Finance Minister Nirmala Sitharaman, having presented the interim budget in February, is now getting ready to deliver her seventh consecutive budget. With the new government reaffirming its mandate in the recent Lok Sabha elections, all eyes are on the Union Budget for FY25. The big reveal is set for July 24.

Anticipation is palpable as sectors await clarity on the government’s strategic priorities. A significant thrust on infrastructure, especially in the railway sector, is expected. What transformative measures and investments will this budget introduce? Which stocks are ready to take the limelight? Dive in to explore the possibilities.

Interim budget 2024 highlights

Capital expenditure was increased by 11.1%, bringing the total to ₹11.11 lakh crore for FY25. This boost aims to accelerate infrastructure projects, especially in railways, road transport, and highways, which have already utilised an 85% portion of their FY24 allocations up to December.

Key departments saw substantial funding. Defence received ₹6.2 lakh crore. ₹2.13 lakh crore for consumer affairs, food & public distribution, and ₹2.03 lakh crore for home affairs. Particularly road transport & highways got ₹2.78 lakh crore, while the railways secured ₹2.55 lakh crore.

The fiscal deficit target is now 5.8% of GDP. Gross borrowing is estimated at ₹14.13 lakh crore, with net borrowing at ₹11.75 lakh crore. This is to support economic growth while keeping fiscal discipline.

Tax structures did not change. However, benefits for start-ups and investments by sovereign wealth & pension funds were extended until the end of March 2025. Total revenue receipts for FY25 are projected at ₹30 lakh crore, showing strong growth.

The allocation homes four key areas, which are the reduction of poverty, empowering young people, farmer assistance & the growth of women. New schemes have been rolled out to bolster these areas.

Also read: India’s billion-dollar infrastructure industry: How to invest in it?

Railways in budget 2024

The railway budget 2024 unveils a forward-looking plan for upgrading rail infrastructure and services. Over the next five years, capital expenditure is set to jump by 76%, reaching ₹2.55 lakh crore.

The upcoming budget is expected to keep strong financial backing for the railways sector, even with calls to slow down infrastructure spending. This glaring increase aims to enhance logistics, with a focus on better rail-road connectivity, dedicated tracks for coal and mineral transport, and reducing congestion.

In the February budget ₹2.52 lakh crore allocated for railways through gross budgetary support (GBS), along with an extra ₹10k crore from extra-budgetary resources (EBR). Officials suggest that GBS might not only be maintained but could also potentially increase, signalling a robust focus on railway development.

In recent years, the reliance on GBS for capital expenditure has grown, while the share of EBR has lessened. Funds from the Indian Railway Finance Corporation (IRFC), institutional financing, public-private partnerships, and foreign direct investment (FDI) are among the sources of funding for EBR. While EBR allows for delayed investments, the emphasis on GBS highlights the need for immediate spending.

Here are some of the major schemes and initiatives announced in the interim budget:

- Passenger services are in for a major boost. The railway ministry plans to roll out 250 Amrit Bharat Trains over the next 5-7 years, targeting high-demand routes with general and sleeper class coaches. This year, 25 such trains will be launched.

- New sleeper versions of Vande Bharat Trains will start trials by mid-August, with six set to run on long routes like Mumbai to Delhi and Chennai. Vande Metro trains will improve intercity travel on shorter routes.

- On the digital side, the IRCTC Super App is being developed to attract new customers, especially in the freight and parcel sectors. Investment in the Container Corporation of India (Concor) will also increase, adding more wagons to the freight network.

- Safety is a top priority, with significant funds allocated for the KAVACH system. This automatic train protection technology will cover 4,500 km of the rail network in the next fiscal year. KAVACH ensures safe train operations by automatically applying brakes if speed limits are exceeded or if drivers fail to respond, especially in low-visibility conditions.

You may also like: 1853 to 2023: A case study on Indian railways, its birth and growth

Key beneficiaries

Industry experts are noting a shift towards investment in infrastructure & railways as many road and highway projects near completion. At the same time, the railway sector has seen a rise in significant orders, which has boosted investor confidence.

This optimism is also driven by the sector’s strong earnings potential and the ambitious capital expenditure plans of Indian Railways. These initiatives are attracting substantial interest from investors, paving the way for ongoing growth and innovation.

Companies like IRCON and NBCC are positioned to potentially benefit from this growth.

IRCON

Ircon International Limited started in 1976. Back then, it mainly focused on building railroads. Over the years, it has changed. It has evolved into a comprehensive engineering and construction venture within the public sector, managing intricate infra projects in multiple domains, such as highways and railroads.

As of March 2024, IRCON’s order book predominantly features railway projects, which constitute 77.8% of its total orders. Highway projects make up 21.9%, with the remaining 0.3% in other sectors.

