The telecoms sector in India is the second-largest globally, boasting a consumer base of 1.091 billion in April 2024 (wireless + wireline subscribers). The teledensity for the entire country is 85.76%, with rural areas – where there are still many potential customers waiting to be tapped into – having a teledensity of 59.44% and urban areas having a teledensity of 133.42%.

Among the many players in India’s cutthroat telecommunications industry are Bharti Airtel and Vodafone Idea, both of which have made huge contributions to shaping this field by offering new services and striving towards technological advancements.

In terms of market share battles, it is worth considering what sets these two giants apart from each other based on their strengths as well as strategies employed so far while competing for dominance within different regions served alongside performance levels achieved, thus giving an overall comparison between Bharti Airtel vs Vodafone Idea.

Also read: Telecom industry in India: An overview of growth and opportunities

Company profiles

Bharti Airtel

Bharti Airtel Limited is a well-known telecommunication company based in New Delhi, India. As per customer numbers, it stands among the top three worldwide mobile operators. The company has a presence all over the USA, Europe Africa, the Middle East, Asia Pacific, India and SAARC regions providing ICT services to millions of people.

Airtel serves across 2G, 3G, 4G & 5G ready networks throughout India with many other products like wireless services, mobile commerce, fixed line services, high-speed broadband for homes & enterprise customers and DTH which is a Direct-to-Home TV broadcast service and many more across 700 cities pan-India.

The organisation ensures better customer experience by having undersea cable systems alongside satellite links connecting more than 365,000 RKMs (Route kilometres) in fifty countries on five continents thereby, guaranteeing uninterrupted access to infrastructure all day long as well as ensuring better quality services.

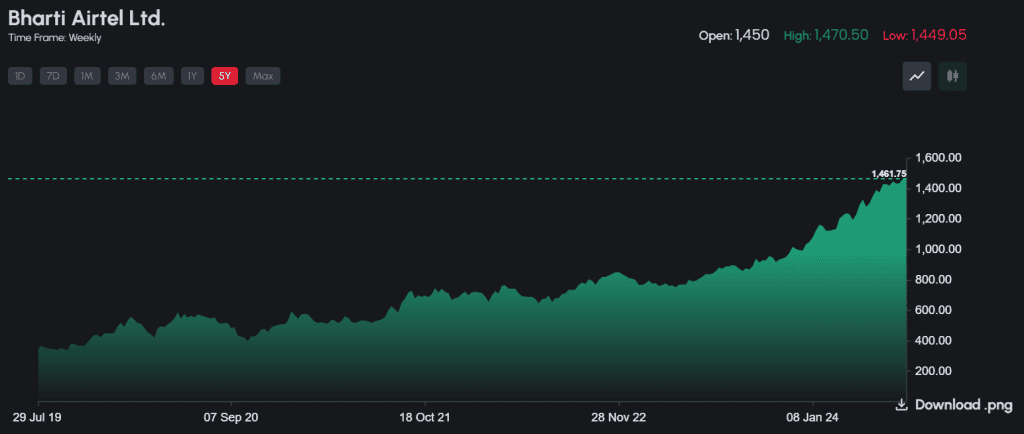

Bharti Airtel share price news

As of July 22, 2024, the Bharti Airtel share price NSE is ₹1,461.75. Looking at the Bharti Airtel share price history, the return given by the stock for the past 5 years is 329.77%.

Across its various plans, Bharti Airtel has announced a tariff hike of 10–20% effective from July 3, 2024. This step is anticipated to enhance returns and enable the company to continue investing in network expansion and improvement.

Consequently, Prabhudas Lilladher has revised its target price for Bharti Airtel shares to ₹1,620 from the earlier target of Bharti Airtel share price ₹1,373. The stock should be “accumulated” because the researchers have faith in the financial position of the company and its potential for growth within India.

Must read: Understanding the basics of the broking industry and its recent trends

Vodafone Idea (Vi)

One of the major telecom service providers in India is Vodafone Idea. The Company’s business consists of Mobility and Long Distance Services, trading on handsets and data cards. Voice services, broadband services, enterprise services, content services and other value-adding services offerings like entertainment, utility etc form part of the company’s business.

Vi will be deploying new technology across 3000 sites in Kolkata to expand its network infrastructure for better indoor coverage, improved call quality and faster data speeds. Vi now has a total spectrum portfolio of 334.4 megahertz in Kolkata and 536.8 megahertz in West Bengal.

This particular move by Vi is part of an overall broader strategy aimed at upgrading its network infrastructure which was supported by a successful ₹18,000 crore Follow-on Public Offering (FPO).

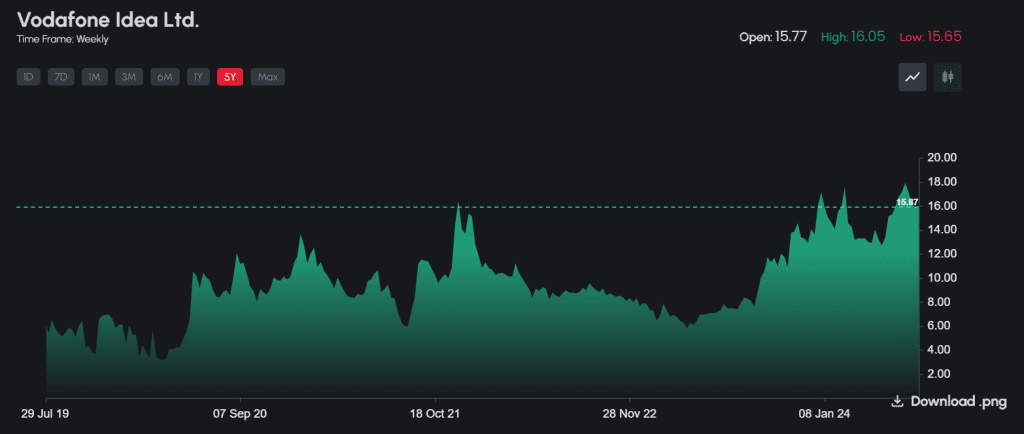

Vodafone Idea share news

In the Vodafone Idea shares latest news: As of July 22, 2024, the Vodafone Idea share price NSE is ₹15.87. Today, the Vodafone Idea share price hit a 52-week low of ₹15.65.

