The BSE SME IPO index recently recorded a significant recovery, scaling new highs in April with a market capitalisation of ₹1.55 trillion. This marks a considerable turnaround from its performance in March.

We’ll go through the main causes of its comeback in this blog. For what reason did the preceding decline reverse itself in April? Let’s find out.

What is the BSE SME IPO index?

96% of all industrial units in India are small and medium-sized enterprises (SMEs), which are essential to the country’s economy. They contribute to both employment and entrepreneurship in the nation. India currently has 633.9 lakh MSMEs, demonstrating the size of the industry.

New SME IPOs are consistently introduced within this segment. The number of companies going public has risen from 125 to 205 this year. The BSE SME IPO index tracks the performance of these BSE SME IPOs once they are listed on the BSE SME platform.

As of April 24 2024, the index includes around 59 companies. Companies that debut on the BSE SME platform are added to the index on the second trading day following their listing. Once a company has been listed for one year post-IPO, it is removed from the index. The index is required to have at least 10 stocks at all times. To ensure this minimum count is maintained, the removal of a constituent is postponed until a new company is added to the index.

Listed in December 2012, this index offers a focused gauge of how these companies fare in the public market post-IPO, reflecting their ongoing financial health and market valuation.

Historical performance

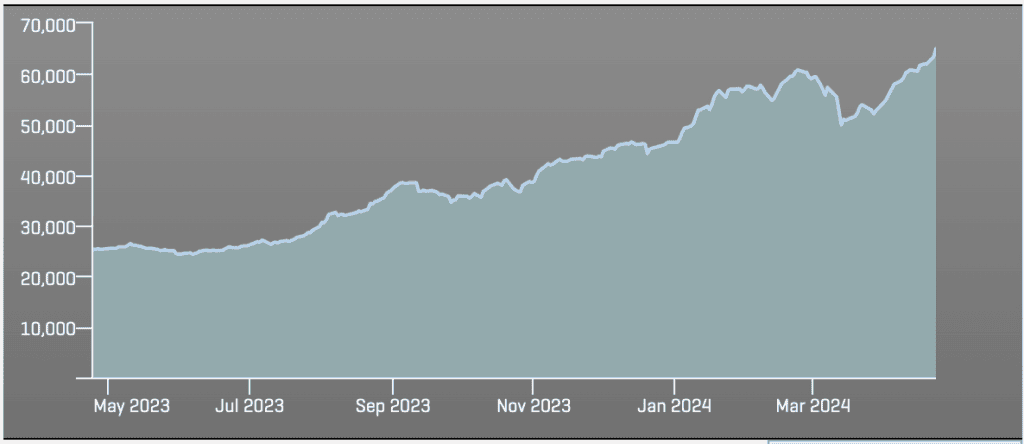

When we look at the BSE SME IPO index chart, in March, the index experienced a notable drop, declining from 59,395.21 points to 52,725.41 points. However, it rebounded significantly, reaching a record high of 65,046.2 points on April 23, 2024 from 25,294 points on April 24, 2023. This marked an impressive one-year return of 161.95%.

Source: Asia Index as on 24.4.2024

The index’s daily performance was also strong, gaining +2.59% in just one day. On a month-to-date (MTD) and quarter-to-date (QTD) basis, the index surged by 23.37%. From the beginning of the year (YTD), the index has seen a substantial increase of 39.80%.

In contrast, the broader benchmark Sensex index closed at 73,738.44, up by 89.82 points.

