’ lending products.

Also read: EMI vs SIP: Features, analysis and pros & cons

RBI announcement

On the 2nd of May, 2024, a pivotal announcement was made by the Reserve Bank of India (RBI).

The reinstatement of these services is attributed to Bajaj Finance’s commitment to meeting the RBI’s requirements. The company made significant strides in providing Key Fact Statements (KFS) to borrowers, which are essential for transparent lending practices.

Following the RBI’s green light, Bajaj Finance announced its plans to resume the sanctioning and disbursal of loans through ‘eCOM’ and the ‘Insta EMI Card.’ This move is poised to benefit consumers by offering them access to credit for various purchases, both online and offline, through Bajaj Finance’s extensive network of partner merchants.

The lifting of restrictions heralds a promising future for Bajaj Finance, marking the end of a challenging period and the beginning of renewed growth opportunities.

Market reaction

Bajaj Finance’s shares experienced a significant surge of over 7.5% following the Reserve Bank of India (RBI)’s decision to remove restrictions on the company’s ability to sanction and disburse loans via eCOM and Insta EMI Card.

On the BSE, Bajaj Finance share price witnessed a robust rally, escalating 7.54% to reach ₹7,400. Similarly, on the NSE, Bajaj Finance Ltd share price saw an upward movement of 7.51%, also touching ₹7,400.

Also read: NSE considers extending trading hours

The market valuation of the company experienced a significant rise, moving from ₹23,008.1 crore to a staggering ₹4,49,205.63 crore.

When looking at Bajaj Finance’s share price history for the last 5 days, the trading pattern clearly indicates a sudden rise on 3rd May 2024, the day after the announcement.

Emkay Global has reaffirmed its ‘Buy’ rating on the stock and has kept its March 2025 Bajaj Finance share price target at ₹9,000 per share.

Analysts have expressed a positive outlook. They believe that the removal of these restrictions, which came as a surprise within less than six months, not only endorses the company’s management’s ability to quickly correct course but also signals a strong start for Bajaj Finance in the fiscal year 2025.

Moreover, analysts predict that the removal of the ban will result in an upsurge in customer acquisition and an enhancement in fee income. A senior research analyst at Emkay Global Financial Services underscored that the prohibition on the two products had considerably affected Bajaj Finance’s profitability.

Now that the restrictions have been lifted, there is a resurgence of confidence in the company’s FY25 prospects and expectations for the RBI’s approval for the renewal of Bajaj Finance’s co-branded credit card with RBL Bank in December 2024.

Bajaj Finance Q4 performance

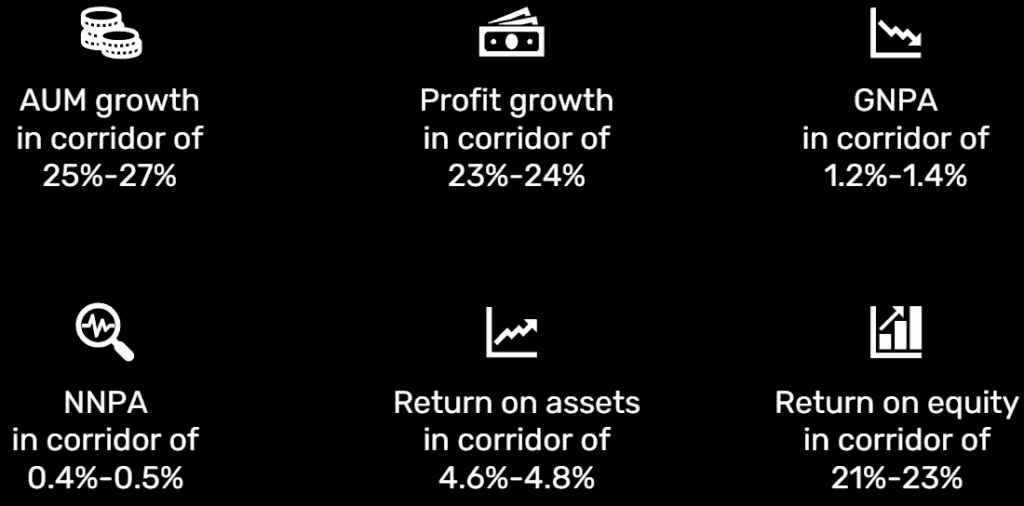

Bajaj Finance’s results in Q4 demonstrated strong growth and operational effectiveness. The company saw a substantial increase in Assets Under Management (AUM), with a growth of ₹19,647 crore in Q4, marking a year-over-year rise of 34%, culminating at ₹330,615 crore.

This expansion was bolstered by the procurement of 7.87 million new loans and the acquisition of 3.23 million new customers during the quarter.

Even with regulatory constraints affecting some products, the company’s operational efficiencies saw an improvement. The ratio of Operating Expenses (Opex) to Net Total Income showed a slight enhancement, standing at 34.0% as opposed to 34.2% in the same quarter of the previous year. Furthermore, the Net Non-Performing Assets (NPA) stayed low at 0.37%, signifying a robust credit quality.

The company’s profitability also experienced a positive trajectory, with the Profit After Tax (PAT) witnessing a growth of 21%, reaching ₹3,825 crore. The Return on Equity (ROE) was a robust 20.48%, albeit lower than the 23.94% in Q4 FY23, indicating the company’s consistent profitability.

These are a few of the financial metrics long long-term guidance:

Also read: Understanding AUM: Mastering financial skills

Bottomline

The lifting of the RBI’s restrictions on Bajaj Finance’s ‘eCOM’ and ‘Insta EMI Card’ lending products marked a significant turning point for the company. It not only led to a surge in the company’s share price but also reinstated the market’s confidence in Bajaj Finance’s resilience and future growth prospects.