As Coca-Cola’s leaders, including global CEO James Quincey, meet in India this week for high-level strategy talks, the future looks bright for the beverage giant in this fast-growing market.

With homegrown brands like Thums Up and Maaza leading the charge in India, Coca-Cola aims to expand its business across the region. Let’s look at Coca-Cola’s growth and financial performance and how to invest in Coca-Cola (KO) shares in India.

About Coca-Cola India Private Limited

Coca-Cola India’s history started on February 20, 1992, and it serves as a subsidiary of a foreign organisation.

The story of the OG Coca-Cola started when beverage creator John Stith Pemberton asked his accountant, Frank Robinson, to help him name his product. Frank’s first suggestion was Coca-Cola, which is both simple and effective. A year after the marketing campaign’s success, Frank designed the company’s initial logo, which was the scribbled name.

Currently, Coca-Cola relies on bottling partners to produce and ship its beverages to specific locations. In India, 11 bottlers run fifty-four factories.

If we talk about the market share of Coca-Cola in India, the leading carbonated soft drink in the nation is Sprite Coca-Cola, which has a 20% market share.

Among carbonated soft drink brands, Thums Up accounts for 16% of the market, while Coca-Cola accounts for 9%. In India, 8% of all the soft drinks sold are Pepsi.

In its estimate for 2024, the business predicted a free cash flow of around $9.2 billion, an operational cash flow of about $11.4 billion, and an overall reduction in capital expenditure of around $2.2 billion.

Also read: HUL vs ITC shares – Which FMCG stock is your pick?

Coca-Cola India gears up for a mega strategy meet

India is hosting Coca-Cola’s yearly business meeting in the last week of February 2024. The nation ranks as the fifth most significant market for the beverage giant worldwide, and it is currently increasing its investments in the area.

This week, James Quincey—global chairman and CEO of The Coca-Cola Company—will lead a 220-person leadership team on a trip to India that might have a significant effect.

Insiders say the Atlanta-based beverage company targets established countries like the US and Europe to boost sales, but New Delhi is quickly becoming an essential player in the industry.

At an investor meeting recently, Coca-Cola’s global executive team highlighted the success of its mango drink Maaza and its billion-dollar brand Thums Up. Both brands are leading the value-added dairy market in India.

The executives look forward to meeting with senior government officials and conversing with bottling partners, who manage over half of Coca-Cola’s bottling operations in India. These partners are crucial because they will inject funds into the company.

According to Quincey’s, after the December quarter, Coca-Cola’s India division had robust development throughout 2023, despite the challenges posed by climate change.

In addition to the Asia-Pacific area and developing markets, the Indian market supported Coca-Cola’s development, according to the business.

Net sales for the December quarter increased 7% to $10.8 billion, while organic sales (non-GAAP) increased 12%. Consolidated profit for Coca-Cola India reached 722 crore rupees in FY23, up 57%, while operational revenue reached 4,521 crore rupees, up 45%.

Partner investment scenario

The local bottling partner of Coca-Cola, Hindustan Coca-Cola Beverages (HCCB), declared a ₹3,000 crore expenditure on juice and aerated beverage production in 2023.

In its annual report, the Coca-Cola Company said that developing and emerging countries, including India and Brazil, would continue to grow strongly through 2024, after leading in 2023. According to the company, India, the Philippines, South Korea, and Japan were the top four countries in the Asia-Pacific area where the business’s value share climbed.

From a 2019 valuation of ₹67,100 crore, analysts predict that India’s non-alcoholic beverage industry will soar to ₹1.47 lakh crore by 2030.

Coca-Cola’s competitors

Below are the competitors of Coca-Cola India ranked by market capitalisation (₹ cr.) as of February 28, 2024.

- Varun Beverages (184,865.02)

- Orient Beverage (70.67)

Also read: Varun Beverages Ltd.

