India is third globally in pharmaceutical production by volume and fourteenth in value. Near 10,500 manufacturing units and about 3,000 drug companies imply a matured domestic pharmaceutical industry.

As per the recent EY FICCI report, there is an anticipation that the Indian pharmaceutical market will grow to $450 billion by 2047 and $130 billion by the year 2030 as there is a growing agreement on the provision of new innovative treatments to patients.

In an accelerating world of medicine, Cipla and Sun Pharma are two major players. Both these companies are also significant global health contributors with their diverse range of pharma products and incremental innovations.

The article presents a comprehensive analysis of Cipla vs Sun Pharma. It will assess the differences between these two organisations in terms of product mix, performance record in the market, and strategic orientation, among others.

Company profiles

Cipla Ltd

Cipla is a worldwide healthcare company that was founded in 1935 and its main purpose is to offer cheap drugs. Complex generics, respiratory, anti-retroviral, urology, cardiology, anti-infective, CNS and other popular therapeutic areas encompass Cipla’s range of products.

Besides having this strong portfolio, Cipla is further expanding in India, South Africa, and North America, amongst other leading controlled and uncontrolled markets. Cipla has 47 manufacturing sites globally, producing more than 50 dosage forms and over 1,500 generic medicines that serve 85 countries.

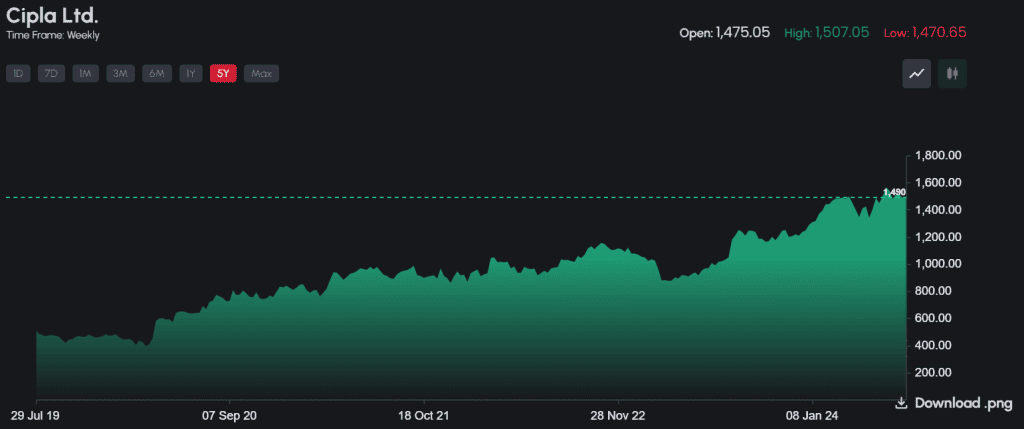

Cipla share news

As of July 23, 2024, the Cipla share price NSE is ₹1,490. Looking at the Cipla share price history, the return given by the stock for the past 5 years is 181.07%.

According to Motilal Oswal, the Cipla share price should be considered with a “buy” rating while the Cipla share price target suggested is ₹1,700 thereby signifying some potential upside from the present market price.

This advice is premised on the organisation’s impressive earnings growth, which is projected at 12% CAGR between FY24-FY26, and its strong pipeline of niche products, together with its exceptional branded generic execution.

Also read: Understanding the basics of the broking industry and its recent trends

Sun Pharmaceuticals Industries Ltd

Sun Pharmaceuticals is a world leader in speciality generics and believes in patients first. Sun Pharma operates in over 100 countries, with its varied product portfolio consisting of high-quality drugs that are affordable for all people. With manufacturing facilities across six continents numbering 41, the company has wide geographical coverage, ensuring stable supply.

Sun Pharma is one of the companies that have fully embraced complex generics, APIs (Active Pharmaceutical Ingredients) and NDDSs (Novel Drug Delivery Systems) thus being able to spend about 6.7% of its global sales on research and development during FY24.

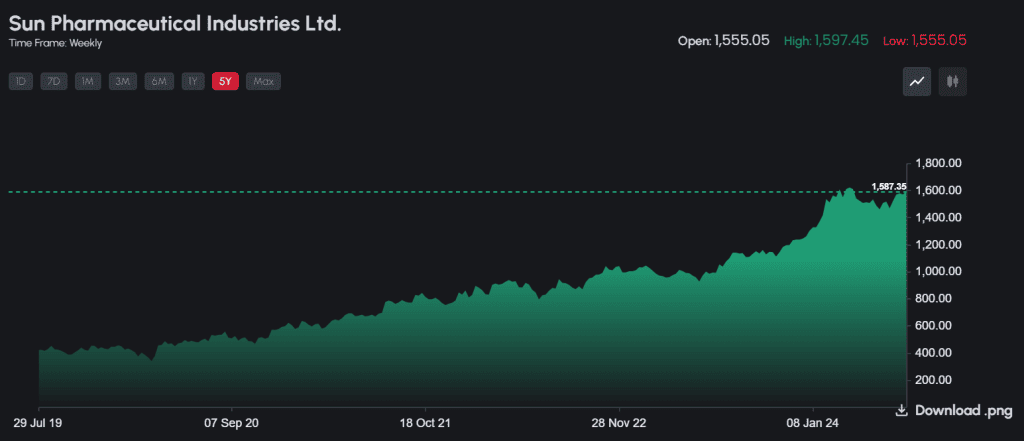

Sun Pharma share news

As of July 23, 2024, the Sun Pharma share price NSE is ₹1,587.35. Looking at the Sun Pharma share price history, the return given by the stock for the past 5 years is 270.39%.

