India’s automotive industry is among the major contributors to its economy. From when this sector was liberalised in 1991 to now where 100% FDI has been allowed through automatic route, the Indian auto industry has come a long way. In the country, there exist many leading global automakers. By the end of the year 2024, India expects to increase its automotive industry by about ₹15 lakh crore.

Comparing MRF with CEAT extends beyond two titans going head to head. It is about appreciating their strategies, splintering down their growth paths as well as revealing their winning formulas.

Also read: Rise of automobile industry in India

Company profiles

MRF (Madras Rubber Factory) Ltd

MRF Limited is a well-known Indian company based in Chennai that specialises in manufacturing rubber products. Since its establishment in 1960, due to their exceptional quality tyres and innovative solutions, MRF has become one of the leading tyre companies globally. The company is listed on stock exchanges like NSE and BSE.

MRF offers a wide range of tyres for different vehicles e.g. cars, motorcycles, trucks and buses among others. Further, it also produces tubes; flaps as well as tread rubbers. MRF whose business sustainability policy includes extended producer responsibility (EPR) compliance with waste tires regulations, has various initiatives towards sustainable development aimed at reducing its ecological impact.

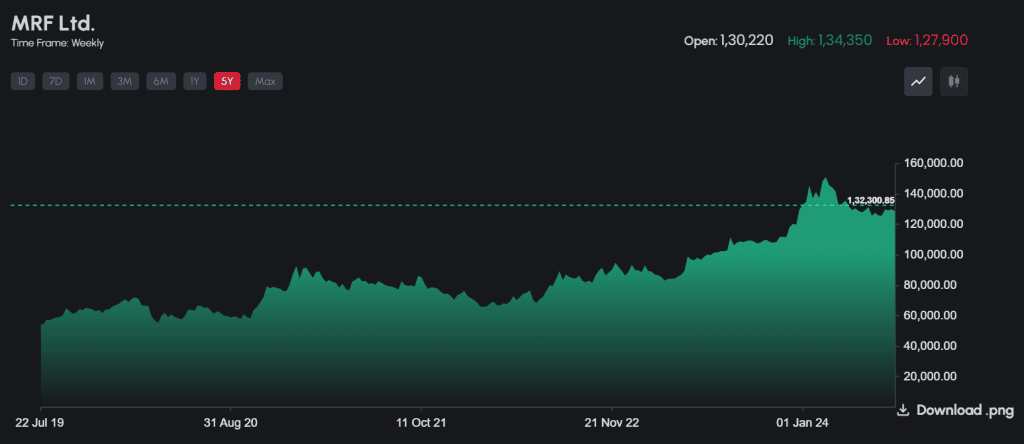

MRF tyre share rate news

As of July 19, 2024, the MRF share price is ₹1,28,399.50. Looking at the MRF share price history, the return given by the stock for the past 5 years is 131.39%.

Motilal Oswal recommends a Sell rating for MRF tyre share price with a target MRF share price NSE of ₹92,000. This target reflects a valuation of 18 times the expected earnings per share (EPS) for March 2026, indicating a potential downside of 28% from the current market price.

The recommendation is based on MRF’s weak operational performance, higher raw material costs, and recurring EPR provisions, which are expected to continue impacting EBITDA (Earnings before interest, tax, depreciation, and amortisation) margins negatively.

Must read: Understanding the basics of the broking industry and its recent trends

CEAT Ltd

CEAT Limited, India’s major tyre producer, is the flagship company of RPG Group. It was established in 1958 and has its head office located in Mumbai; it operates worldwide.

The company manufactures over 140,000 tyres per day and offers a range of products for various vehicle groups such as heavy-duty vehicles including trucks and buses, light commercial vehicles (LCVs), earth-movers, forklifts, tractors, trailers, passenger cars automobiles, motorcycles bikes, scooters bikes and auto-rickshaws.

This innovation-oriented premium brand has been known for its high-quality services that cater for all consumer needs. It produces some finest radial tyres for various types of vehicles which provide excellent performance standards in terms of durability and safety. In its product development goals towards sustainability and improvement of performance, CEAT shows considerable commitment to quality.

The CEAT tyres market share in India is 16% (passenger market) as of January 25, 2024.

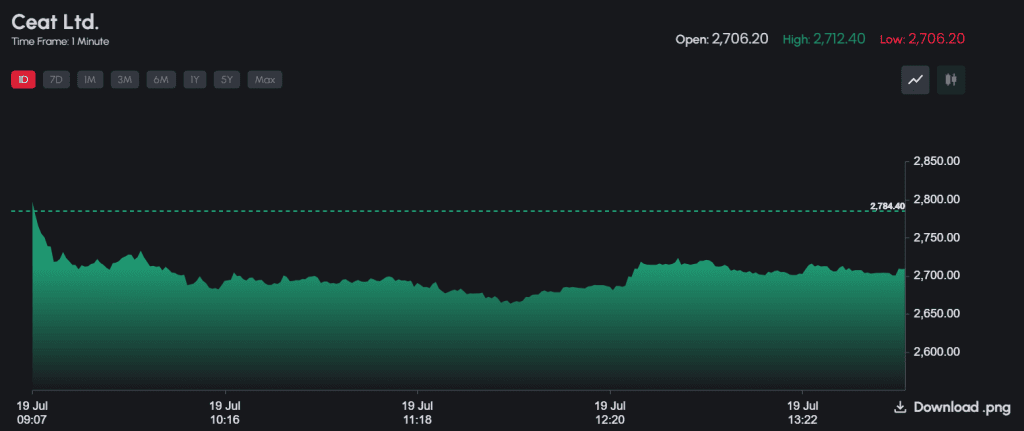

CEAT Tyre share price news

As of July 19, 2024, the CEAT share price is ₹2,784.40. Looking at the CEAT share price history, the return given by the stock for the past 5 years is 205.67%.