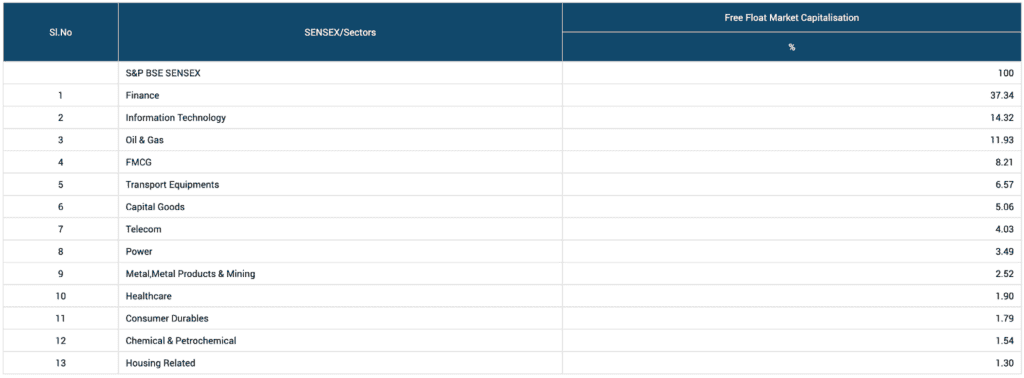

Sector-wise, the top contributors to market capitalisation are Finance, IT, and Oil & Gas, highlighting the diverse strength across these leading sectors.

Source: BSE

Why did the S&P BSE SME IPO index slump in March?

In March, the BSE SME IPO index experienced an 11.2% decline. This drop was influenced by concerns from the Securities and Exchange Board of India (SEBI) chairperson, Madhabi Puri Buch, regarding the high valuations of small-cap and mid-cap stocks. These sectors had outperformed the benchmarks substantially since the start of the year.

The inflow into small-cap funds was particularly notable, with a total of ₹41,035.49 crore in 2023, leading to returns averaging 41%. Such robust performance sparked worries about the market potentially overheating and the need for closer regulatory oversight. Additionally, feedback to SEBI suggested that certain market practices related to SME listings could be problematic.

To address these issues, Buch announced the implementation of an optional T+0 settlement system starting at the end of March. This system allows for same-day settlement of stock trades, aiming to curb any unfair advantages in ‘grey’ market activities and maintain market competitiveness.

SEBI also took preventive measures by instructing mutual funds to carefully evaluate the implications of large, lump-sum investments into small- and mid-cap funds. Furthermore, from March 15, mutual funds were directed to publish the results of stress tests on these funds to better understand the liquidity risks during periods of market stress.

Stress tests are analyses conducted under hypothetical scenarios to check how easily they can sell stocks without losing money. It’s important because it helps ensure that the fund can handle investors wanting to withdraw their money without having to sell stocks at much lower prices.

These steps are part of broader efforts to temper excessive speculation and ensure investor protection in volatile market segments.

Key contributors to the current rally

In less than two weeks, small-cap stocks in India experienced a significant decline, shedding more than $80 billion in market value, following the regulators’ announcements. These events notably dampened investor sentiment.

Despite the initial downturn, the index did not succumb to market pessimism. In March alone, 28 companies raised ₹954 crore through IPOs on the SME exchanges, marking a notable increase from the previous fiscal year.

Hence, in April, the BSE SME IPO formed a significant recovery, surging by 19% and reaching an all-time high. This rally suggests a rebound in investor confidence in the SME sector, indicating a robust return of interest and capital into these markets.

Additionally, specific companies played pivotal roles in driving the index’s rebound. Here’s an overview of the key contributors:

| Company | Contribution to BSE SME IPO Index Increase |

| Bondada Engineering Ltd | 22.80% |

| KP Green Engineering | 12.40% |

| Insolation Energy | 8.00% |

| Meson Valves India | 7.50% |

| Cosmic Crf | 5.60% |

| CFF Fluid Control | 5.30% |

| Khazanchi Jewellers | 5.00% |

| PNGS Gargi Fashion Jewellery | 4.90% |

| Amic Forging | 4.80% |

| Veefin Solutions Ltd | 4.20% |

Source: Mint

Bottomline

In conclusion, the S&P BSE SME IPO index’s strong recovery in April, reaching new highs, reflects renewed investor confidence in India’s SME sector. The index showed remarkable resilience and recovery in spite of a challenging March that was impacted by regulatory worries and considerable market movements.

This tenacity demonstrates the SME market’s dynamic character and ability to bounce back quickly from setbacks. It is recommended that investors maintain awareness of the industry’s volatility and any regulatory changes that may impact it, and exercise caution. For astute investors, the SME market’s ongoing transformations offer both opportunities and challenges.