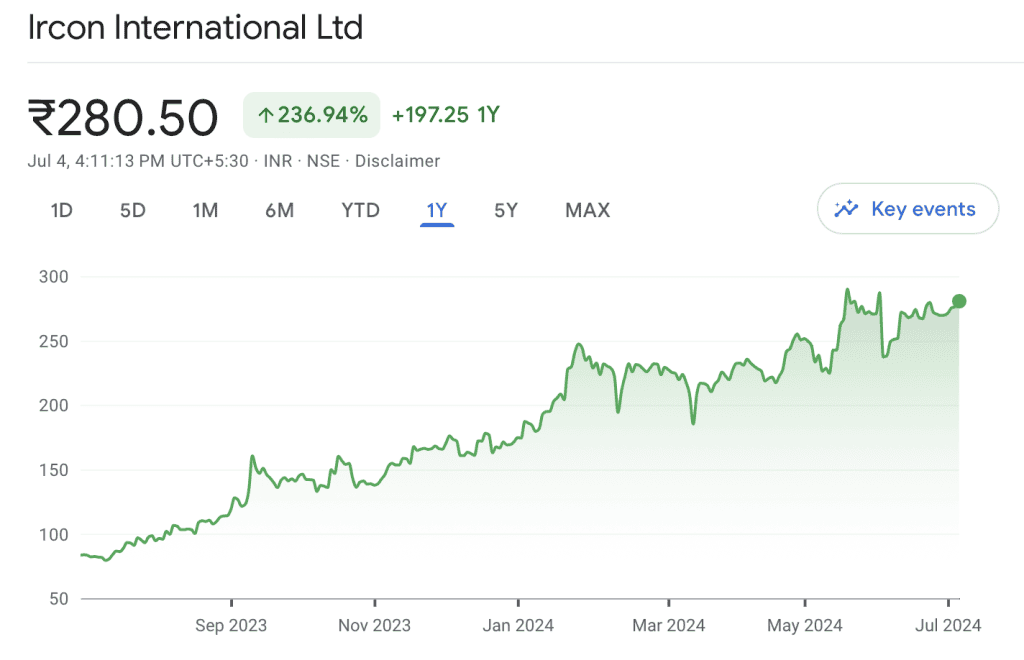

In the recent IRCON share news, as of July 4, 2024, its share price is ₹280.5.

Over the past year, IRCON share price has increased by nearly 237%.

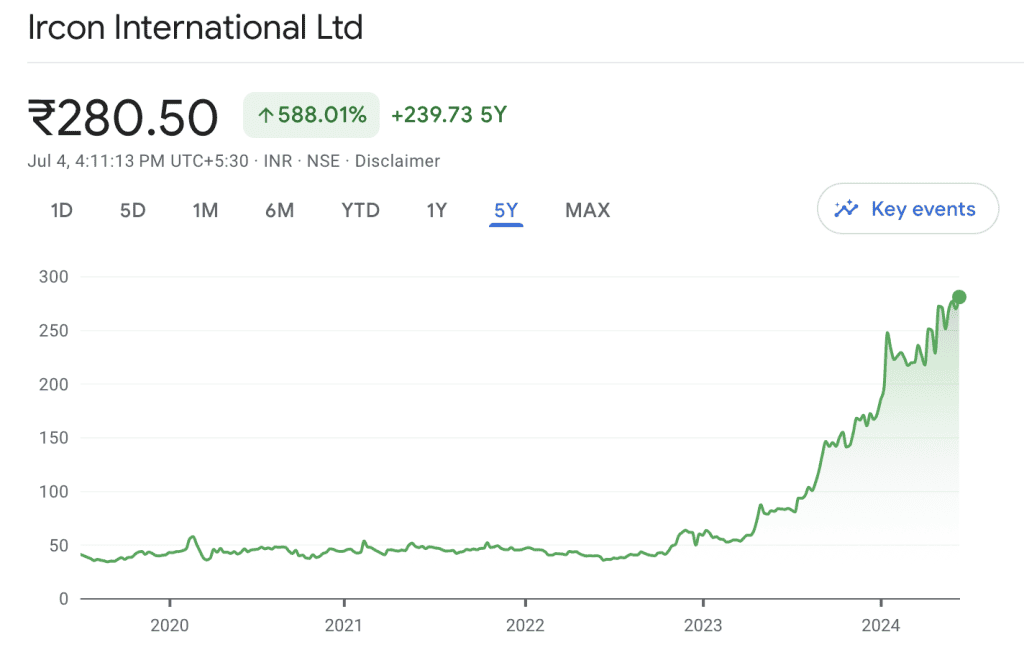

And when we look at the IRCON share price history over the past five years, it has surged by 588%.

NBCC

This Navratna enterprise under the Ministry of Housing and Urban Affairs, operates in project management, EPC i.e., Engineering Procurement & Construction, and real estate.

The company won a new business during the last financial term valued at ₹23.5k crores, indicating a 250% increase. In the upcoming year, the company anticipates a top-line of ₹12.5k–13.5k crores, with order inflows of around ₹25k crores.

The NBCC share news has been remarkable.

