In the adrenaline-fueled arena of the tyre industry, two titans are leaving their unique tread marks – Balkrishna Industries and CEAT Ltd.

As they race on the track of a market that reached a staggering volume of 190.54 million units in 2023, the stakes have never been higher. With the market projected to reach at a volume of around 339.37 million units by 2032, the race is truly on.

This article provides an exciting exploration of the strategies, successes, and future goals of these leaders in the industry.

Company profiles

Balkrishna Ind

Balkrishna Industries Limited (BKT) is a well-known player in the Off-Highway tyre industry, with a rich history dating back to 1954. The company’s story started with manufacturing bicycle tyres in response to the mobility demands of post-independence India.

Throughout its history, BKT has transformed into a worldwide organisation, establishing itself as a tyre company in 1987 and later expanding its operations to become a global Off-Highway Tires business by 1995.

BKT manufactures its products in five advanced factories in Aurangabad, Bhiwadi, Chopanki, Dombivali, and Bhuj.

The company has established a strong presence in the global off-the-road tyre market. BKT has a strong presence in the replacement markets of North America and Europe, especially in the United States farm market. They are an original equipment manufacturing (OEM) vendor for heavy equipment manufacturers such as JCB, John Deere, and CNH Industrial.

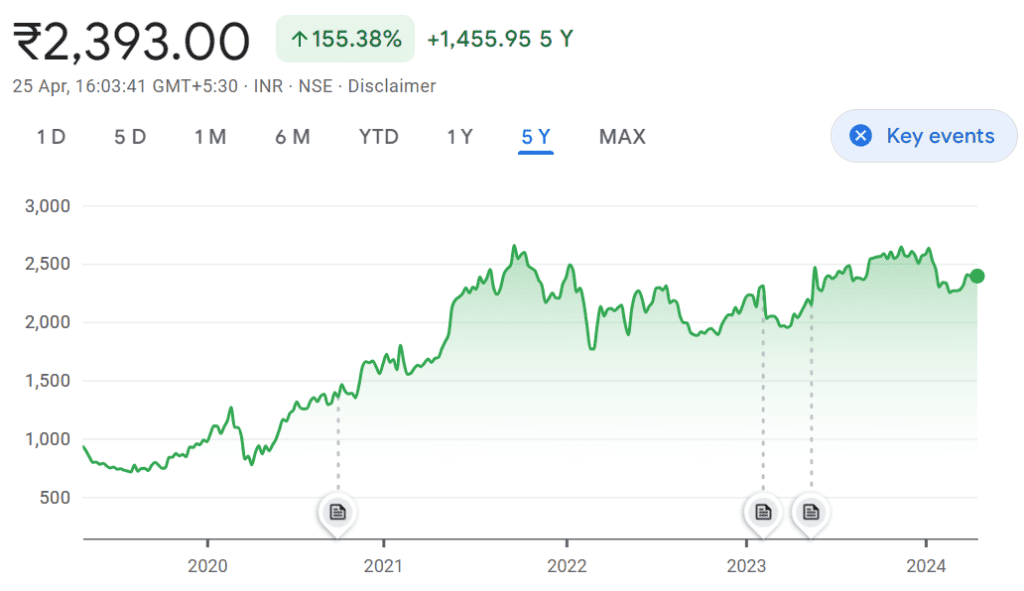

Balkrishna Ind share price news: As of April 25, 2024, the BKT share price is ₹2,393.00. Reviewing the BKT share price history reveals that over the past five years, it has delivered an impressive return of 155.38%.

CEAT ltd

CEAT Limited is an Indian multinational tyre manufacturing company that is part of the RPG Group. Founded in 1924 in Turin, Italy, by Virginio Bruni Tedeschi, CEAT has expanded its reach to become a prominent player in the global tyre industry.

The company started by manufacturing cables for telephones and railways. Over time, it has diversified its product offerings to include a diverse range of tyres for different types of vehicles, such as passenger cars, motorcycles, trucks, buses, and more.

CEAT has made significant contributions to the automotive sector, providing a wide range of products and services in over 110 countries. CEAT has achieved several significant milestones, including winning the Lighthouse Certification from the World Economic Forum and the prestigious Deming Prize. These accomplishments demonstrate CEAT’s commitment to safety and innovation.

The company’s unwavering commitment to customer satisfaction and meticulous risk management has garnered it a multitude of prestigious awards, cementing its status as an industry frontrunner in the tyre manufacturing sector. CEAT remains committed to providing a seamless and secure travel experience for millions of people around the globe.

CEAT tyres share price news: As of April 25, 2024, the CEAT share price is ₹2,560.00. Upon reviewing the CEAT share price history, it is evident that over the past 5 years, it has delivered an impressive return of 136.60%.