Motilal Oswal recommends a buy rating for the CEAT tyre share rate with a target CEAT tyre share rate of ₹2,930, representing a potential upside of 19% from the current market price.

This recommendation is based on several factors including CEAT’s strategic focus on increasing its brand presence within the domestic replacement segment and raising export sales while maintaining caution as to capital expenditure.

CEAT and MRF financial profiles

Let’s compare the key financial metrics for both companies – CEAT vs MRF.

| MRF(For the year ending March 2024) | CEAT(For the year ending March 2024) | |

| Revenue (₹ crores) | 25,169 | 11,943 |

| Operating profit (₹ crores) | 4,272 | 1,652 |

| Profit before tax (₹ crores) | 2,787 | 836 |

| Net profit (₹ crores) | 2,081 | 635 |

| Earnings per share (₹) | 4,907.26 | 158.87 |

| Market cap (₹ crores) | 54,515 | 10,973 |

| Price to earning | 27.7 | 16.1 |

| Debt to equity | 0.17 | 0.44 |

| ROCE (%) | 16.1 | 20.1 |

MRF vs CEAT: Reasons for growth

MRF

- Revenue growth: The company made ₹24,986 crore in total revenue during the financial year 2023-24 which was achieved by expanding production in nearly all product categories.

- Profit increase: Profit before tax increased to ₹2,739 crore during the FY 2023-24, while profit after tax went up to ₹2,041 crore due to cheaper raw materials and better profit margins.

- Product development: New offerings were introduced for OEMs as well as after-sales markets through both bias and radial segments thereby consolidating its market position.

- Export performance: In critical areas of trade, where a large part of sales takes place abroad, volumes and income were maintained despite difficulties.

CEAT Ltd

- Strong demand: India has shown strong demand in the replacement market and exports, while the Middle East, Brazil and Europe have experienced remarkable growth.

- Operational efficiency: CEAT kept its margins steady as well as generated strong amounts of free cash flow (₹857 crores during the FY 2024), achieved through operational efficiencies across different segments where it also maintained pricing.

- Strategic investments: This included continuous investments into premium categories such as marketing ventures and expansion plans which involve establishing a huge electric vehicle presence alongside penetrating international markets.

- Financial health: The business recorded good levels of profitability, high debt coverage ratios based on EBITDA multiples, and substantial reductions in borrowings thereby contributing towards overall financial stability.

You may also like: Financing your next car purchase? India’s auto finance sector and lenders

MRF vs CEAT: Company strategies

MRF

- Human resources: MRF honours its workers. The company’s main priority is to employ the best people and to keep them by supporting their growth in a respectful atmosphere of teamwork. These training programs promote leadership skills and team cohesiveness, making the workforce agile and resilient. There were 19,209 people employed as of March 31, 2024.

- Corporate governance: MRF adheres to good corporate governance principles which are fairness, transparency, accountability and ethics. It ensures that necessary information is disclosed on time while promoting cooperation among stakeholders for sustainable development.

- Sustainability and compliance: MRF’s focus lies in sustainability where it addresses environmental concerns alongside social ones plus governance issues. Moreover, they follow rules set by authorities thus dealing with problems fairly when handling them this company documents everything on the Business Responsibility & Sustainability Report.

CEAT Ltd

- Focus on electrification: CEAT is growing in the electric vehicle (EV) sector, and it has secured a large share of the two-wheeler and passenger EV market in India. It plans to collaborate with Tata and Volvo Eicher among other major OEMs for commercial EVs.

- International expansion: International sales are targeted by the company to go up as a proportion of total revenue from 19% currently recorded, to 25% in the next 2 years. The United States, Europe, and Latin America will be its key markets where it will concentrate on agricultural and high-margin radials for passenger cars.

- Sustainability and innovation: CEAT does everything possible towards being sustainable which includes; cutting down on carbon emissions as well as increasing renewable energy consumption. They also invest heavily into research & development so that they can come up with better quality products which fall under premium categories.

Bottomline

MRF along with CEAT represents resilience and adaptability within India’s tyre sector; while MRF has a strong history of success making them an attractive option for conservative investors who prefer stability over growth — CEAT aggressively expands into new markets through its innovative strategies which makes them appealing to risk-seeking investors looking for higher returns from emerging economies.

Both companies are set to play significant roles in shaping the future of the Indian automotive industry hence providing great investment opportunities for astute investors as the sector continues evolving in this country.