For centuries, gold has been a symbol of riches and protection prized by societies worldwide. It is still a “safe haven” investment that provides stability when other assets fail in today’s hazy economic scene.

However, what makes gold such a dependable option for both novice and experienced investors? It stands out due to its intrinsic value, liquidity, and ability to withstand market fluctuations.

Covering gold investment advantages from portfolio diversification to inflation protection, this article will explore the top 10 reasons why investing in gold is a wise decision.

You may also like: White Gold: Elegance and Differences Explained

Gold investments

Investing in gold is a timeless strategy, offering stability in uncertain times. If you’re wondering why invest in gold, its historical reliability and security make it a trusted asset. The benefits of gold investment go beyond its value, serving as a safeguard for your wealth.

Here are a few reasons why gold investments are considered smart investments

#1: Hedge against inflation

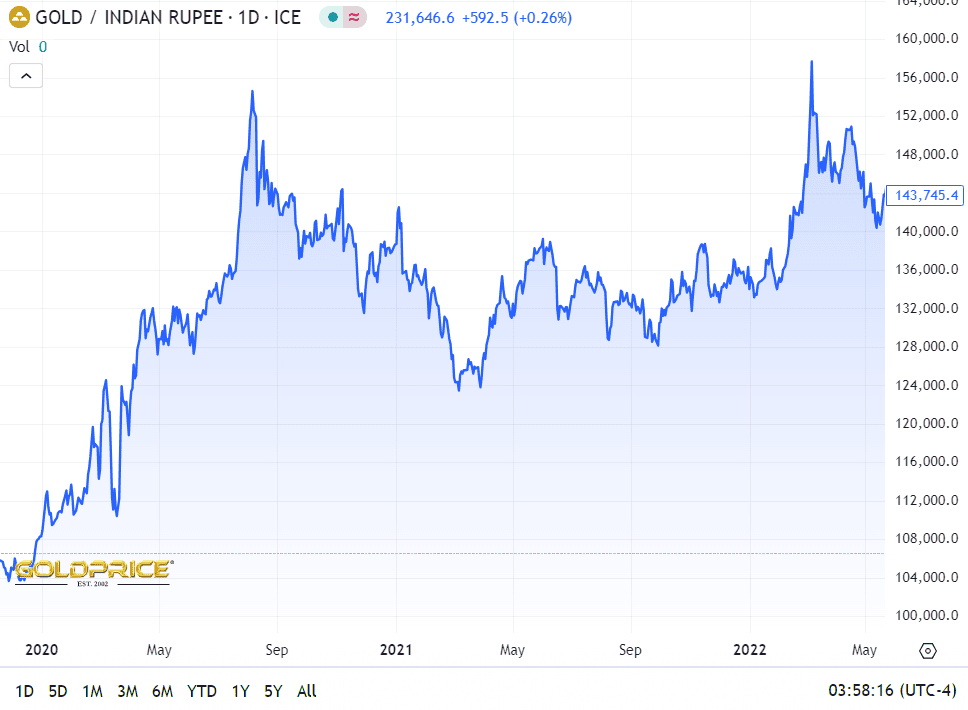

Gold is a reliable inflation hedge that maintains its value as living costs rise. As an illustration of its ability to preserve purchasing power, gold prices surged throughout India’s periods of high inflation, particularly in 2021 (when inflation was 5.13%) and 2022 (when inflation was 6.70%).

Investors migrate to gold as conventional currencies lose value because of inflation, therefore ensuring their investments remain valuable. This quality makes gold a wise decision for people trying to protect their financial future despite growing prices and uncertain economic times.

#2: Portfolio diversification

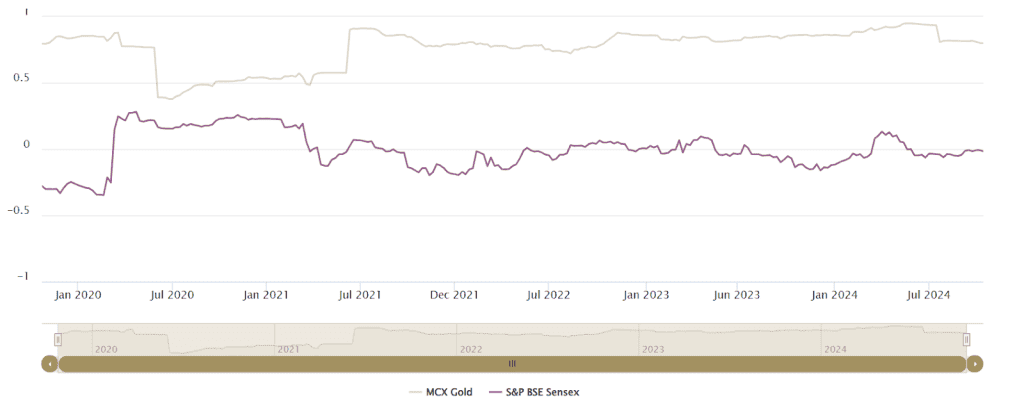

Investment diversification is essential for reducing risk and increasing profits. You can lessen the impact of a poor-performing investment on your entire portfolio by having a diverse range of assets.

