The automobile industry is the biggest indicator of the economic health of our country. The rate of improvement of the automobile industry proves not only the technical advancement of the country but also the economic growth of the nation. The demand for two-wheelers increases because of an increase in middle-income households.

The automobile companies are expanding their markets to rural areas. This has resulted in companies finding newer clients, thus driving up their sales.

Auto industry overview

India houses the world’s third-largest automobile market. The growing and strong middle-income household has given rise to increased demand, resulting in a total production of 28.43 million vehicles, including:

- Passenger vehicles

- Commercial vehicles

- Three-wheelers

- Two-wheelers

- Quadricycles

India has produced 25.9 million vehicles in FY23. Following are a few points that further illustrate India’s strong auto industry:

- India is the world’s biggest tractor producer.

- It is the second-largest bus producer.

- Third largest heavy truck manufacturer.

India’s global strength has led the automobile industry to soar in both domestic markets and International markets. This resulted in exports reaching 47,61,487 vehicles in FY23. Two-wheelers accounted for 76.8% of total exports in 2023-2024.

EV (electronic vehicle) is supposed to grow by 49% CAGR in 2022-2030.

Also read: Adani Infra Invests in PSP Projects with 30% Stake.

3 best auto stocks in India

The best auto industry stocks in India are listed below. These stocks are based on market capitalisation.

Mahindra & Mahindra Ltd. (M&M)

M&M Ltd. has different products. Its products include:

- Two-wheelers

- Three-wheelers

- Passenger vehicles

- Commercial vehicles

- Tractors and earthmovers

The company has a very strong global presence across 22 industries, 100+ countries and 150+ entities.

The company has a strong global presence in the automotive sector because:

- M&M is the fourth largest manufacturer in the passenger vehicle segment.

- M&M is the second-largest producer of CV.

- M&M is the largest LCV manufacturer in the domestic market and has a 50% market share.

- M&M leads (21% market share in Q3FY24) in the SUV segment.

- The company gets approximately 50% bookings per month of UVs with only about 10% cancellations. The company’s UV range includes XUV 300, XUV 400, XUV 700, Thar, Bolero and Scorpio-N.

Maruti Suzuki India Ltd.

MSIL is a market leader in the passenger vehicle segment. The company’s primary activities include:

- Manufacturing

- Purchase and sale of motor vehicle components

- Purchase and sale of spare parts.

7 models in the list of top 10 automobile models sold in FY2020 belonged to MSIL (Maruti Suzuki India Ltd.).

A big advantage to the company was its transition to BS-VI (Bharat Stage Emission Standard 6) before its market competitors.

The company focuses a lot on having better products. This is evident in the following points.

- Successful transition ahead of competitors to BS-VI.

- Continuous expansion and improvement of product portfolio.

- The success of existing products.

Such a strong focus on consumer experience is a key reason why it is one of the best auto stocks in India.

LAUNCH OF NEXA

To enter the mid-to-premium segment, MSIL launched its best initiative to date, i.e., NEXA. This category of Maruti cars offers the customer the most premium experience with state-of-the-art technology and buying experience.

With 4000 touchpoints across 1,989 towns and cities, MSIL has the largest network of services in India.

Also read: Best IT Stocks in India for Long-Term Growth.

TATA Motors Ltd.

TATA Motors Ltd. is one of the best auto industry stocks in India.

The company has different products, which include the following:

- Cars

- Sports utility vehicles

- Trucks

- Buses

- Defense vehicles

TATA’s presence in the passenger vehicle segment is strong and illustrious, with successful products and great business strategies.

- The domestic market share of VAHAN in H1FY24 was 13.5%

- TATA Motors commands approximately 75% EV market share with its 287 dealers in 10+ cities in H1FY24. It can be comfortably assumed that whenever the EV market takes off, the TATA group will be the first beneficiary.

The company operates in many places apart from India, resulting in a strong global presence across the UK, South Korea, South Africa, China, Brazil, Austria, Slovakia.

Apart from its production, TATA Motors enjoys a strong network of subsidiaries, associates, and joint ventures.