Financials

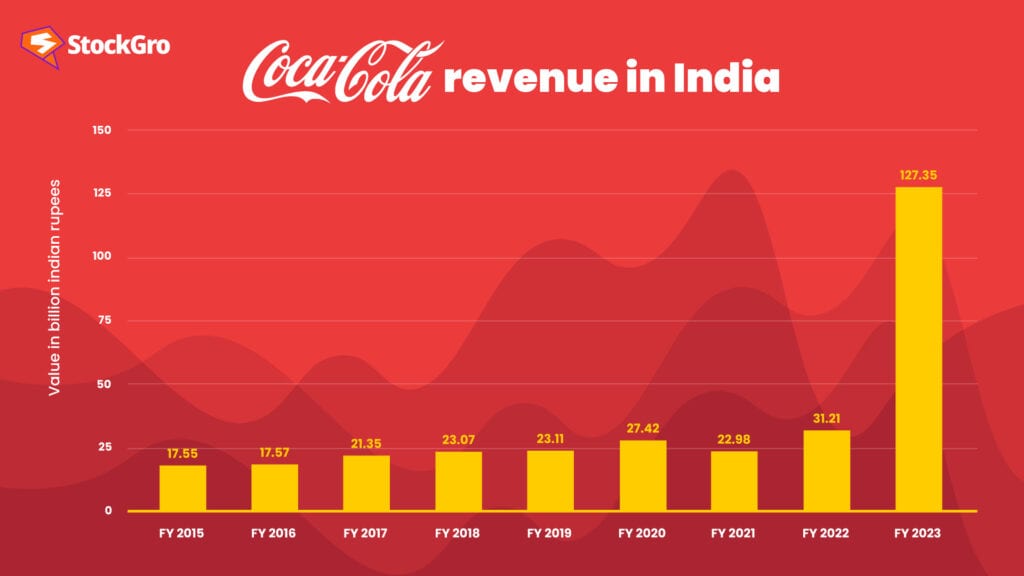

Coca-Cola’s revenue in India in the financial year 2023 was above 127 billion Indian rupees, up from around 31.21 billion in the previous fiscal year. The income was up significantly from the prior year.

How to buy Coca-Cola shares in India?

There’s a good reason why the Coca-Cola Company (KO) is the world’s most significant soft drink brand. But how can someone from India invest in Coca-Cola? Here are the following ways to do it.

- Direct investment

If you’re an Indian citizen and you want to invest in Coca-Cola, you may do so by creating an account with a US brokerage that provides this service or by using a foreign brokerage with a physical office in India.

This procedure would include a Know Your Customer check. Once your account is activated, you can invest in Coca-Cola Company (KO) using US dollars through bank deposits.

- Mutual funds

Another option is to put your money into a local mutual fund that invests in a US-based mutual fund. Since the transaction will be made in Indian rupees, there is no restriction on the amount that may be invested. However, it is also possible that this strategy will cost you more.

- ETFs

With Exchange Traded Funds (ETFs), you have all the flexibility and accessibility of a mutual fund with the extra benefit of increased liquidity since these investments may be traded on the stock market like any other stock.

However, an ETF is not the same as a single stock. Consider it an investment portfolio; similar to the S&P 500 ETF, it allows you to acquire Coke shares by selecting a specific set of companies.

- Basket stacks

If ETFs are an advance over mutual funds, then basket stacks are much better. Since market professionals create these basket stacks, seasoned financial management organisations and global hedge funds provide diversity and profit to your portfolio.

Additionally, the stacks are automatically rebalanced to provide you with the best stock exposure with the least risk.

Also read: Reddit’s IPO and AI ambitions: A game-changer for social media?

Conclusion

As a high-potential growth market, India remains at the core of Coca-Cola’s global roadmap. With executives focusing on the region this week, it’s clear the company believes investing in brands, bottling infrastructure and understanding local consumer tastes better will allow it to garner market share.

The signs look promising for Coca-Cola to attract more Indian investors in the years ahead.