Because gold has a low connection with other assets—such as equities and bonds—it usually performs well when other investments fail. This chart shows the correlation between the gold market (MCX Gold) and the equity market (S&P BSE Sensex) over 1 year (as of October 2024):

This special feature helps reduce general portfolio risk, hence investing in gold is a good approach to get a strong and balanced portfolio.

#3: High liquidity

Gold is well-known for its great liquidity, which means practically anywhere in the globe one may readily purchase or sell it. Investors may rapidly turn gold into cash when needed, whether in digital form—gold exchange-traded funds (ETFs) or physical form—gold bars and coins.

This simplicity of access lets investors respond quickly to market prospects or financial requirements. For individuals who value financial flexibility, gold’s viability as an investment is much improved by the quick liquidation of its holdings.

Also read: Digital gold vs physical gold: Find out which is the better buy

#4: Safe haven in uncertain times

Often considered a secure refuge during times of geopolitical and economic uncertainty, gold is a consistent investment choice. Historical instances showing this trend include the COVID-19 epidemic, where gold prices surged as people rushed to it for protection.

Gold’s inherent value gives stability even as market volatility rises and uncertainty looms. This quality makes gold a desirable choice for those trying to safeguard their riches and negotiate difficult financial terrain.

#5: Tangible asset with intrinsic value

One obvious object that can be physically grasped and generally acknowledged for worth is gold. Gold can be passed down through generations, therefore conserving wealth for the next generations unlike stocks or bonds, which are only paper assets. It can also be collateral for loans, thereby offering still another benefit.

Knowing they have a widely accepted genuine asset, its physical form and intrinsic worth provide investors peace of mind.

#6: Protection against currency fluctuations

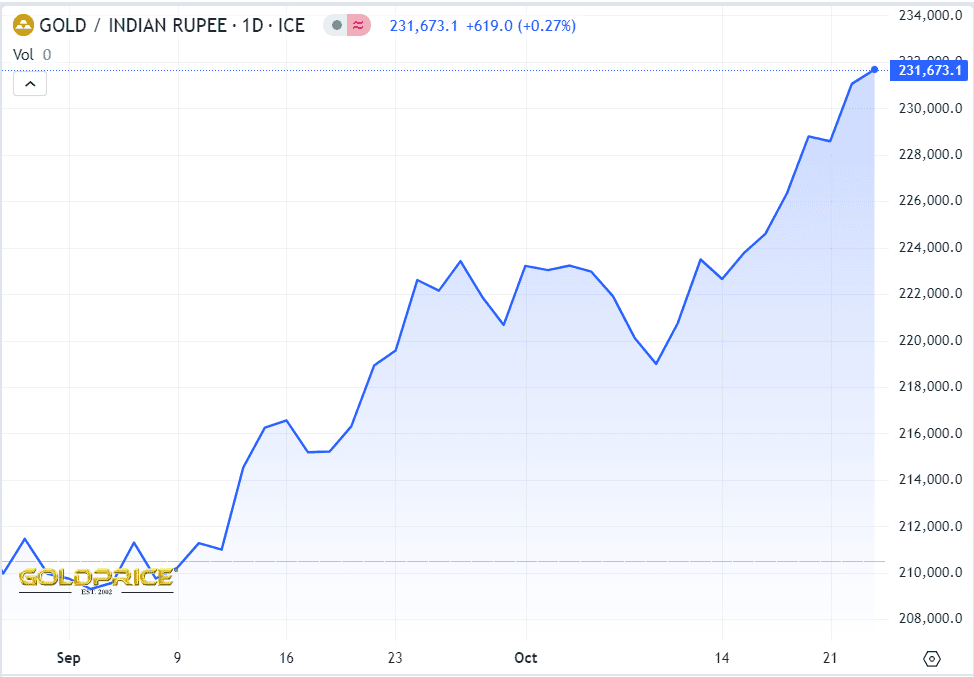

Especially in times of currency devaluation, gold serves as a good hedge against changes in the value of money. For example, gold prices in India usually rise when the Indian Rupee depresses versus the US dollar, therefore protecting investors. It happens because gold is largely imported, making it more expensive in Rupee terms when the rupee weakens.