Looking at the Bharti Airtel share price history, the return given by the stock for the past 5 years is 45.84%.

Geojit Financial Services has given Vodafone Idea share price a “hold” rating with a revised Vodafone Idea share target price of ₹16.4.

Despite the growing net loss, given the improved ARPU (average revenue per user) and a better mix of subscribers, this rating is suggested. Its follow-on public offer was responded to positively by the company indicating that there are signs of recovery as well as plans for expanding network infrastructure, including rolling out 5G services in six months from now.

Financial profiles

Let’s compare the key financial metrics for both companies – Bharti Airtel vs Vodafone Idea.

| Bharti Airtel(For the year ending March 2024) | Vodafone Idea(For the year ending March 2024) | |

| Revenue (₹ crores) | 149,982 | 42,652 |

| Operating profit (₹ crores) | 78,292 | 17,120 |

| Profit before tax (₹ crores) | 12,679 | -30,410 |

| Net profit (₹ crores) | 8,558 | -31,238 |

| Earnings per share (₹) | 13.20 | -6.23 |

| Market cap (₹ crores) | 8,66,720 | 1,06,977 |

| ROCE (%) | 13.1 | -3.56 |

Comparative analysis of spectrum holding and subscriber base:

| Spectrum holding per mn subs (megahertz) | Vodafone Idea | Bharti Airtel |

| Spectrum excl 5G per mn subs | 8.5 | 6.6 |

| All spectrum which can be utilised towards 4G | 1,812.8 | 2,338.4 |

| Subscribers (in million) | 213.0 | 352.0 |

| Spectrum excl mmWave per mn subs | 12.5 | 12.9 |

| All spectrum except 26 gigahertz | 2,661.6 | 4,538.4 |

| 5G spectrum per mn 4G subs | 6.7 | 8.7 |

| 700MHz and 3300 MHz to offer 5G services | 850.0 | 2,200.0 |

Source: Vodafone Idea Limited – Investors Presentation for Q4FY24

Further reading: Connecting communities: A mobile broadband case study

Reasons for growth

Bharti Airtel

- Solid execution: The company has been successful in driving growth across all its business segments due to effective execution strategies.

- 5G expansion: Network capabilities have been improved through the deployment of 43,100 network sites and 55,982 kilometres of fibre that have seen rapid rollout of 5G technology.

- ESG initiatives: Sustainability efforts by the firm have been recognised such as winning awards for being the most sustainable developing market telco and making strides in diversity and environmental initiatives.

- Financial management: A strong financial performance with continuous improvement in revenue, better EBITDA (Earnings before interest, tax, depreciation, and amortisation) margins and a significant decrease in debt.

- Bharti Airtel market share: Performance is based on excellent execution, which is why all business areas are growing steadily. Bharti Airtel has reached a new high in revenue market share.

Vodafone Idea

- Successful fundraising: Raised ₹180 billion through FPO, with additional equity contributions and debt discussions in progress.

- Strategic investments: Concentrated on enhancing 4G coverage, investing in 5G and other enterprise services.

- Brand and market initiatives: A strong brand campaign, launching innovative products and comprehensive marketing activities.

- Operational efficiency: There has been consistent growth in the ARPU and the number of 4G subscribers, enhanced EBITDA as well as effective cost control.

Company strategies

Bharti Airtel

- Winning with quality customers: Focus on expanding the fibre presence and penetration of convergence offers as well as leveraging digital targeting capabilities.

- Delivering a brilliant customer experience: Improve infrastructure, enhance digital and network experiences, and ensure high-quality service delivery.

- Incubating new digital businesses: Investing in digital services such as Airtel IQ, Internet of Things (IoT), Cloud and Airtel Finance whilst utilising their Converged Data Engine for better data management.

- War on waste: Optimise costs by reducing network costs through stringent execution and leveraging digital tools.

Vodafone Idea

- Focused investment approach: The firm has plans to invest about 500-550 billion for the next three years to expand its 4G coverage, introduce 5G services and develop its business in the enterprise area.

- Market initiatives: Vodafone Idea is running a campaign and also launching innovative products to promote the brand Vi. They want to improve customer experience as well as increase average revenue per user.

- Business services: The company is changing from being a telecoms company to a technology-based organisation which provides more than just connectivity such as rich business messaging services and IoT solutions.

- Digital revenue streams: Through strategic alliances, Vodafone Idea is creating a digital ecosystem that focuses on digital engagement by monetising through Vi App having forms of entertainment, gaming, utility bill payment services and others.

Bottomline

Within the telecommunications industry in India, there are two distinct narratives; Bharti Airtel and Vodafone Idea. Due to strong financial performance, strategic investments, and a customer-centric approach, Bharti Airtel stands as one of the leading firms with a promising future. However, despite facing some challenges, Vodafone Idea can turn around its fortunes by making strategic investments and undertaking market initiatives.

As technology advances and consumer demand increases in the sector, competition between these two companies will continue to be significant in shaping the way forward for Indian telecommunications.