In 2024, India is set to hold its general elections, a situation that could lead to heightened fluctuations in the Indian stock market. This unpredictability can often stir up worry among investors, who may be apprehensive about the possible effects on their investment portfolios.

The upcoming elections, which will be held in seven phases starting April 19th with counting on June 4th, are significant events that can influence market dynamics.

Elections play a vital role in shaping India’s economic and political landscape. They act as a barometer of stability, impacting strategic investment decisions and investor sentiment. The intricate relationship between elections and market movements can influence future economic policies, ultimately swaying investor confidence.

Let’s see the election’s effect on the stock market.

How have previous elections impacted the stock market?

As with any major event that affects the industry, there are always fluctuations before and after the general election, especially two to three months before.

The year 2024 stands out due to the US presidential elections. The upcoming general election in India set for May, along with the US presidential election in November, could potentially trigger market fluctuations as these events draw near.

Further, Jefferies, an investment banking company, predicts a 25% decline in Indian stocks if the BJP does not win the 2024 elections. However, they believe the market will revive in the long run.

It has always been observed that during pre-and post-elections, the markets are volatile, but they tend to give positive returns after the elections in the long run, whatever the outcomes of the election are.

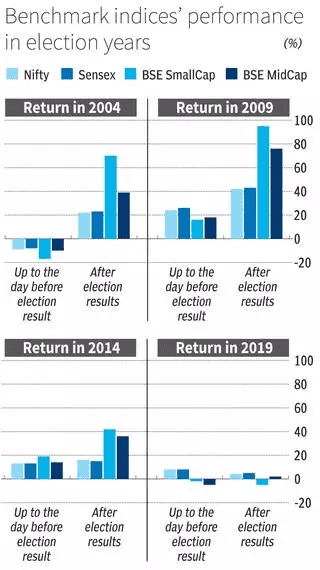

Let’s see how the markets have performed in 4 election years: 2004, 2009, 2014 and 2019.

In the three separate occasions of 2009, 2014, and 2019, both the Sensex and Nifty 50 experienced a rise in their returns, before election results. The most remarkable of these was in 2009, when both indices saw an increase of 26% and 24% respectively by May 15, 2009, just a day before the announcement of the election results. 2004 was the only instance when both indices concluded negatively during the run-up to the election outcomes.

Specifically, on May 12, 2004, a day prior to the declaration of the election results, the Nifty 50 and Sensex had experienced a decline of 9% and 8% respectively for the year thus far.

Interestingly, in all four previous cases, both the Sensex and Nifty 50 have consistently shown positive returns for the rest of the calendar year, starting from the day following the announcement of the election results.

Specifically, in 2009, both the Sensex and Nifty 50 witnessed a significant surge of over 40% from May 18 (the first trading day post-election results) until the end of the year on December 31, 2009.

However, the year 2019, which was the latest election year, showed the slowest growth among the four, with the benchmark indices only increasing in the range of 4-5%.

Regardless of the pre-election trend, the Information Technology, Consumer Durables, and Banking sectors have consistently ranked among the top five best performers post-election.

Also, post-election (6 months), the returns of indices like Sensex were positive.

| 6 Months before Election Results Date | Sensex Closing Price (CP) 6 Months before Results Date | Election Results Date | Sensex Closing Price on Results Date | Percentage Change in Six Months |

| November 26, 2018 | 35,354.08 | May 23, 2019 | 38,811.39 | 9.80% |

| November 18, 2013 | 20,850.74 | May 16, 2014 | 24,121.74 | 15.70% |

| November 18, 2008 | 8,937.20 | May 18, 2009 | 14,284.21 | 59.80% |

| November 13, 2003 | 4,949.16 | May 13, 2004 | 5,399.47 | 9.10% |

Also read: Indians who aced the stock market

What historical trends suggest?

Government strategies can essentially influence the viability and profitability of numerous business segments. So, investors stay restless about the ramifications of political decision results. Notwithstanding, going by the patterns, things cool down in the medium term, particularly after political race results are declared.

The result of decisions can prompt changes in political belief systems, government, and ensuing changes in strategies, monetary needs, and guidelines, influencing different segments and the market all in all.

While elections frequently present transient unpredictability, the lasting effects are determined by the economic initiatives implemented by the winning party.

Also read: Q3 gdp india key takeaways

You might have various questions: is the stock market open on election day? Does the BSE stock market remain closed on election day? Yes, the markets will remain closed on May 20, 2024, when elections will be held in Mumbai.

Why does the election impact the stock market?

There are several reasons why the election has an impact on the stock market:

Uncertainty: Elections signal a change in leadership, which may result in new policies regarding regulations, taxes, spending, and international relations. Investors are averse to uncertainty and may hold back on investments or sell existing holdings until they are sure what the new administration will do, leading to short-term volatility.

Policy changes: The winning party often outlines its economic goals. Policies such as corporate tax cuts and increased infrastructure spending may be positive for the market, while higher taxes and tighter environmental regulations may be negative. Investors react to how they believe these changes will affect the companies in which they invest.

What should investors do?

Investors should watch out for the most recent turns of events and search for sectors and companies which can profit from the general elections. Being prepared with the right portfolio blend is the right move as opposed to stressing over market movement around the election race.

A crucial takeaway is that fluctuations in the short-term are typical as elections approach. It is advisable for investors to concentrate on the enduring fundamentals of their chosen companies rather than acting hastily due to temporary market shifts.

Spreading investments across various sectors remains a wise approach to reduce risk, given that some sectors may react more strongly to political shifts.

Unless there is a significant event that could negatively impact a particular stock or sector where you have a substantial investment, there may be no need for a strategy specifically tailored to elections when managing your equity portfolio.

Must read: How to make a financial plan

Bottomline

In conclusion, India’s economic trajectory is influenced by a multitude of factors, such as corporate earnings, inflation trends, monsoon patterns, and government policies. These factors are likely to shape the market dynamics post-election rather than the election outcomes alone.

While the general election is undeniably significant for India’s political landscape, it may not offer substantial bullish prospects for investors in its aftermath.

Instead, market movements are expected to be more closely tied to fundamental economic indicators than to electoral events. This suggests that a comprehensive understanding of these economic fundamentals is crucial for making informed investment decisions.