Financial profiles

Let’s compare the CEAT quarterly results with BKT quarterly results:

| CEAT Ltd(Q3FY24) | BKT Ltd(Q3FY24) | |

| Revenue (₹ crores) | 2,963 | 2,274 |

| Operating profit (₹ crores) | 418 | 541 |

| Profit before tax (₹ crores) | 228 | 409 |

| Net profit (₹ crores) | 181 | 305 |

| EPS (₹) | 44.87 | 15.80 |

Source: Screener

Reasons for growth

Balkrishna Ind

- Increased market share: Balkrishna Industries Limited (BKT) has successfully expanded its market share to over 5% globally, resulting in increased sales and a more prominent position within the industry.

- Significant volume growth: The company has seen a strong 9% increase in volume year-on-year for the third quarter of the financial year 2024, suggesting a healthy demand for its products.

- Operational excellence: BKT has implemented highly effective operational strategies to optimise efficiency and productivity, which have greatly contributed to the company’s overall growth.

- Effective cost management: By implementing strategic cost-saving initiatives, BKT has enhanced its profit margins, guaranteeing that its growth is reflected not just in sales volume but also in financial gain.

CEAT ltd

- Volume growth: The company witnessed a 12.5% increase in volume compared to the previous year, which played a substantial role in its comprehensive growth.

- Market segment performance: All three market segments – original equipment manufacturing (OEM), replacement, and international business—experienced strong performance, with international business showing an impressive 25% year-over-year growth.

- Product mix: The introduction of new products and the emphasis on premiumisation, such as the successful launch of CEAT motorcycle steel radial tyres, have been instrumental in driving growth.

- Operational efficiencies: The company has implemented operational enhancements that have led to improved margins and increased utilisation, resulting in a post-tax ROCE in the double digits.

Company strategies

Balkrishna Ind

- Product portfolio expansion: The company intends to pursue new growth prospects by expanding into markets for “Ultra Large Earthmovers & Mining Radial Tires” and taking advantage of the transition from Bias to Radial Tires.

- Technological advancements: The company plans to establish India’s first Ultra Large size all-steel off-the-road (OTR) Radial tire plant at Bhuj and later increase production capacity to meet the growing market demand.

- Market leadership: The company aims to solidify its market dominance by offering a wide range of products that meet the diverse needs and requirements of different customer segments.

CEAT ltd

- Product expansion: The company is set to introduce a range of new offerings, particularly targeting the off-road and high-end passenger tyre categories, which will encompass SUV tyres for both the domestic Indian market and overseas markets.

- International growth: CEAT is looking to drive growth by expanding its product range in international markets, specifically targeting Europe, the US, and Latin America.

- Premiumisation: Introducing premium products such as the CEAT motorcycle steel radial for high-end bikes is a strategic move to meet the needs of the premium segment.

- Digital engagement: CEAT aims to improve customer engagement by leveraging digital channels, with a focus on boosting online sales and brand visibility. They intend to utilise advanced analytics models to enhance operational efficiency.

Future outlook of the industry

The Indian tyre industry is poised for a promising future, as the organised tyre retreading market is projected to experience a steady growth rate of 7-9% CAGR from FY2023-26. Here are the important trends and challenges:

- Sustainable growth: The emphasis on eco-friendly tyres and the enhancement of tyre retreading methods is a key trend that underpins the growth of the industry.

- Infrastructure & radicalisation: The increasing demand for tyre retreading is being driven by factors such as improved road infrastructure and the growing popularity of radicalisation in the commercial vehicle segment.

- Rising demand for vehicles: The growing need for vehicles within local and global markets is resulting in a heightened requirement for tyres.

Nevertheless, the industry encounters obstacles like fierce competition, shifts in regulations, and the constant demand for innovation to keep up with evolving customer expectations.

Despite the obstacles, the Indian Tyre Industry is set to experience substantial growth in the upcoming years, providing plenty of opportunities for both established companies and newcomers.

Bottomline

India’s tyre sector is experiencing an evolving environment marked by intense rivalry, strong potential for expansion, and a continuous drive for innovation. Companies like Balkrishna Industries and CEAT Ltd. serve as prime examples of this, showcasing exceptional adaptability and resourcefulness in overcoming obstacles and seizing growth opportunities.

Both companies have demonstrated strong financial performances, strategic vision, and operational expertise, which have propelled them to become market leaders and make substantial contributions to the sector’s overall growth.

As leading entities in the sector, Balkrishna Industries and CEAT Ltd. stand at the forefront, ready to spearhead progress and drive the Indian tyre industry towards a more vibrant and successful era.