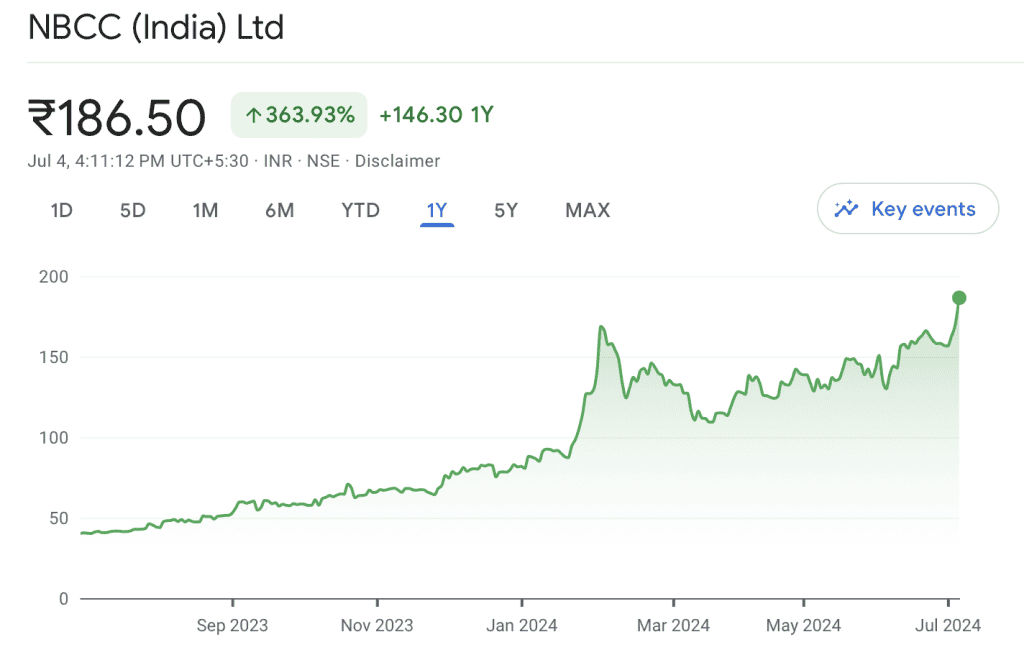

When we look at the NBCC share price history, over the past year, the stock has increased by nearly 364%.

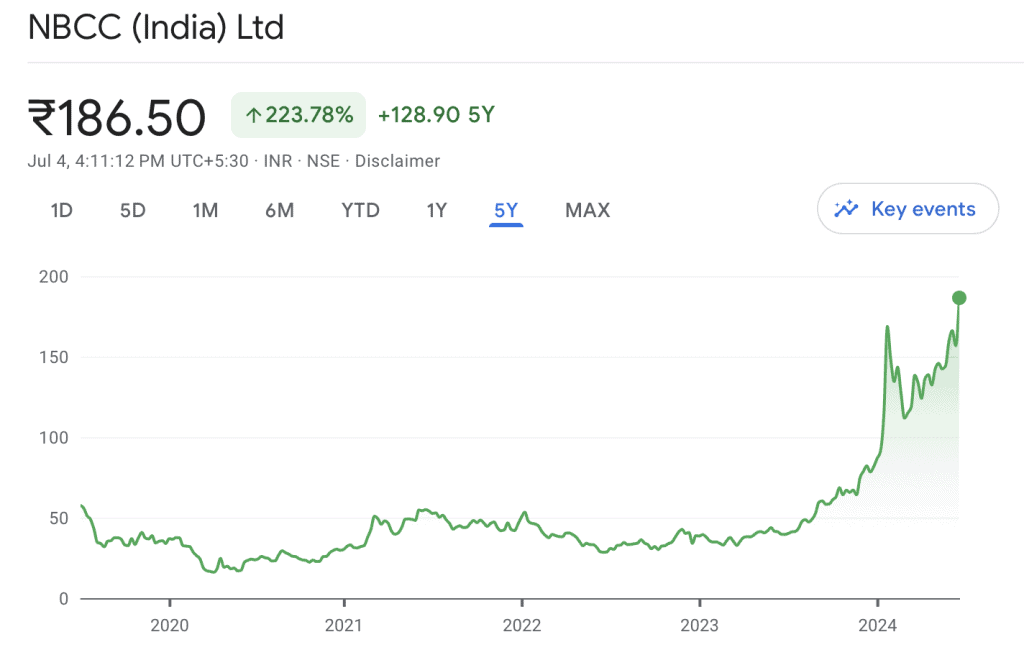

And for the past five years, it has risen by 223.78% and the NBCC share price is ₹186.5.

Also read: In Nirmala Sitharaman budget 2024: What it means for you

Bottomline

Budget FY’25 seeks to boost the railway sector, creating significant opportunities for companies in the sector. With large capital expenditure plans and an emphasis on modernising infrastructure, the next fiscal year looks set to bring considerable growth and progress to the industry.