The Union Budget 2024 is receiving varied opinions. This year’s focus areas are: employment, skilling, medium & small scale businesses, and lastly the middle class.

For the commoner there’s a mix of hope and scepticism. Price cuts on essentials might ease some financial pressure, but how significant will this relief be? Let’s understand how the Budget 2024 impacts the common man.

You may also like: In Nirmala Sitharaman budget 2024: What it means for you

Major changes in Income tax: Budget 2024

Revised income tax slabs

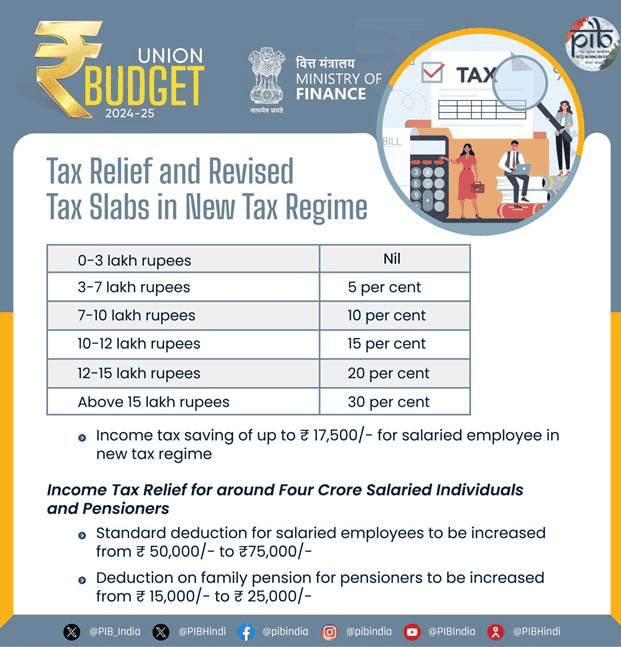

In Budget 2024, tax slab revamps have been made to the new tax regime. Earnings up to ₹3 lakh are exempt from tax. Income between ₹3-7 lakh will be taxed @5%, ₹7-10 lakh @10% tax rate, ₹10-12 lakh is taxed at 15%. For ₹12 lakh to ₹15 lakh, the rate is 20%, and for income exceeding ₹15 lakh, it is 30%.

Source: PIB

You may also like: Old vs. New – Which income tax regime is better for FY 2023-24?

Enhanced standard deduction

Salaried who chose the newer system will benefit from an increased standard deduction, which has risen from ₹50k to ₹75k. This measure aims to reduce the tax burden for about 4 crore salaried individuals and pensioners potentially saving them ₹17,500 annually.

Increased family pension deduction

The deduction limit for family pensions has been raised from ₹15000 to ₹25000. This change provides additional relief for pensioners dependent on family pensions.

Boost to National Pension System (NPS)

The deducted amount for the NPS payment made by the employer went from 10% to 14%. This increase is intended to benefit both government and private sector employees, promoting better retirement savings.

Streamlined Income Tax Act

A thorough review of the Income Tax Act aims to streamline tax compliance. This initiative seeks to make the tax system more accessible for the common man, especially for those opting for the new tax regime.

Source: Budget 2024- Key Features

Tax Deducted at Source (TDS)

The TDS rates are also revised, reducing many payments from 5% to 2%. E-commerce platforms see a significant cut in their rate, dropping to 0.1% from the previous 1%.

Credits for tax collected at source or TCS can now offset against salary deductions, easing the tax burden. Additionally, the government has decriminalised delays in remitting these taxes up to the filing deadline. Expect new simplified guidelines for handling defaults.

Also read: What is TDS? A complete overview of TDS in income tax

Budget 2024 highlights: What’s cheaper and what’s not?

| Cheaper | New customs duty | Costlier | New customs duty |

| Mobile phones and accessories | 15% | Plastic and related goods (non-biodegradable) | 10% |

| Precious metals | 6% for gold and silver, 6.4% for platinum | Ammonium nitrate | 10% (up from 7.5%) |

| Cancer medicines (3) and X-ray equipment | Exempt | Telecom equipment | 15% (up from 10%) |

| Fish and fish products | 5% | Imported garden umbrellas | Increased |

| Essential metals and minerals (25) | Exempt | Laboratory chemicals | Increased |

| Solar panels | Exempt | ||

| Leather goods | Reduced |

Source: India Budget 2024-25

Impact of Budget 2024 on your portfolio

Changes in capital gains tax

- Long-term capital gains or LTCG tax: Hiked to 12.5% from 10%.

- Short-term capital gains/ STCG tax: Raised to 20% from 15%.

- Exemption limit: Increased to ₹1.25 lakh annually for LTCG.

- Indexation benefits: Eliminated, affecting long-term investments.

Effect on Securities Transaction Tax (STT)

- STT on Futures: Now at 0.2%.

- STT on Options: Raised to 0.1%.

- These increases mean higher costs for frequent traders and large portfolios.

Impact on mutual funds

- Equity and hybrid funds: LTCG benefits after 24 months if over 65% equity exposure.

- Indexation loss: Funds with 35-65% equity lose benefits if held over three years.

- Gold mutual funds, ETFs, and international schemes: Regain LTCG tax benefits.

- Debt mutual funds: Taxation unchanged.

TDS modifications

- 20% TDS on mutual fund repurchase: Withdrawn from October 1, 2024.

- Before October 2024: Redemptions over ₹1 lakh faced 20% TDS.

- Post-October 2024: No TDS on mutual fund redemptions. Investors must still handle capital gains tax calculations during tax filing.

More key announcements from Budget 2024 news

- Taxation reforms: The ANGEL Tax, which was charged on investments in startups, is now gone for all investors. This change should help startups grow. Foreign companies also get a break. Their corporate tax is now @35%, down from 40%

- Upgrading ITIs: 1000 Industrial Training Institutes will be upgraded to improve technical education and job readiness among youth.

- Space sector investment: To grow the space economy 5x over the next decade, a venture capital fund of ₹1000 crore will be invested.

- Rural infrastructure boost: The sum totalling around ₹2.66 lakh crore have been set aside for rural growth, with emphasis placed on enhancing living conditions and infrastructure.

- Support for agriculture: For agriculture & related, ₹1.52 lakh crore has been budgeted. This pertains to the introduction of 109 crop varieties that are both climate-resilient as well as highly yielding.

- Women-centric schemes: Programs supporting women & girls have received about ₹3 lakh crore in funding, with the goal of promoting women-led development.

- Increased Mudra loan limit: With the rise in the Mudra loan limit from ₹10- ₹20 lakh, small enterprises would receive more financial assistance.

- Internship opportunities: An innovative programme would assist close the skills gap between education and work by providing internships in 500 elite companies over a 5-year period.

- Urban housing investment: One crore urban poor & middle-income people would have their housing requirements met with investments of ₹10 lakh crore under the second version of PM Awas Yojana Urban .

- Eastern region development: Growth of east states like Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh would be the main goals of the Purvodaya plan.

Bottomline

The Budget presents a mixed bag of opportunities & challenges for the common man. Tax cuts and increased deductions offer some relief, but the increased capital gains tax makes investments less attractive. The real impact will depend on the effective implementation of these measures, balancing hope with cautious optimism.