Sun Pharma share price has been given a buy rating by Motilal Oswal with a Sun Pharma share target price of ₹1,810.

This is driven by an anticipated earnings CAGR of 18% from FY 24-26, propelled by a 12-13% sales CAGR in the Domestic Formulation markets and a 9% sales CAGR in the US market. The margin will also expand by up to 220 bps due to a greater focus on building speciality pipelines in dermatology, ophthalmology and once-dermatology.

Cipla and Sun Pharma financial profiles

Let’s compare the key financial metrics for both companies – Cipla vs Sun Pharma:

| Cipla Ltd(For the year ending March 2024) | Sun Pharmaceuticals Industries Ltd(For the year ending March 2024) | |

| Revenue (₹ crores) | 25,774 | 48,497 |

| Operating profit (₹ crores) | 6,291 | 13,018 |

| Profit before tax (₹ crores) | 5,702 | 11,088 |

| Net profit (₹ crores) | 4,154 | 9,610 |

| Earnings per share (₹) | 51.05 | 39.91 |

| Market cap (₹ crores) | 1,20,349 | 3,81,039 |

| Price to earnings | 28.3 | 38.1 |

| ROCE (%) | 23.1 | 17.3 |

| Debt to equity | 0.02 | 0.05 |

Also read: Decoding the significance of market capitalisation

Reasons for growth

Cipla Ltd

- Revenue growth: Cipla reached its peak-ever revenue, crossing ₹10,000 crore with a 14% YoY growth.

- Profitability: The company has experienced considerable gains in profitability as EBITDA and PAT increased by 25.9% and 47.3%, respectively.

- Market leadership: Cipla’s market share remained #1 in the South African prescription market, while also recording impressive performance in both North America and India.

- Strategic investments: The resolution of regulations on R&D, mergers, acquisitions, and others will produce future business growth prospects for strengthening the product pipeline and market presence.

Sun Pharmaceuticals Industries Ltd

- Sales growth: For the fourth quarter of FY24 compared with that of FY23, sales grew by 10.1%, thanks to an improved product range and increased speciality sales.

- Cost management: Material costs were lowered to 20.2% of sales due to a better product mix.

- Profit increase: In Q4 FY24, adjusted net profit increased by 27.8% compared to Q4 FY23, indicative of good cost management as well as the rise in sales.

- Market leadership: Having an 8.5% market share in India’s pharmaceutical industry, Sun Pharma has been the leading Indian drug manufacturer for many years.

Company strategies

Cipla Ltd

- Market expansion: Cipla targets developing its business in other countries such as North America, South Africa, and India. In India, the emphasis is on the growth of the chronic market, while South Africa intends to expand the OTC (Over-the-counter) portfolio.

- Product development: Research and development expenditure has been allocated with significant expenses on the development of complex generics, peptides and differentiated products. They have a strong pipeline of assets due for launch within the next few years.

- Regulatory compliance: Cipla is working towards resolving regulatory matters and remediating various facilities to ensure compliance for continued operations.

- Sustainability initiatives: This firm is committed to ESG (Environmental, social, and governance) goals such as cutting down greenhouse gas emissions, raising renewable energy uptake, and achieving water neutrality.

Must read: ESG: A new formula for investing success?

Sun Pharmaceuticals Industries Ltd

- Investment in R&D: The firm plans to increase its research and development spending to 8% to 10% of sales for FY’25, concentrating on both its global manufacturers and distinguished business aspects.

- Expansion of speciality business: Sun Pharma’s focus is on expanding its speciality business, especially in the U.S. and many other global markets with products such as Ilumya and Winlevi.

- Geographic and product mix optimisation: The company is currently optimising its product and geographic mix to enhance margins as well as stimulate growth.

- Compliance and quality improvements: There are ongoing compliance issues at Sun Pharma’s manufacturing sites, which the management seeks to address so that better performance can be achieved during future audits.

Bottomline

Cipla and Sun Pharmaceuticals depict two captivating stories about India’s pharmaceutical industry. Cipla’s strong presence in the marketplace, and strategic investments, combined with affordable healthcare commitment make it a key player in global health. Solid financial performance by Sun Pharma, innovative product development plus strategic market focus demonstrate leadership within specialty generics and patient-centred healthcare.