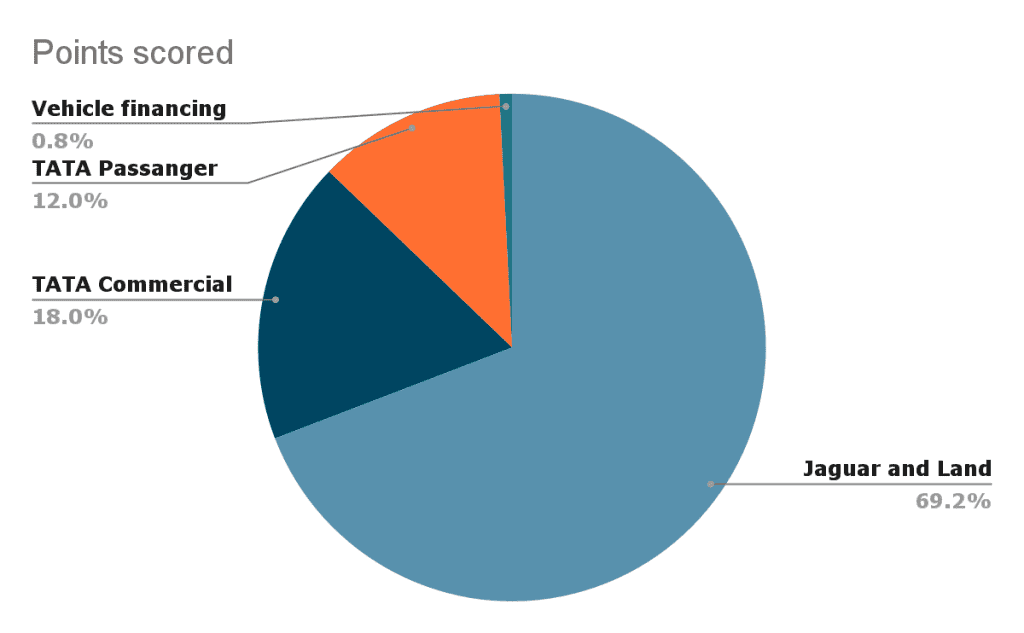

Let us take a look at the revenue mix of the company in FY24.

Source: Screener

Stock comparison

Let us take a look at the fiscal metrics of the best auto industry stocks in India.

| Name | CMP(₹) | P/E | Market Cap.(₹ Cr.) | Div. Yield (%) | NP Qtr.(₹ Cr.) | Qtr Profit Var. (%) | ROCE |

| M&M | 2948.95 | 30.90 | 366710.43 | 0.72 | 3361.06 | 35.05 | 13.58 |

| Maruti Suzuki | 10959.30 | 24.57 | 344563.21 | 1.14 | 3102.50 | -18.06 | 21.82 |

| TATA Motors | 783.20 | 8.62 | 288295.28 | 0.38 | 3450.00 | -12.93 | 20.11 |

Source: Screener as of 2024

Key Takeaways

- The working capital debt of MSIL is low.

- A healthy dividend payout of 36.7%, is maintained by MSIL.

- The return on equity over the last 3 years (12.3%) is also low.

- M&M Ltd. also pays a good dividend.

- The promoter holding of M&M has been reduced to 18.5%

- TATA Motors has reduced its debt over the years.

- A decent profit growth of 93.1% CAGR was earned by TATA Motors over the last 5 years.

- M&M, with the highest market capitalisation, has delivered the lowest ROCE.

Also read: Avoid These Money Mistakes Before You Retire.

Bottomline

All the best auto industry stocks mentioned above are recommended for 2024 investment, considering the following points:

- They hold substantially better market shares and the potential to grow.

- Their function is measured based on indices like,

- Sales

- Profit

- Turnover

These metrics indicate that they can succeed in the upcoming years. However, it is important to carry out proper research and close monitoring of the concerned stocks so that informed decisions are made.

FAQs

- What are the best auto stocks in India?

The best auto industry stocks in India based on market capitalisation are as follows:

- M&M

- MSIL

- TATA Motors Ltd.

These stocks are researched and selected based on market capitalisation. Some other factors which influence stock decisions are as follows:

- Your financial needs

- Your financial goals

- Duration for which you can hold your investment

2. What 5 stocks to buy in India?

When it comes to what stocks you should buy, there are several interlinked parameters at play. Here are the industries which are expected to perform well in the future.

- IT

- Energy

- Healthcare

- FMCG

- Infrastructure

Given the need for sustainability, there is a foreseeable rise in EVs. Therefore, the automobile industry is something to watch out for as well.

However, the big question here is who will dominate the EV space.

- The big automobile giants or

- The start-ups.

3. Which is the No. 1 automobile company in India?

Based on market capitalisation the best stock is M&M Ltd.

Mahindra & Mahindra Ltd. has different products. Its products include:

- Two-wheelers

- Three-wheelers

- PVs

- CVs

- Tractors and earthmovers

The company has a very strong global presence across:

- 22 industries

- 100+ countries

- 150+ entities

4. Which stocks come under Nifty Auto?

The stocks which come under Nifty Auto are as follows:

- Maruti Suzuki India

- Tata Motors

- Bajaj Auto

- Eicher Motors

- TVS Motors

- Ashok Leyland

- Samvardhana Motherson International

- M&M Ltd

- MRF Ltd

We have curated detailed research on Maruti Suzuki India Ltd and TATA Motors Ltd. The research is complete with top picks, trends, facts, analysis and much more.

5. What are the top 3 car brands?

The top 3 car brands are as follows:

- M&M Ltd.

- Maruti Suzuki India Ltd.

- TATA Motors Ltd.

These are the top car brands because of the following reasons:

- They dominate significant market share.

- They are usually profitable and have strong sales.

- They are the biggest producers in the country.