For instance, in October 2024, when the Indian Rupee depreciated to below ₹84 per US Dollar, the price of 24-carat gold in India rose to ₹7,677 per gram (as of Oct 22, 2024). This inverse relationship balances the effect of a sinking currency, therefore preserving wealth.

Investing in gold helps people guard their assets against the devaluation of currencies, therefore preserving their buying power even in difficult economic times. For investors trying to balance their portfolio, gold is a wise investment because of this feature.

#7: No counterparty risk

Counterparty risk is the risk that the other party in a financial transaction may default on their contractual obligations. Gold is unique in that it has no counterparty risk, hence its value is not based on the state of affairs of a government or firm. For instance, gold maintains value while equities and bonds could fall amid market collapses or financial institution crises.

Since they are not depending on other entities for the value of the asset, this feature gives investors protection. A wise complement to any investment plan, gold helps investors reduce risks connected with defaults and economic uncertainty.

#8: Gold’s cultural and economic significance in India

In India, gold has great cultural and financial value beyond its function as a simple investment. It is fundamental in many customs, including religious events and marriages, where it stands for riches and success.

For example, during Diwali, gold demand surges as families buy gold coins and jewellery to honour traditions. This seasonal boost not only makes gold a culturally significant investment but also influences its price. Thus, investing in gold aligns with India’s customs and provides financial benefits.

#9: Easy accessibility to different gold investment forms

Gold is available to all kinds of investors since it presents a variety of investing choices. There are several options to fit different budgets and tastes ranging from traditional jewellery to gold exchange-traded funds (ETFs), Sovereign Gold Bonds, or digital gold.

Investors can start small by buying digital gold through easy-to-use mobile apps or opt for Sovereign Gold Bonds (SGBs), which offer interest rates of 2.5% per annum along with exposure to gold price movements. This adaptability lets investors readily include gold in their investing plans and diversify their portfolios.

#10: Gold as a long-term wealth storage

Many people know that gold can help to sustain riches over the long run. Unlike paper assets, which can lose value depending on inflation or market swings, gold keeps buying power over several generations.

Whether for family legacy, schooling, or retirement, this steadiness makes gold a good approach to protect riches for the next use. Investing in gold helps people make sure their wealth is safeguarded and can expand even under trying circumstances.

Further reading: GST on Gold and How to Calculate It

Bottomline

For both experienced and novice investors, gold presents many benefits that make it a wise investment. Its capacity to diversify portfolios, offset inflation and offer liquidity guarantees that gold will always be a consistent asset in unpredictable times.

Gold not only preserves riches but also conforms to traditional ideals given its cultural importance in India and different accessible investment options. Gold is clearly a tangible asset with an established track record that is fundamental for long-term wealth preservation and financial security.

FAQs

Why is investing in gold a good idea?

Investing in gold makes sense since it provides stability in unpredictable times by acting as a hedge against inflation and changes in the value of currencies. Over the long run, gold keeps its value and provides diversity, therefore lowering the total portfolio risk. Its minimal correlation with other assets guarantees that should other investments fail, gold usually retains great value and efficiently protects money.

Why is gold better than stocks?

For risk control and stability, gold is superior to stocks. It provides protection against market declines, inflation, and changes in the value of currencies. Gold holds value over time, unlike volatile stocks. Its minimal connection with other assets lowers portfolio risk, thereby offering protection in unpredictable times economically. Gold provides essentially a consistent store of value that stocks cannot always ensure.

Is gold better than FD?

Fixed Deposits (FDs) and gold have various investing uses. With the possibility of a price increase, gold is a hedge against inflation and economic uncertainty. Its worth is erratic, though. Conversely, FDs provide reduced risk yet consistent, certain returns. FDs are ideal if you wish for consistency and steady income. Gold can be the superior option if you seek diversity and long-term value preservation.

Which type of gold investment is best?

Though digital gold and gold ETFs are usually regarded as the finest gold investments, physical gold like coins and jewellery has cultural importance. They are simple to trade, provide flexibility and less expenses. Adding another degree of advantage are sovereign gold bonds, which offer interest along with price appreciation. Every provides special benefits; so, the optimal option relies on your own preferences and objectives.

Is gold a high-risk investment?

Usually regarded as a lower-risk investment than stocks or other volatile assets is gold. It offers a counterpoint against economic uncertainty and inflation. Still, there are hazards; gold prices change depending on geopolitical events, the state of the market, and the value of currencies. Although it’s a steady and worthwhile tool, diversifying your portfolio with different investments is still smart to properly control risk.